AUD/USD Forecast: Bearish momentum to accelerate once below 0.7000

AUD/USD Current Price: 0.7030

- Precious metals consolidated near their weekly lows ahead of the close.

- AUD/USD has bounced just modestly from a critical level, risking further falls ahead.

The AUD/USD pair flirted with the 0.7000 level on Friday, ending the day not far above this last while suffering the largest weekly decline since mid-March. Australian data failed to impress, as the country published the preliminary estimate of the August Trade Balance, which posted a surplus 0f 4294M, below the previous 4607M. Imports were down 7% in the month, while exports fell 2%. By the end of the week, gold prices held steady, with spot trading at around $1,861.00 a troy ounce. The macroeconomic calendar has nothing to offer at the beginning of the week.

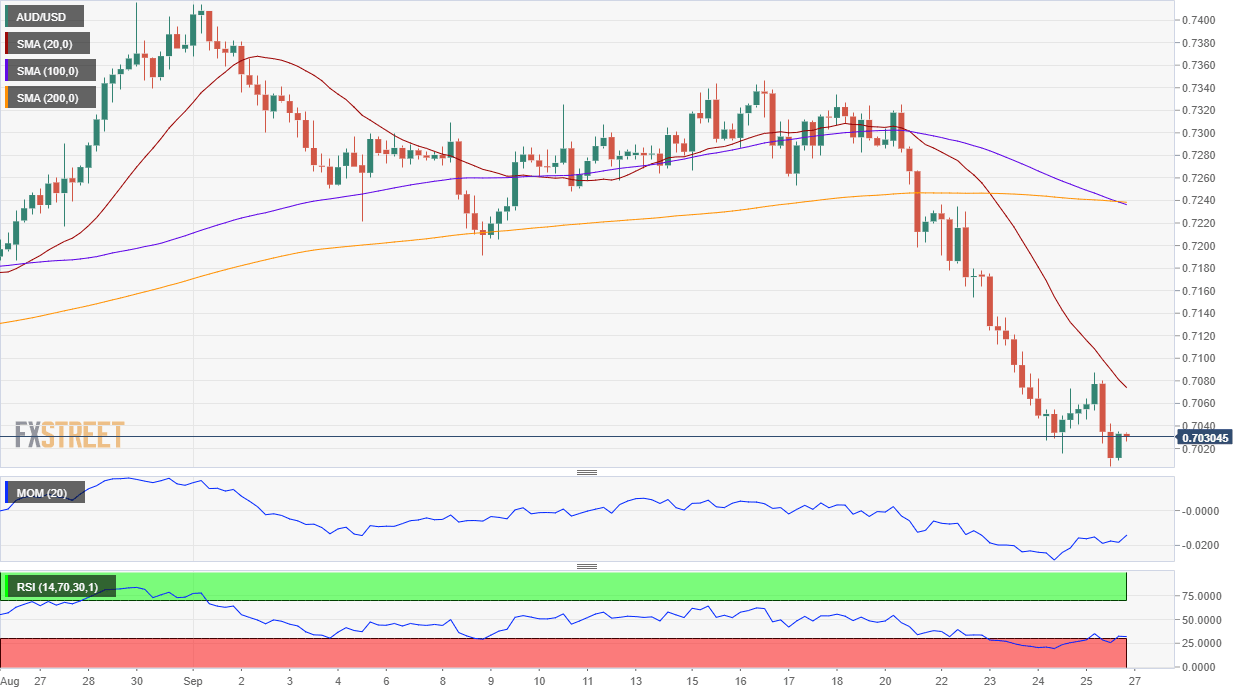

AUD/USD short-term technical outlook

The AUD/USD pair is at risk of falling further as in the daily chart, it is trading below a bearish 20 DMA and a few pips above the 100 DMA, which maintains a mildly bullish slope. Technical indicators, in the meantime, maintain their bearish slopes. In the shorter-term, and according to the 4-hour chart, the pair is bearish, as the 20 SMA heads firmly lower above the current level and below the larger ones, while technical indicators hold within negative levels, lacking bullish strength.

Support levels: 0.7000 0.6965 06930

Resistance levels: 0.7040 0.7085 0.7120

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.