A few tips for trading gold right now

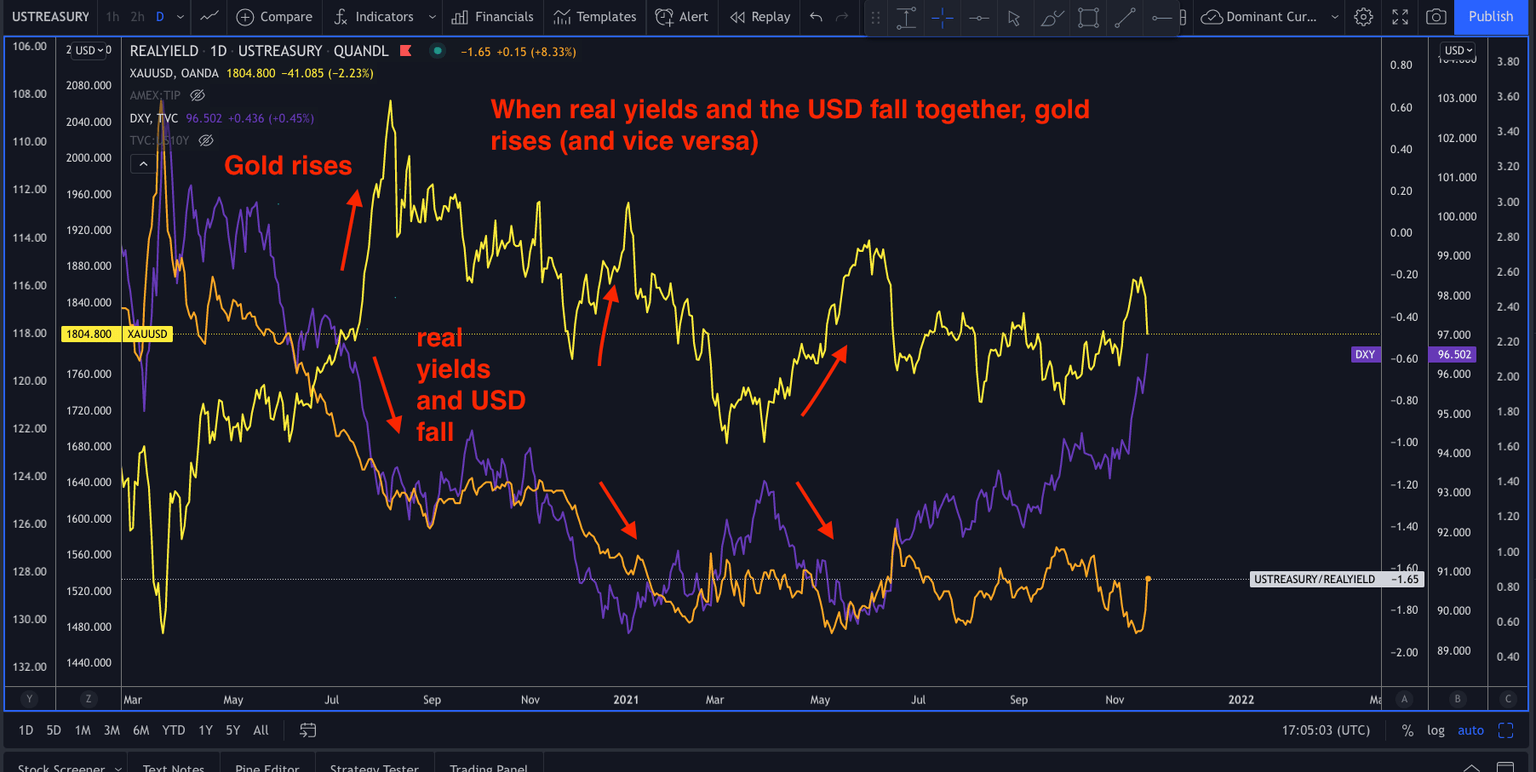

Gold is actually really simple to trade at the moment as it is being driven by the US yield story. The expectations of the Fed having to move on hiking rates more quickly are sending real yields higher. Remember that falling real yields is good for gold, and rising real yields is bad for gold prices. However, it is necessary to look at real yields in association with the USD.

What you want to see, in order to get a handle on gold’s direction, is not only real yields and the USD moving together but good reasons for that to continue. When both of these other markets align, that makes gold’s direction much more predictable.

Here would be the best scenario for further gold upside into year-end and 2022.

-

The Fed pushes back strongly against early tapering. Unlikely to happen, but this would suppress yields AND weaken the USD.

-

Inflation continues to rise sharply higher. This, in conjunction with point 1, would push real yields lower. So, if inflation moves higher faster than bond yields this can in effect push real yields lower.

-

Expect year-end demand on strong seasonals for gold purchases around the Chinese Lunar New Year. Check out just how strong this seasonal pattern is here, courtesy of Seasonax.

-

If the ECB suddenly turn aggressive (highly unlikely) on QE exit and move towards rate hikes this weakens the USD as the EURUSD gains.

The charts

If you would like to track this yourself, and you use trading view, here is the symbol information.

-

The real yields symbol name on the trading view is QUANDL:USTREASURY/REALYIELD.

-

The dollar index chart is the DXY.

The problem you will discover is that real yields are only updated daily. So, if you want to get a sense for real yields intraday then you can use this TIPS bond ETF symbol: AMEX:TIP. It is updated during the UK afternoon after the US open and is a good proxy for real yields.

That is the key to getting a handle of gold. If the stars align then just use the key tech to manage and define that risk. Some of the very major levels are marked below:

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.

-637734274882119716.png&w=1536&q=95)

-637734275156898807.png&w=1536&q=95)