Apple Stock Analysis 2020: Buy AAPL before or after stock split? [Video]

![Apple Stock Analysis 2020: Buy AAPL before or after stock split? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/us-share-dividend-20282603_XtraLarge.jpg)

Apple Stock Analysis: Is it Overvalued?

Is Apple stock a buy now, days after announcing its 5th stock split since 1987 and delivering impressive earnings? Or is it way overvalued? How has Apple stock splits impacted its price in the past, and how could it impact it before and after its split-adjusted trading begins on August 31st? Am I adding the AAPL stock to my portfolio and if so, at what price? How much AAPL do I even have in my portfolio? And what type of investor should be looking into adding the Apple stock to their portfolio? Because as you probably know by now if you’ve been following me for a while, investing strategies are not a one-size fit all. What works for me, may not work for you. That’s because I probably have a different risk tolerance than you, my financial situation and goals are likely different than you, and we’re probably not the same exact same age and are not married to the same exact person because that would be weird

In this video, I analyze the AAPL stock from 5 points of my signature Invest Diva Diamond Analysis (IDDA) which analyzes any asset from 5 points: fundamentals, technicals, market sentiment, risk assessment and overall how it can fit in your portfolio, and of course, my most recent price targets.

Apple Stock Analysis – Fundamentals

I’ve been following the AAPL stock for years and most recently I compared it with its 5G infrastructure competition in this video, so if you haven’t watched that already, make sure you check it out. Fun fact: Apple’s market value of over $1.9 trillion is bigger than the GDP of Canada, Russia or Spain.

Apple delivered impressive results on July 30 as it announced in its third-quarter earnings, and its Board of Directors has approved a four-for-one stock split.

The Apple stock split

What does the Apple Stock Split mean? It means if you have 1 share of Apple priced at around $400, you’re now going to have 4 shares of AAPL each worth around $100. It’s kinda like changing your $20 for four $5 bills. It won’t add on to or reduce your net holdings, but it’ll give you more bills.

Why is Apple doing a stock split?

In my opinion, the reason why Apple has done it in the past and did it this time, is purely for marketing purposes. Apple has one of the greatest marketing minds behind it so it kinda makes sense that they extend their talents to their financial department. What the heck does this have to do with marketing, you ask?

Well, for one, it’s a huge PR boost every time they do this, because more media contributors, including myself, will feel necessary to cover the news. But have you heard of the term, “buy the news, sell the rumor”? So the news came out on July 31st… but when will its impact start to wear out? I’ll get to that in a little bit when I look at AAPL stock price action on the charts.

Back to stock split advantages, being traded at a lower price could make the Apple stock more approachable. The idea of the Apple stock being super cheap makes it more of a household name which goes hand in hand with Apple’s brand identity as well.

Of course in reality this is absolutely pointless because you can buy ANY stock at a fractional amount on brokers like Robinhood, Webull, and TD Ameritrade. For example, even if you have only $50 to invest, you still can buy $50 worth of Amazon stock which is priced well above $1,000. So this part of it is more about investors’ psychology than a real fundamental change in the company’s valuation.

Apple stock market sentiment analysis

Let’s now move on to IDDA’s second point which is market sentiment.

Currently, we have bulls and bears evenly distributed across the market

Apple stock bulls say…

- Apple isn’t too big to grow even more

- The company is still innovating with introductions of Apple Pay, Apple Watch, Apple TV, and AirPods; each of these could drive incremental revenue, but more crucially help to retain iPhone users over time.

Apple stock bears say…

- AAPL stock is way too stable that wouldn’t give investors with high-risk appetite an opportunity for great gains

- It has the most expensive valuation in a decade.

- Apple is behind firms like Google and Amazon in artificial intelligence, or AI, development (notably Siri voice recognition), which could be problematic as tech firms look to integrate AI in order to deliver premium services to customers..

