AUD/USD Analysis: Continues to show resilience below 0.6600, not out of the woods yet

- AUD/USD catches fresh bids on Thursday and is supported by a combination of factors.

- A positive risk tone undermines the safe-haven USD and benefits the risk-sensitive Aussie.

- The upbeat domestic employment figures lend additional support to the Australian Dollar.

- The fundamental backdrop, however, warrants some caution for aggressive bullish traders.

The AUD/USD pair regains positive traction during the Asian session on Thursday and reverses a part of the previous day's slide to sub-0.6600 levels, or the weekly low. A generally positive tone around the equity markets prompts some selling around the safe-haven US Dollar and turns out to be a key factor benefitting the risk-sensitive Aussie. Investors piled back into stocks after the Swiss bank Credit Suisse announced that it will exercise an option to borrow up to $54 billion from the Swiss National Bank (SNB) to shore up liquidity. This eases fears of an imminent banking crisis and leads to a modest recovery in the global risk sentiment.

The Australian Dollar is drawing additional support from the upbeat domestic employment figures, which showed that the jobless rate fell back to match the lowest level since the 1970s seen in December. In fact, the Australian Bureau of Statistics (ABS) reported that the seasonally adjusted unemployment rate fell to 3.5% in February against the anticipated dip to 3.6% from the 3.7% previous. Furthermore, the number of employed people rose by 64.6K during the reported month, beating the 48.5 rise estimated. This follows consecutive falls in December and January, which is now expected to attract more rate hikes by the Reserve Bank of Australia (RBA).

The Australian central bank, however, recently signalled that it might be nearing the end of its rate-hiking cycle. In contrast, the Federal Reserve (Fed) is still expected to deliver at least a 25 bps lift-off at its upcoming policy meeting on March 21-22. The bets were lifted by the crucial US CPI report released earlier this week, which showed that inflation isn't coming down quite as fast as hoped. Furthermore, concerns about a broader systemic crisis and fresh turmoil in the banking sector should keep a lid on any optimism in the markets. This, in turn, suggests that any subsequent move up in the AUD/USD pair is more likely to attract fresh sellers and remain capped.

Market participants now look forward to the US economic docket, featuring the release of the usual Weekly Initial Jobless Claims, the Philly Fed Manufacturing Index and housing market data - Building Permits and Housing Starts. Apart from this, the European Central Bank (ECB)-inspired volatility might influence the USD and provide some impetus to the AUD/USD pair. Traders will further take cues from the broader risk sentiment to grab short-term opportunities, though the focus will remain glued to next week's FOMC meeting.

Technical Outlook

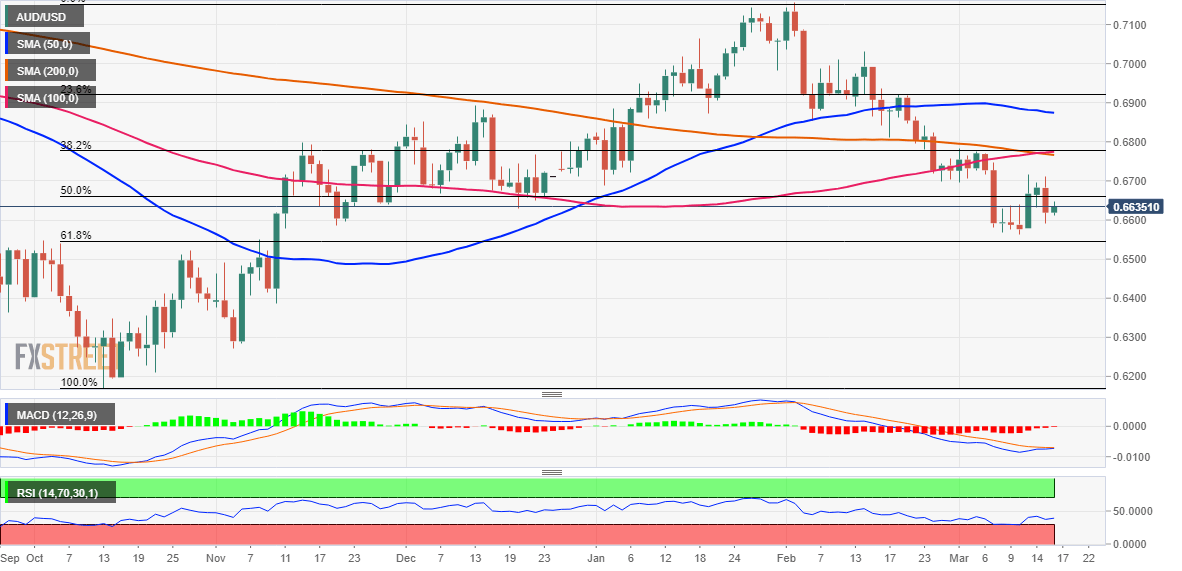

From a technical perspective, this week’s repeated failures to find acceptance above the 0.6700 mark warrants some caution for the AUD/USD pair. Hence, it will be prudent to wait for some follow-through buying beyond the 0.6710-0.6715 region, or the weekly high, before positioning for an extension of the recent bounce from the 0.6565 area, or a four-month low touched last week. Spot prices might then accelerate the momentum towards testing the 0.6770 confluence, comprising of the 100 and 200-day, Simple Moving Averages (SMAs), and the 38.2% Fibonacci retracement level of the rally from the October 2022 low. This is followed by the 0.6800 mark, above which the upward trajectory could get extended further towards the 50-day SMA, currently pegged near the 0.6870 zone.

On the flip side, sustained weakness below the 0.6600 mark is likely to find some support near the multi-month low, around the 0.6565 region. The latter coincides with the 61.8% Fibo. level, which if broken decisively will be seen as a fresh trigger for bearish traders. The AUD/USD pair might then slide towards testing the 0.6500 psychological mark before eventually dropping to the next relevant support near the 0.6410-0.6400 region.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.