Apple (AAPL) — Head and shoulders history

Apple has a long history of forming the Head and Shoulders chart pattern.

The monthly chart below shows the historical timing of the H&S patterns (yellow boxes).

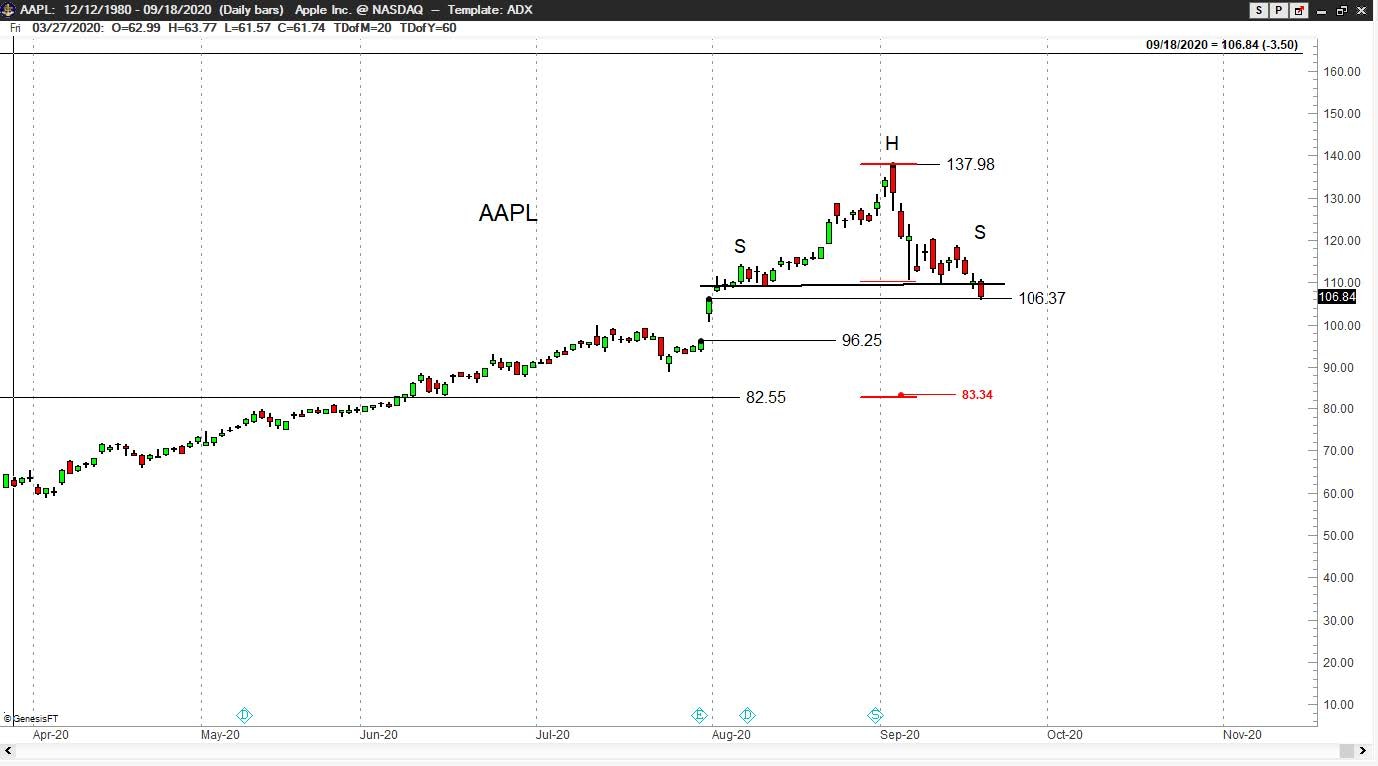

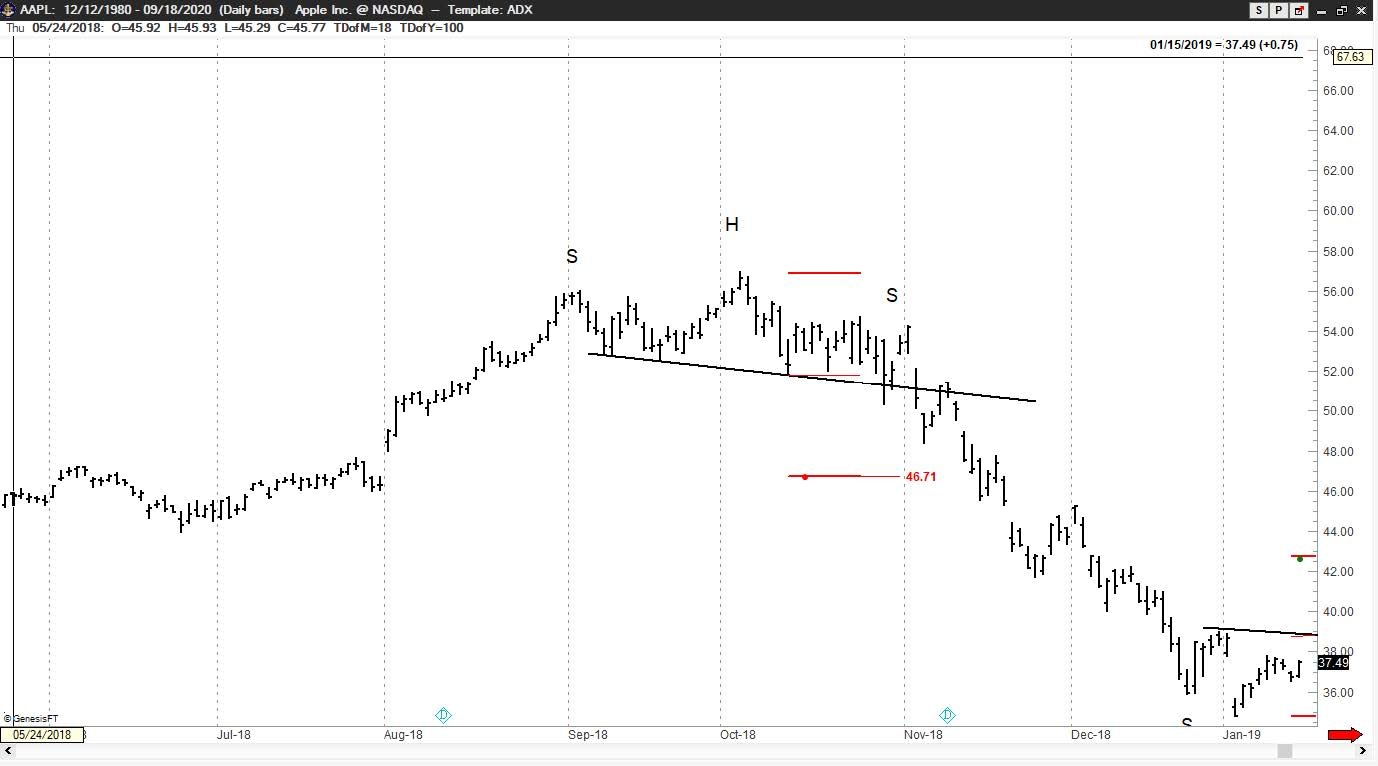

The daily charts of each H&S pattern indicate the price targets, including the H&S top just completed on Sep 18, 2020. In most cases price far exceeded the chart target.

The point is this – pay attention when a H&S pattern is completed in AAPL.

Completed Sep 18, 2020

Completed Apr 30, 2020

Completed Jan 30, 2019

Nov 2, 2018

Completed Mar 1, 2016

Completed Aug 5, 2013

Completed Oct 12, 2012

Completed Mar 23, 2009

Completed Mar 24, 2008

Feb 6, 2006

Author

Peter L. Brandt

Factor LLC

Peter Brandt is the founder and CEO of Factor LLC, a proprietary trading firm founded in 1981 at the Chicago Board of Trade.