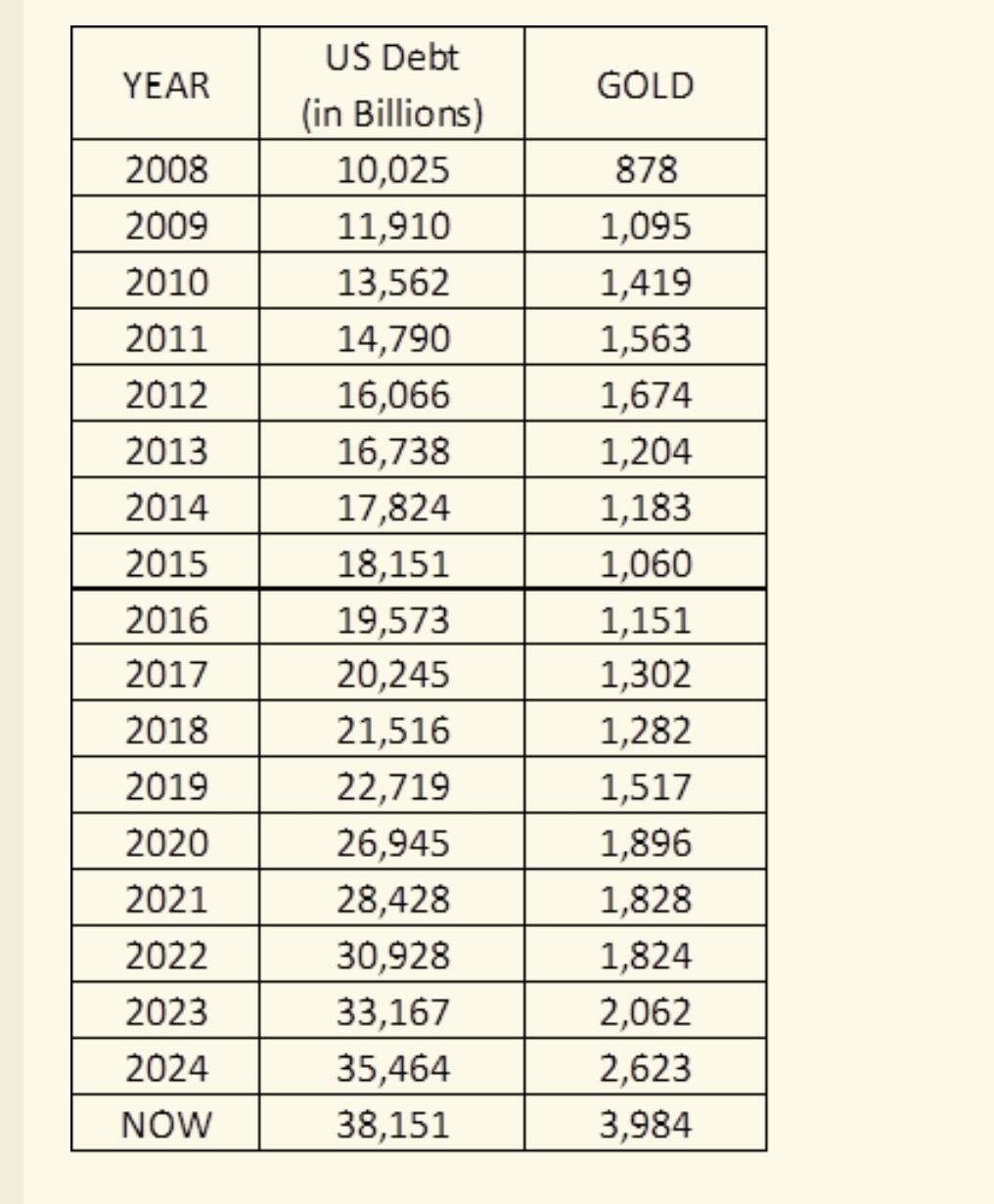

Analysis of correlation between US debt and Gold price

The correlation coefficient( R ) was calculated to determine the strength of the relationship between the US Federal Debt (in Billions) and the Gold price (USD/Ounce) for the specified periods.

From 2008 till now R is 83%.

From 2021 till now R is 90 %.

The strong correlation figures signify a very strong positive relationship between the growth of the US National Debt and the price of gold.

This reflects gold's traditional role as a hedge against fiat currency depreciation and a safe-haven asset during periods of high government borrowing and fiscal uncertainty.

The US debt is 38 $ Trillion now.

It grows yearly by roughly 7 % along with Big Beautiful Bill which is estimated to be around 3 trillion.

The Fed has no answer to the debt bubble except printing more money !!

Based on current gold level of around 4000 $ an ounce, along with a simple math of US debt yearly growth,

Gold is expected to head north to 4400 at least which is 10% from current price.

This correlation and simple math can answer many questions about next expected gold move !

Gold is the real money compared to debt & credit bubbles.

Author

Hany Saleeb

Independent Analyst

Hany Saleeb is a highly experienced Senior Treasurer. With over a decade of experience in treasury, served as Head of Treasury at BM in France and head of research in Sinai Securities.