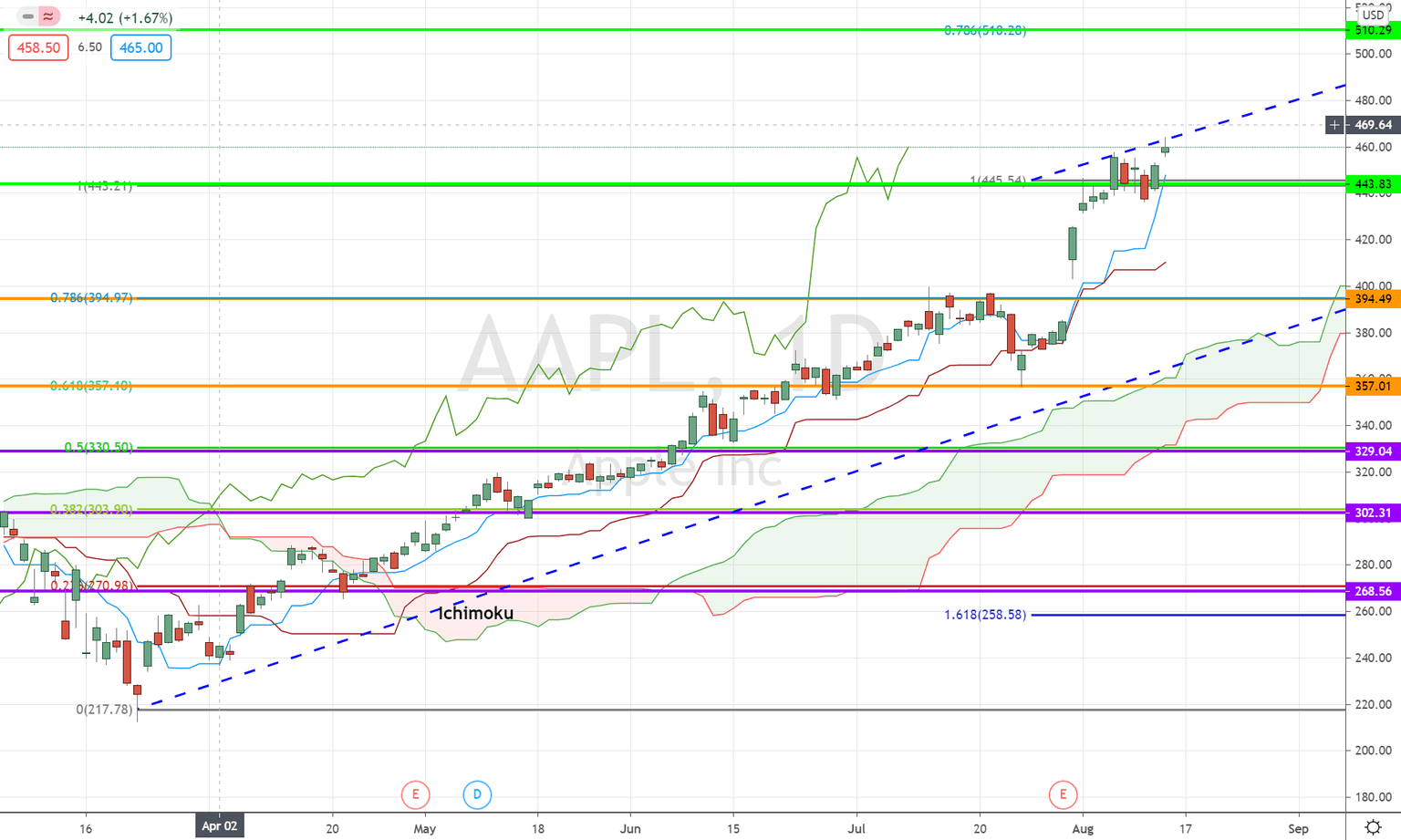

Apple stock price – technical analysis

The Apple stock price has reached a new all-time high above $460 before the split. In this video, I explain why I have set buy limit orders at $394 and $357.

Author

Kiana Danial, CFP

Invest Diva

Kiana Danial is an award-winning, internationally recognized personal investing and wealth management expert.