Are Oil and Gold signalling a market reset in H2?

For years, commodities have been emotional creatures. Oil rallied on cuts, and gold surged on chaos. But as we head into the second half of 2025, something unexpected is happening - and markets may need a new playbook.

Oil prices are rising, even as production ramps up. Gold, on the other hand, is cooling off - not because of collapsing fundamentals, but thanks to a surprising wave of optimism. It’s the kind of shift that suggests we’re moving from knee-jerk trading to something more strategic. Less panic, more positioning.

The big question now is whether this marks the start of a new phase in which commodities no longer just mirror the headlines but help shape them.

OPEC changes gear – And Oil holds steady

OPEC+ has spent the past two years playing firefighter. Slashing output. Smoothing nerves. Propping up prices. But 2025 has delivered a gear shift. Instead of wielding the usual production cuts, the group is now opening the taps - and markets aren’t blinking.

Recent announcements signal a supply boost of over 800,000 barrels per day. A year ago, that would have triggered panic selling. Today, oil prices are holding firm. In fact, Saudi Arabia has raised its official selling prices to Asia, a bold move that signals strength, not surrender.

Sure, there’s friction under the surface. A Reuters report suggests more increases could be on the table, especially if compliance keeps slipping. Voluntary cuts of 2.2 million barrels per day risk being fully reversed by October or November.

Countries like Kazakhstan and Iraq have repeatedly breached quotas, testing Riyadh's patience. But even here, the numbers may not be as dramatic as they appear. Kazakhstan is already producing near its ceiling, Iraq may soon face enforced compensatory cuts, and the UAE has limited spare capacity.

In reality, OPEC’s own data point to a more measured increase - closer to 600,000 barrels per day between March and June. This is hardly a flood.

Source: OPEC, IEA, Commerzbank Research

This could be a message more than a manoeuvre. A subtle power play. OPEC+ might be using production tweaks to nudge sentiment, exert pressure on undisciplined members, and keep competitors guessing - all while riding the tailwinds of improving US-China trade relations.

Rather than losing control, OPEC+ may be evolving, shifting from steering the market with showy cuts to influencing it with quieter, strategic moves.

Gold dips – But don’t call it defeated

Then there’s gold, which has taken a tumble.

After hitting record highs in April, gold prices dropped nearly 9%, falling below $3,200. The trigger? A streak of good news: easing US-China tensions, hinting at a new Iran nuclear deal. Markets exhaled, and gold, the classic safe haven, slipped.

But here’s the thing: the fundamentals haven’t disappeared. Inflation still lingers. Central banks are still stockpiling gold. Geopolitical flashpoints are very much alive, even if they’ve slipped off the front page.

Even with the pullback, gold remains one of 2025’s best performers so far. And those who’ve watched this market long enough know it doesn’t take much - a hawkish comment from the Fed, a flare-up in the Middle East - to reignite the rally.

This may not be the end of the gold story. It might just be the pause before the next leg is higher.

Oil up, Gold down – What’s really driving the shift?

The most interesting part? Neither move makes immediate sense.

Oil’s going up even though supply is rising. Gold’s falling despite lingering macro risks. What gives?

The answer lies in sentiment. More specifically, markets are beginning to look ahead - not just react. For the first time in a while, expectations are turning positive. That’s nudging commodities to behave like rational markets again - not emotion-driven barometers.

This is more than a passing mood. It could signal a broader shift in how traders view risk, value, and positioning.

Looking ahead: What could shape H2 trading?

So, what does all this mean for the second half of 2025? A lot - especially for those willing to read the signals rather than chase the noise.

- Oil: Monitor price resilience. If demand holds and OPEC+ continues its quiet recalibration, oil could grind higher without the usual drama.

- Gold: The retreat may not be over, but don’t count gold out. One geopolitical shock or inflation scare could flip the narrative fast.

- Commodities as a whole: We may be entering a market cycle where fundamentals, inventories, and strategic policy moves start to matter more than fear.

In short, commodities might not be screaming anymore, but they’re still speaking. For traders and investors paying attention, those signals could be the key to unlocking opportunity in a more composed, more strategic H2.

Oil and Gold technical Outlook

At the time of writing, Oil is seeing some drawdown, hovering around the $61.24 level. Price levels are just below a major sell zone, hinting that sellers could maintain control. However, a potential inverse head and shoulders formation is taking shape, hinting at a potential bullish move. The bullish narrative is also buttressed by the volume bars indicating waning sell pressure.

