AUD/USD Analysis: Defends ascending trend-line support, at least for now

- AUD/USD witnessed aggressive selling on Monday amid a strong pickup in the USD demand.

- Surging US bond yields, hawkish Fed expectations provided a strong boost to the greenback.

- The risk-on mood, stronger Chinese PMI assisted the pair to gain some traction on Tuesday.

The AUD/USD pair stalled its recent upward trajectory witnessed over the past one month or so and came under intense selling pressure on the first trading day of the new year. The US dollar made a solid comeback amid surging US Treasury bond yields, which, in turn, triggered aggressive long-unwinding trade around the major. In fact, the yield on the benchmark 10-year US government bond surged to 1.6420% for the first time since November 24 amid expectations for a faster policy tightening by the Fed. This was seen as a key factor that provided a strong boost to the greenback.

The sharp intraday slide dragged the pair to a one-and-half-week low, though a positive risk sentiment extended some support to the perceived riskier aussie. Despite the continuous rise in COVID-19 cases globally, investors remain optimistic amid signs that the Omicron variant might be less severe than feared. This was evident from an extension of the bullish run in the equity markets. Apart from this, better-than-expected China's Caixin Manufacturing PMI assisted the pair to regain traction and move back above the 0.7200 mark during the Asian session on Tuesday.

According to the survey report, China's factory activity grew at its fastest pace in six months at the end of 2021. The gauge rose to 50.9 in December from 49.9 reported in the previous month. That said, any meaningful upside still seems elusive as investors might refrain from placing aggressive bets ahead of this week's key event/data risks. The packed US economic docket kicks off with the release of the ISM Manufacturing PMI and JOLTS Job Openings, due later during the North American session. The Fed is also scheduled to release the minutes of its December meeting on Wednesday.

Apart from this, investors will take cues from Wednesday release of the ADP report on private-sector employment and the ISM Services PMI on Thursday. The key focus, however, will remain on the closely watched US monthly jobs report – popularly known as NFP on Friday. This, along with developments surrounding the coronavirus saga, will play a key role in influencing the near-term USD price dynamics and provide a fresh directional impetus to the major.

Technical outlook

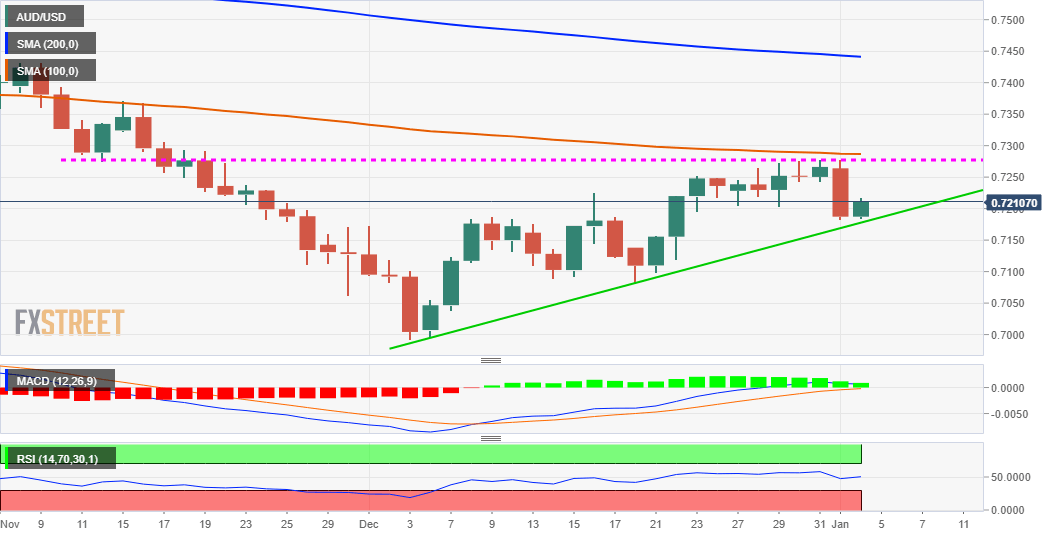

From a technical perspective, the overnight corrective pullback from the vicinity of 100-day SMA stalled near an ascending trend-line extending from the 2021 low. The mentioned support, currently around the 0.7180 region, should now act as a pivotal point for short-term traders. A convincing break below will set the stage for additional losses and accelerate the fall towards the 0.7100 round-figure mark. Some follow-through selling below the 0.7085 horizontal support might turn the pair vulnerable to challenge the key 0.7000 psychological mark.

On the flip side, any subsequent positive move beyond the 0.7220 level might now confront resistance near the 0.7250-55 area. This is followed by the 0.7275-80 region, or the highest level since November 19, which nears the 100-DMA. A convincing breakthrough will be seen as a fresh trigger for bullish traders and set the stage for additional gains. The pair might then climb to the next relevant hurdle near the 0.7340-45 region en-route the 0.7375-80 zone and the 0.7400 round-figure mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.