2019 Sees Cycles From the Two Greatest Panics Ever!

2019 to 2020 is one of the most critical time windows of our lifetimes.

Here is why!

The vast majority of traders and fund managers do not know the value of long term cycles. However, they are the basis of the success of many billionaires.

A financial panic can be likened to a tsunami. They happen very rarely but when they do, they cause massive destruction.

So knowing when they are about to occur will not only enable you to protect your assets but also capitalise on the opportunity.

Take a look at the chart below.

Back in 1929, the western world went through the Wall Street Crash.

By the time the low had come in, the Dow Jones Industrial Average had fallen by 90%

Having made a high at a price of 386 points, the Index collapsed down to 44 points as can be seen from this chart.

That is a big fall.

The decline lasted nearly three years.

It was deemed to have been a freak event but it wasn’t. Legendary trader Jesse Livermore shorted the market down making hundreds of millions of dollars.

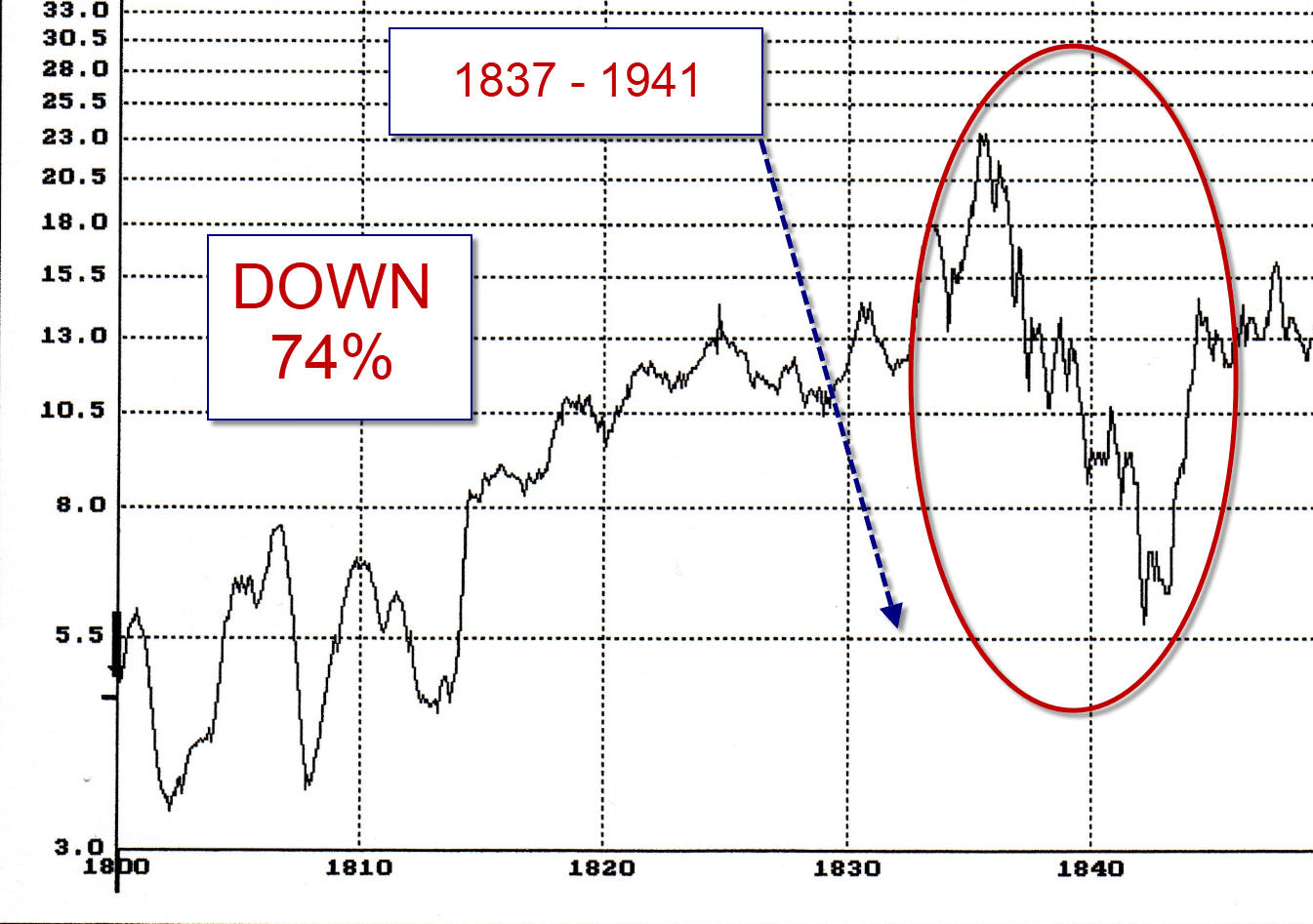

Head back another 90 years and we get to 1839.

In the 1830s, again economies were booming. This time it was canal building and land speculation that fuelled the boom.

It all came to a head in 1837 but then the market crashed again two years later in 1839.

By the time this was over - five years later, the market was down 74%.

2019 sees the 90-year anniversary from the 1929 crash.

2019 also sees the 180-year anniversary from 1839 crash.

However, there is a lot more to these cycles.

Now take a look at this chart - it shows the 90-year cycle from 1929 to present.

Note the halfway point: 1974.

This marked a major low.

This is when the OPEC lead Arab Oil Crisis was taking place bringing America and Europe to their knees.

Oil prices quadrupled. Markets collapsed.

2019 sees the 45 year anniversary from this crisis.

What is interesting is that this week specifically marks the 90-year anniversary of the crash.

Back in September 1929, the high came in on 3rd September.

The market sold off into 4th October the rallied into 11th October before losing 50% of its value by mid November.

This is the type of energy we are in when looking at the 90-year cycle.

Long term cycles rarely repeat to the day.

We believe that between now and the end of 2020 we are likely to see a major financial situation.

And it could come in quite quickly!

Author

Andrew Pancholi

Market Timing Report

Andrew Pancholi is a world-renowned trading expert specializing in market timing.