Should the slump continue, prices could be held at the strong $57.56 support level, which has held prices before. If bulls have their way, prices could encounter resistance walls at the $63.56 and $69.90 resistance levels.

Source: Deriv MT5

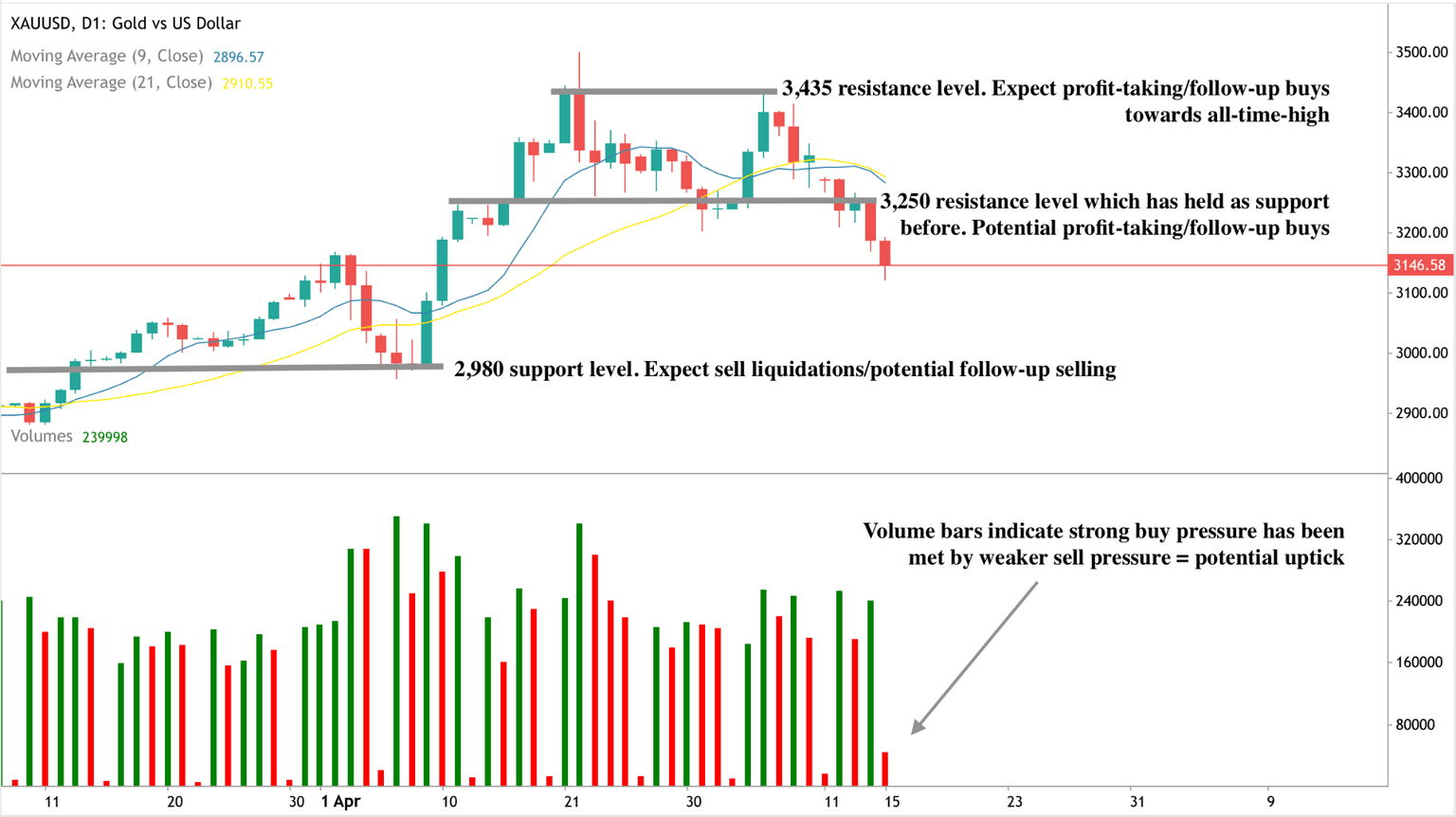

Gold has seen a significant slump as risk-off sentiment dominates the market. Sell-side bias is evident on the daily chart. However, the volume bars tell a story of sells not yet moving with conviction. This could set the stage for a potential return of buyers. Should we see a collapse, prices could find a support floor at the $2,980 support level. If a bounce materialises though, prices could encounter resistance walls at the $3,250 and $3,435 resistance levels.

Source: Deriv MT5

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.