Amsterdam surpasses london as share center

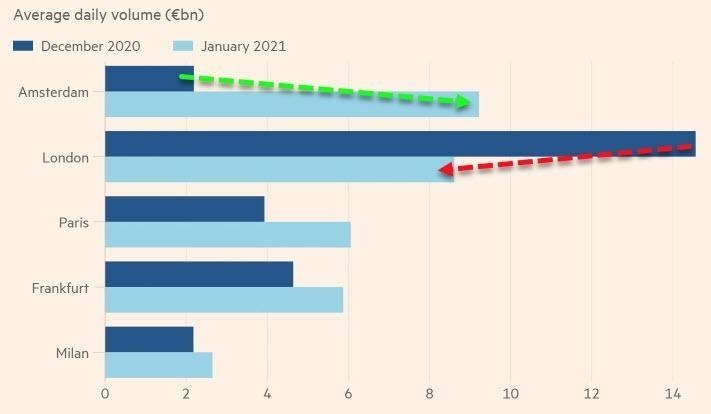

Amsterdam has overtaken London as Europe’s largest share trading center, and experts say the symbolic blow could be followed by the City losing jobs as well as more business owing to Brexit. The Dutch capital, which was previously the sixth largest exchange center in Europe, saw average daily trading surge from €2.6bn to €9.2bn in January as exchanges shifted order books abroad after Brexit. It pushed London into second place, with average daily trading halving from €17.5bn to €8.6bn last month, according to data released by the CBOE exchange.

Under European rules that pre-date Brexit, EU shares traded in euros must be traded on EU exchanges or in countries with special “equivalence” status such as the United States. After Britain failed to gain equivalence with the EU or strike a comprehensive trade deal covering financial services, exchange operators such as the CBOE and Turquoise, which have bases in Amsterdam, had to move their order books abroad by January 2021.

The Impact

According to Nick Bayley, a managing director at the consultancy Duff & Phelps, the figures are large to be sure, however, the overall impact on the City is small. Only a handful of jobs at the exchanges have had to move and the overall tax benefits to Amsterdam from a low-margin business such as trading will be minimal.

He added “In terms of jobs, tax revenues, other revenues, the profit and loss accounts and so on being generated in Holland rather than in the UK, it’s marginal. But it is symbolic, of course.”

The change can be compared to moving a computer that processes online store orders from one city to another. While the computer has moved, all of its customers and suppliers are still in the same place. Likewise, while share trading has shifted, most of the traders, brokers and asset managers are still in London.

According to to William Wright, founder of the New Financial think-tank, the move is more of a “a technological switch or regulatory switch, but it’s not some sort of seismic shift where suddenly people think London isn’t as attractive of a place to do business or London is doomed as a financial center.”

Wright added that roughly 20% of Britain’s financial services industry is related to EU clients and euro operations, while more than half is focused on domestic UK customers. In short, it’s not going anywhere.

Even if half of the City’s EU-related business eventually moves, that would account for only 10% of the financial center’s business, which could shave 1% off the £76bn contributed by the industry to the Treasury last year.

“The fact that the government has just spent nearly £300bn on its response to COVID, a £7bn loss suddenly doesn’t seem like such a big number. I don’t want to minimise the impact, but I think we need to keep it in perspective,” Wright said.

Experts said bigger changes could result in jobs moving away from the City. The accountancy firm Deloitte said the UK should be concerned about whether the EU would continue to recognise London clearing houses – which facilitate trading of financial assets – after an 18-month grace period, and whether it would allow fund managers to handle EU assets from within the UK.

Permanent Move?

As stated before, European rules that pre-date Brexit say that EU shares traded in euros must be traded on EU exchanges or in countries with special “equivalence” status. However, London has not yet secured that “equivalence” because Brussels says it needs information about Britain’s intentions to diverge from EU rules.

Prime Minister Boris Johnson’s spokesman said London had already supplied the necessary paperwork and was “one of the world’s most pre-eminent financial centers, with a strong regulatory system”, adding that fragmenting markets was in no one’s interests.

The EU’s financial services chief Mairead McGuinness said on Thursday the bloc will discuss equivalence with Britain “progressively” and take into account its intentions regarding rules on a case-by-case basis, but there “cannot be equivalence and wide divergence”.

The EU’s securities watchdog ESMA said on Thursday the shift of share trading from London to the bloc is permanent.

The rise of Amsterdam, home to the world’s oldest stock exchange, had been well flagged as pan-European share platforms - Cboe and London Stock Exchange’s Turquoise in London - began preparing to open in Amsterdam after Britain voted in 2016 to leave the EU.

The ICE exchange announced this week that trading in EU carbon emissions worth a billion euros daily will move from London to the Dutch city during the second quarter.

Author

Alexander Douedari

Independent Analyst

Alexander Douedari is an Award Winning Hedge Fund Manager and Selfmade 7-Figure Trader. Now Mentor for Students all around the world.