AUD/USD Forecast: Acceptance below 0.6700 mark should pave the way for deeper losses

- AUD/USD drifts lower for the second straight day and drops to a fresh low since January.

- The RBA lifts rates by 25 bps and signals more hikes, though fails to impress bullish traders.

- A positive risk tone undermines the safe-haven buck and helps limit losses for the Aussie.

- The market focus remains glued to Fed Chair Powell’s semi-annual congressional testimony.

The AUD/USD pair attracts some sellers for the second successive day on Tuesday and touches a fresh two-month low after the Reserve Bank of Australia (RBA) announced its policy decision. As was widely expected, the RBA raised its overnight cash rate by 25 bps to 3.6%, or the highest since June 2012, and indicated that more hikes were still needed to bring inflation under control. That said, RBA Governor Philip Lowe, in the accompanying policy statement, warned that the path to achieving a soft landing for the Australian economy remains a narrow one. This prompted some fears that the economy could suffer a recession over the next 24 months, which, along with the disappointing release of Australia's trade balance data, weigh on the domestic currency. That said, a generally positive tone around the equity markets undermines the safe-haven US Dollar and lends some support to the risk-sensitive Aussie.

The USD downtick, meanwhile, remains cushioned amid growing acceptance that the Federal Reserve will stick to its hawkish stance and keep interest rates higher for longer to tame stubbornly high inflation. In fact, the recent US macro data indicated that inflation isn't coming down quite as fast as hoped and pointed to an economy that remains resilient despite rising borrowing costs. This should allow the US central bank to continue tightening its monetary policy at a faster pace. Furthermore, a slew of FOMC policymakers recently backed the case for higher rate hikes and opened the door for a 50 bps lift-off at the upcoming policy meeting later this month. This remains supportive of elevated US Treasury bond yields, which, along with worries about a deeper global economic downturn, favours the USD bulls and suggests that the path of least resistance for the AUD/USD pair remains to the downside.

Spot prices, however, continue to show some resilience below the 0.6700 mark as traders seem reluctant to place aggressive bets ahead of Fed Chair Jerome Powell's semi-annual congressional testimony on Tuesday and Wednesday. Powell's comments will be closely scrutinized for clues about the Fed's future rate-hike path, which, in turn, will play a key role in influencing the near-term USD price dynamics. Investors this week will also confront the release of the closely-watched US monthly jobs data, popularly known as NFP on Friday. This should further contribute to providing some meaningful impetus to the AUD/USD pair and help determine the next leg of a directional move. Nevertheless, the fundamental backdrop supports prospects for an extension of the depreciating move witnessed over the past month or so.

Technical Outlook

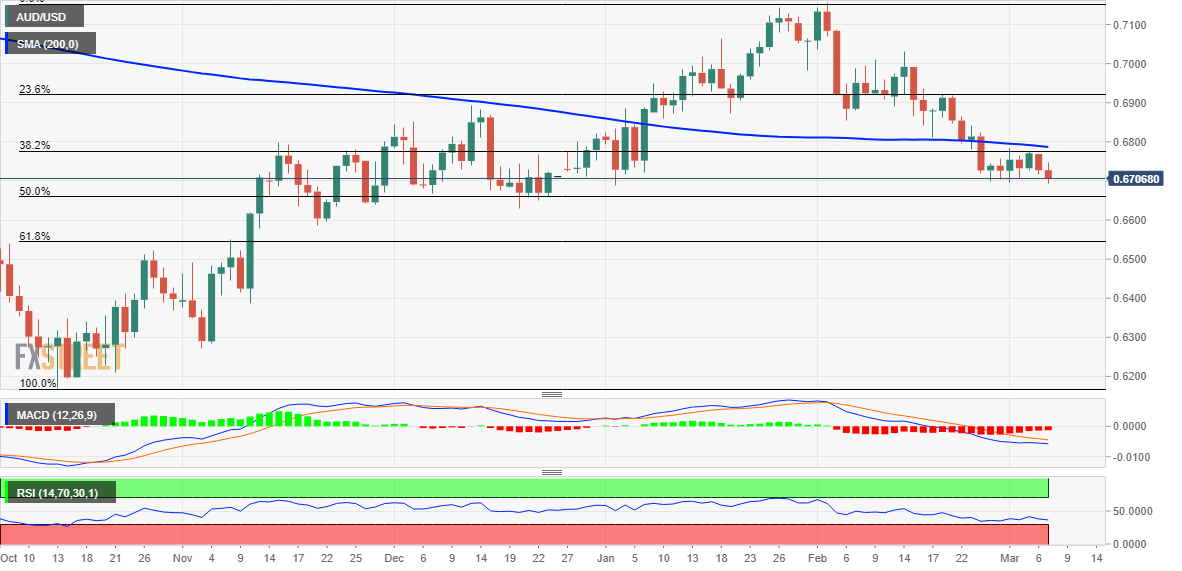

Against the backdrop of the recent breakdown through a technically significant 200-day Simple Moving Average (SMA), acceptance below the 0.6700 mark will be seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart are holding deep in the negative territory and are still far from being in the oversold zone. Hence, a subsequent slide towards the 0.6660 zone, or the 50% Fibonacci retracement level of the rally from October 2022 low, en route to the 0.6600 mark, looks like a distinct possibility. The latter should act as a strong base for the AUD/USD pair and help limit further losses, at least for the time being.

On the flip side, any meaningful recovery attempt might continue to attract fresh supply near the 0.6770-0.6780 resistance zone. This should cap the AUD/USD pair near the 0.6800 confluence support breakpoint, comprising the 200-day SMA and the 38.2% Fibo. level. Some follow-through buying, however, might trigger a short-covering rally and lift spot prices to the next relevant hurdle near the 0.6875-0.6880 area. This is followed by the 0.6900 mark and the 23.6% Fibo. level, around the 0.6925 area, which if cleared decisively might shift the near-term bias in favour of bullish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.