10 trading instruments to watch in H2 2024

Want to know which trading instruments are likely to make waves in the second half of 2024? The experts at Doto, a licensed CFD broker making trading as simple and smart as it gets, picked the top-10 instruments you won’t want to miss. From forex pairs to stocks, here’s a rundown of what’s worth keeping an eye on.

Major Forex pairs: EURUSD, USDJPY, GBPUSD

Since the beginning of the year, major forex pairs like EURUSD, USDJPY and GBPUSD have been hot topics among traders, and the spotlight is only going to get brighter. Why? Political drama and uncertainty around the US elections, anticipated rate cuts from the Federal Reserve in September and December, and monetary policy decisions from the Bank of England and the Bank of Japan.

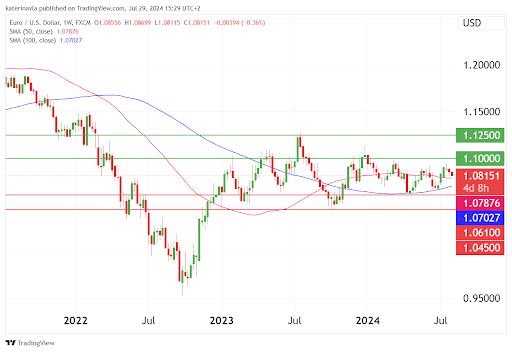

EURUSD: This pair has been in a consolidation channel since February, bouncing between the resistance at 1.1000 and the support at 1.0610. Now, with the Federal Reserve’s expected rate cuts, EURUSD is edging closer to 1.1000. The upcoming US elections could add more volatility depending on the winning party’s stance on economic policies.

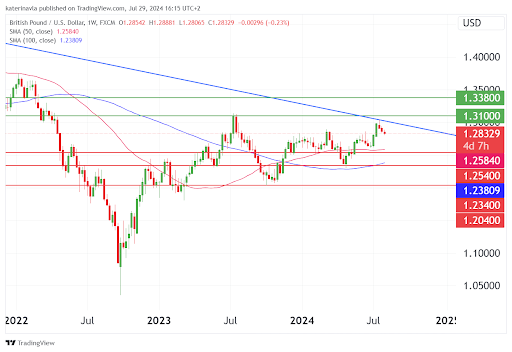

GBPUSD: Driven by inflation rates in both the UK and the US, this pair is seeing significant movement. With UK inflation still on the rise, the Bank of England could delay rate cuts, which may pull the pair lower to 1.2540 and 1.2340. On the upside, GBPUSD is limited by a strong resistance at 1.3100.

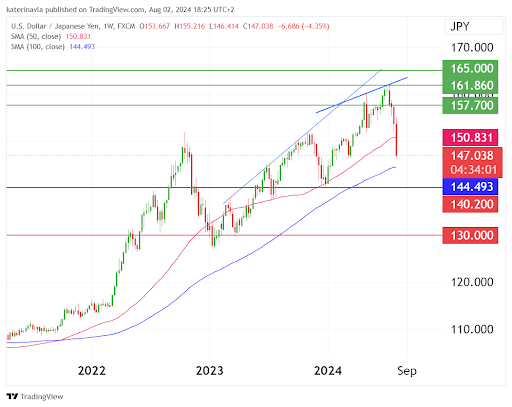

USDJPY: This is one of the most intriguing currency pairs to watch in the second half of 2024. The Bank of Japan’s monetary policy changes coupled with the Federal Reserve’s potential rate cut could push USDJPY to the 140.20 level, making it a hot spot for traders.

Stocks: NVIDIA, Morgan Stanley, Exxon

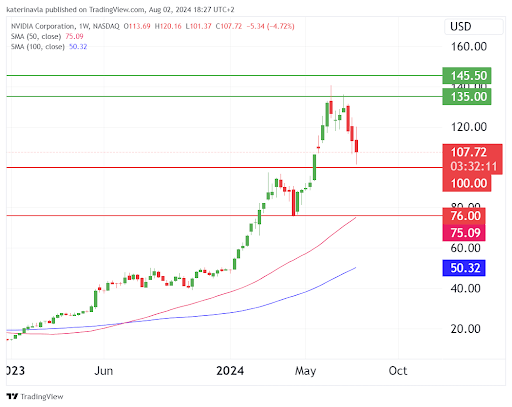

Nvidia: This AI tech stock continues to attract attention. There’s a high chance of a correction to $100 and a fall further downwards before the price reverses. Demand for risky assets amid a Federal Reserve rate cut may push Nvidia to retest the $135 level in the second half of 2024.

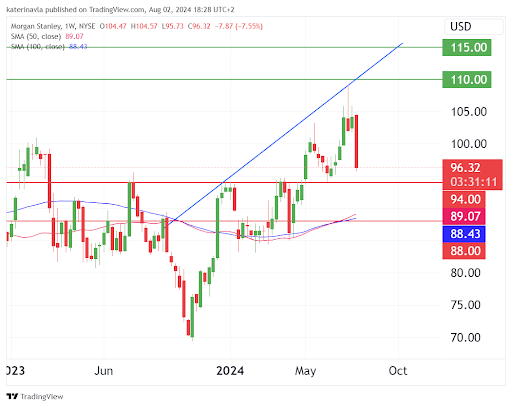

Morgan Stanley: Bank stocks typically thrive during rate cuts, and Morgan Stanley is no different. Its stock has been on a stable uptrend and could reach $110 by the end of the year.

