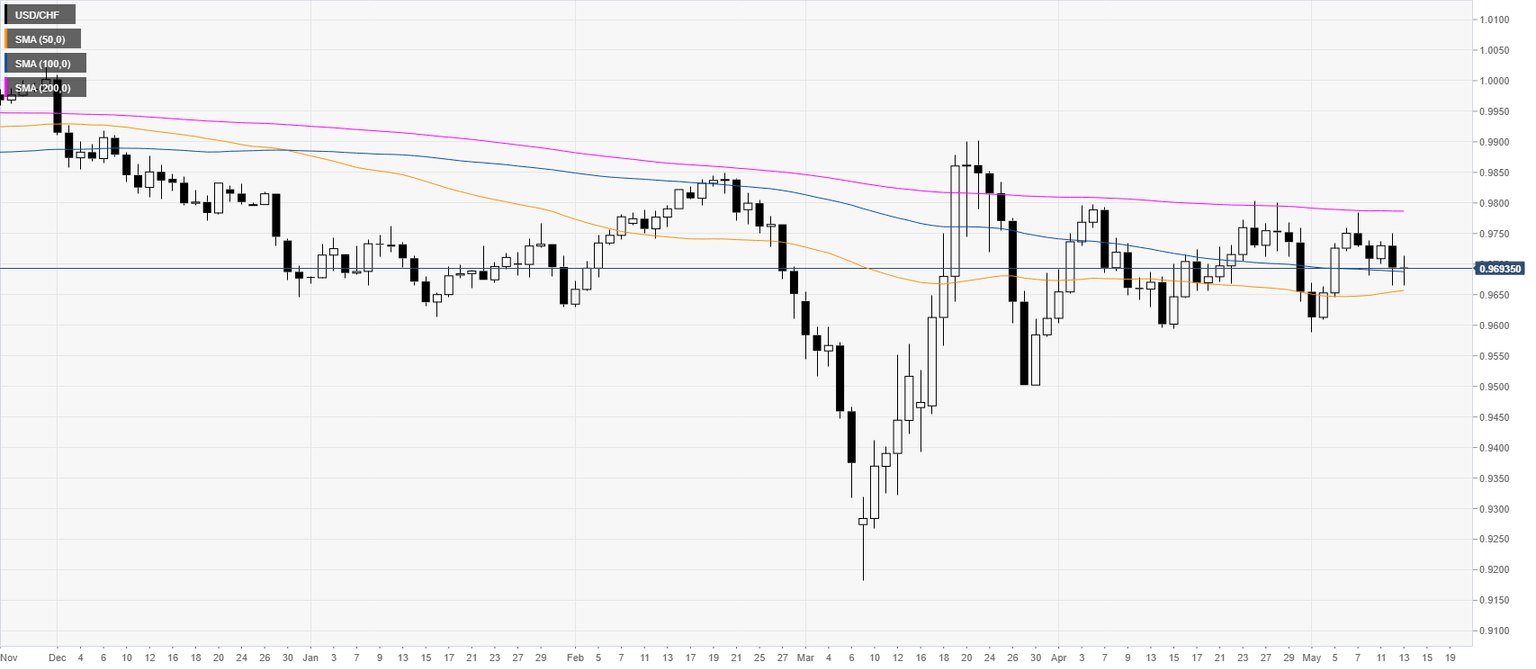

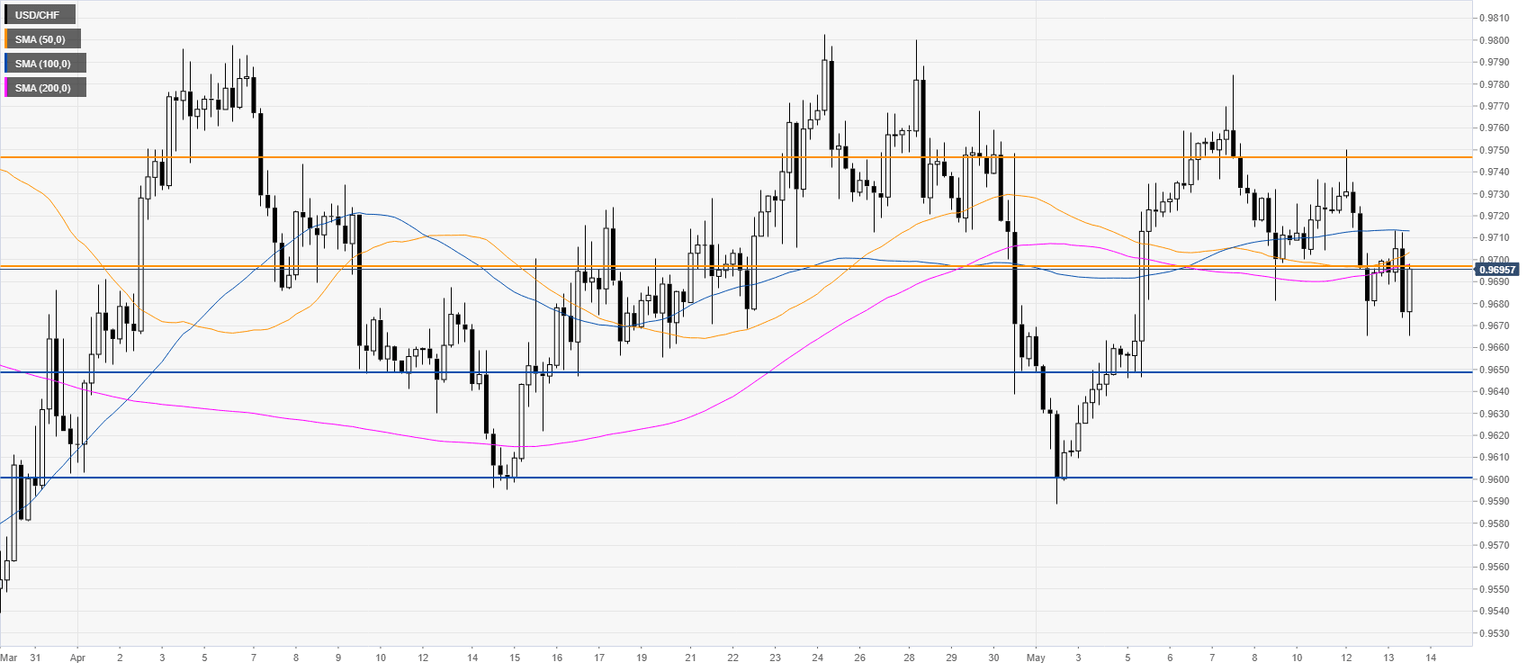

USD/CHF Price Analysis: Greenback trying to regain the 0.9700 figure vs. Swiss franc

- Broad USD weakness keeps the USD/CHF pair below the 0.9700 level.

- There is little to no directional bias as the technical picture is mixed.

USD/CHF daily chart

USD/CHF four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst