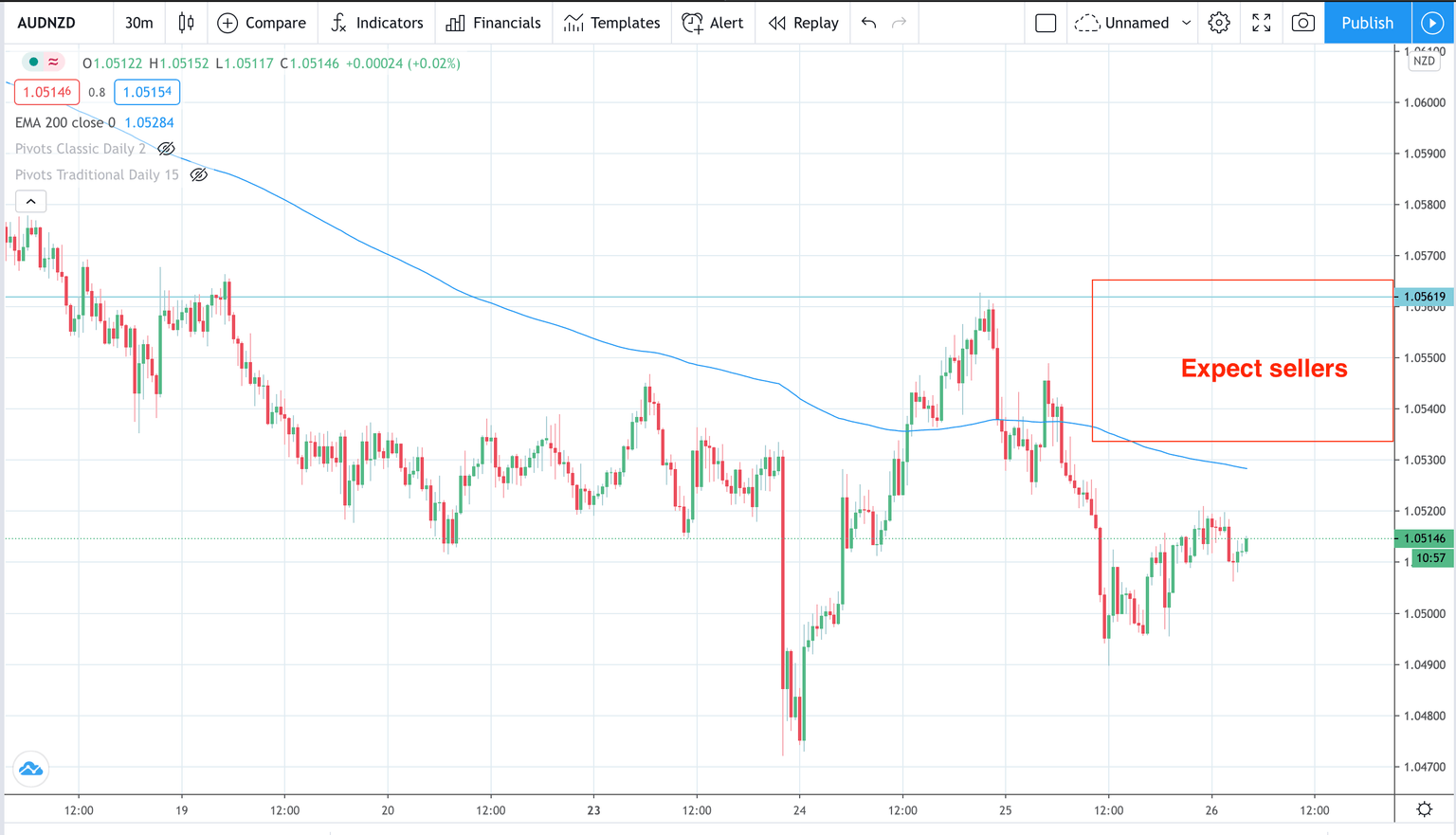

AUD/NZD sell on rallies now?

On Tuesday the RBNZ moved towards the idea of considering house prices as part of their consideration in setting monetary policy. This had the NZ 10 year bond yields moving sharply higher as market participants saw that it decreases the chances of an RBNZ rate cut.

If the RBNZ add house prices to their remit then the subsequent reduction in house prices will act as a form of monetary tightening. Remember that NZ house prices were expected to drop during the pandemic. In fact they rose 8% in October. NZ PM Robertson is concerned and is trying to get Governor Orr to address the situation. The net result is that there will be less need for negative rates.

You can see the reaction in the overnight-indexed swap markets as more than 40bps of cuts had been priced in by the end of 2021. That is now just down to 5bps.

In contrast to the RBNZ the RBA is focusing on keeping short term yields close to the Official Cash Rater and that could leave AUD yields slightly below NZD yields. This opens up the pathway for sellers on AUDNZD rallies higher as long as this divergence remains. This turnaround has come quickly from the RBNZ who seemed set on negative rates from only back in October 14. Assistant Governor Christian Hawkesby had said then that the RBNZ was not bluffing on the prospect of negative rates.

This opens up the prospect of an AUDNZD sell on rallies as long as this divergence remains between the RBNZ and RBA.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.