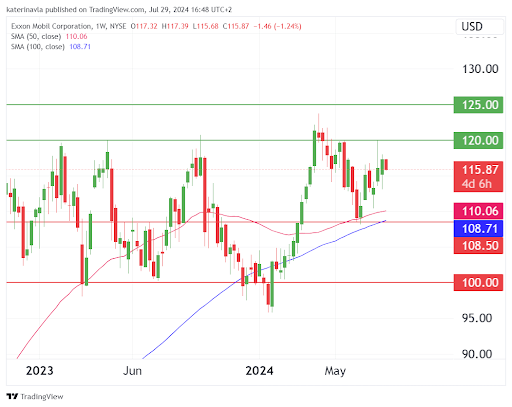

Exxon: The energy sector is generally volatile, and major US oil producer Exxon Mobil offers some of its best trading opportunities. The stock is trending upwards and could rise higher to $150 due to strong oil demand coupled with tensions in the Middle East.

Cryptocurrencies: BTCUSD, ETHUSD

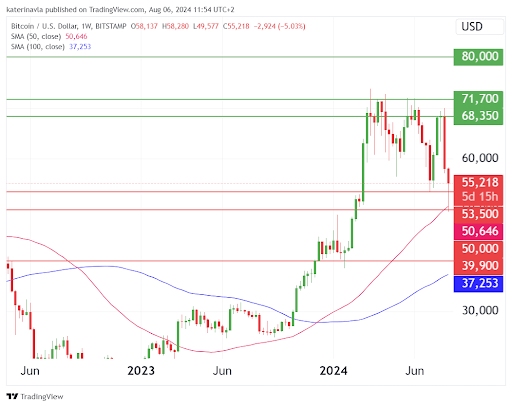

BTCUSD: The crypto market is experiencing its usual ups and downs. After enjoying a post-halving bull run, investors have begun to sell off their risky assets such as Bitcoin amid global instability and fears of a recession. There is a strong support zone for the premier cryptocurrency at $53,500 to $50,000, and Bitcoin falling below it will indicate the start of a bear market. The resistance zone now lies at $68,350 to $71,700.

Commodities: XAUUSD

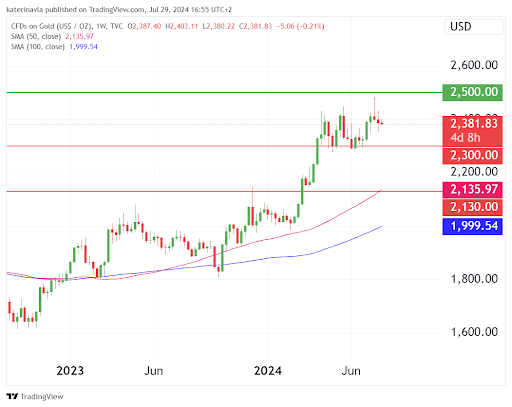

XAUUSD (Gold): Gold stands to benefit from the Federal Reserve’s monetary easing, potentially climbing towards $2,500. However, September is typically bearish for gold, so a correction may occur before the yellow metal tests its summer highs again. Keep an eye on seasonal trends and Fed policy.

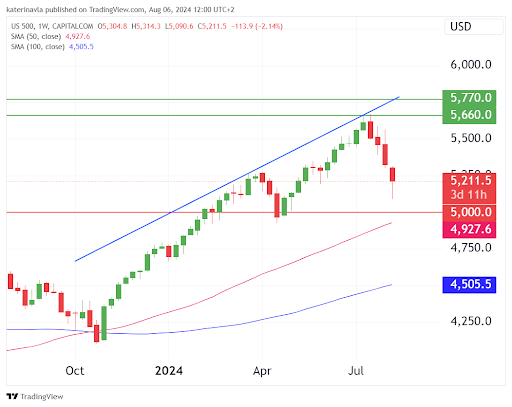

Indices: US500, JP225

US500: After a prolonged rally, the S&P 500 might face a correction, especially with its typically weak performance in September and October. Key levels to monitor are the 5,700 resistance and 4,900 support, especially after the US elections and if the Federal Reserve cuts the interest rate.

JP225: Changes in the Bank of Japan’s monetary policy coupled with risk aversion across the general market pulled Japanese stocks lower in August. Potentially, there is a chance for the index to slide below the $30,300 level towards the support at $26,500. On the upside, the resistance zone lies at a double top, around $41,200 to $42,500.

Looking for a smarter way to trade on these and many other instruments? Try Doto and its easy-to-use yet advanced platform that helps you make data-driven decisions using built-in trading signals and analytics. Get a deposit bonus of up to 50% and enjoy quick withdrawals. The second half of 2024 is looking promising for traders, so don’t miss your chance.

Author

DOTO Team

DOTO

A platform where anyone can become a trader, no matter their experience. Simplicity, Accessibility, People First and Innovation are our main values. Trading Markets: Forex, Commodities, Indices, Crypto and Stocks.