A Hollywood ending for fourth quarter GDP

Summary

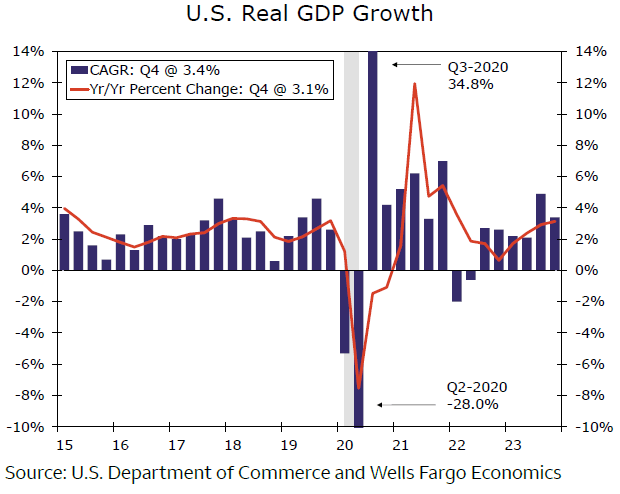

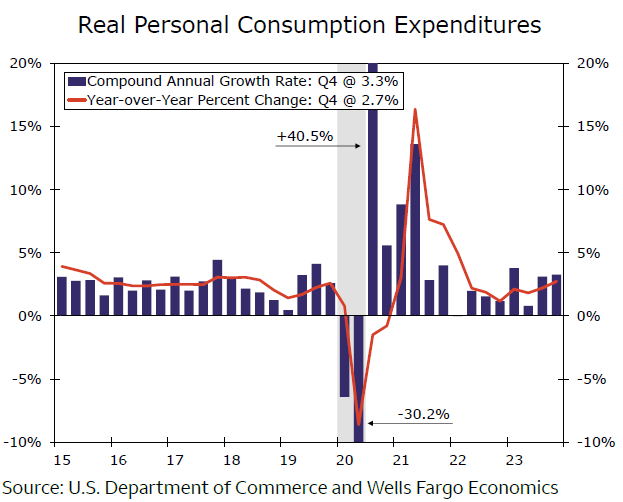

The latest revisions put Q4 GDP at 3.4%, the second fastest quarterly growth rate in two years. Much of the upside was attributable to stronger consumer spending, yet fresh profits data affirmed it was a good quarter for the bottom line as well with profits up by the most since the Q2-2022.

Hindsight 2024

In its latest revision to fourth quarter GDP, the Commerce Department flagged growth during the period at 3.4%, which is a faster clip than previous estimates (chart). With the benefit of even more hindsight, consumer spending is now pegged at an annualized growth rate of 3.3% up from just 3.0% previously (chart). What drove the adjustment higher was a better finish than expected for services outlays. While it may be encouraging to see sustained consumer spending growth in this sector, the staying power could be problematic for the Fed should the sustained demand there prevent a cooling in service prices. Tomorrow will bring monthly data for February on PCE inflation; we already know from the January report that the trend decline in services inflation has been interrupted.

Structures spending jumped to 3.7% from 2.4% in the prior estimate on upward revisions to private nonresidential construction spending. One theme we've highlighted is how a boom in manufacturing construction has scope to lift future output capacity. In the meantime it can be supportive to topline growth through stronger structures investment. Residential fixed investment growth was revised lower by a tenth of a percent.

Author

Wells Fargo Research Team

Wells Fargo