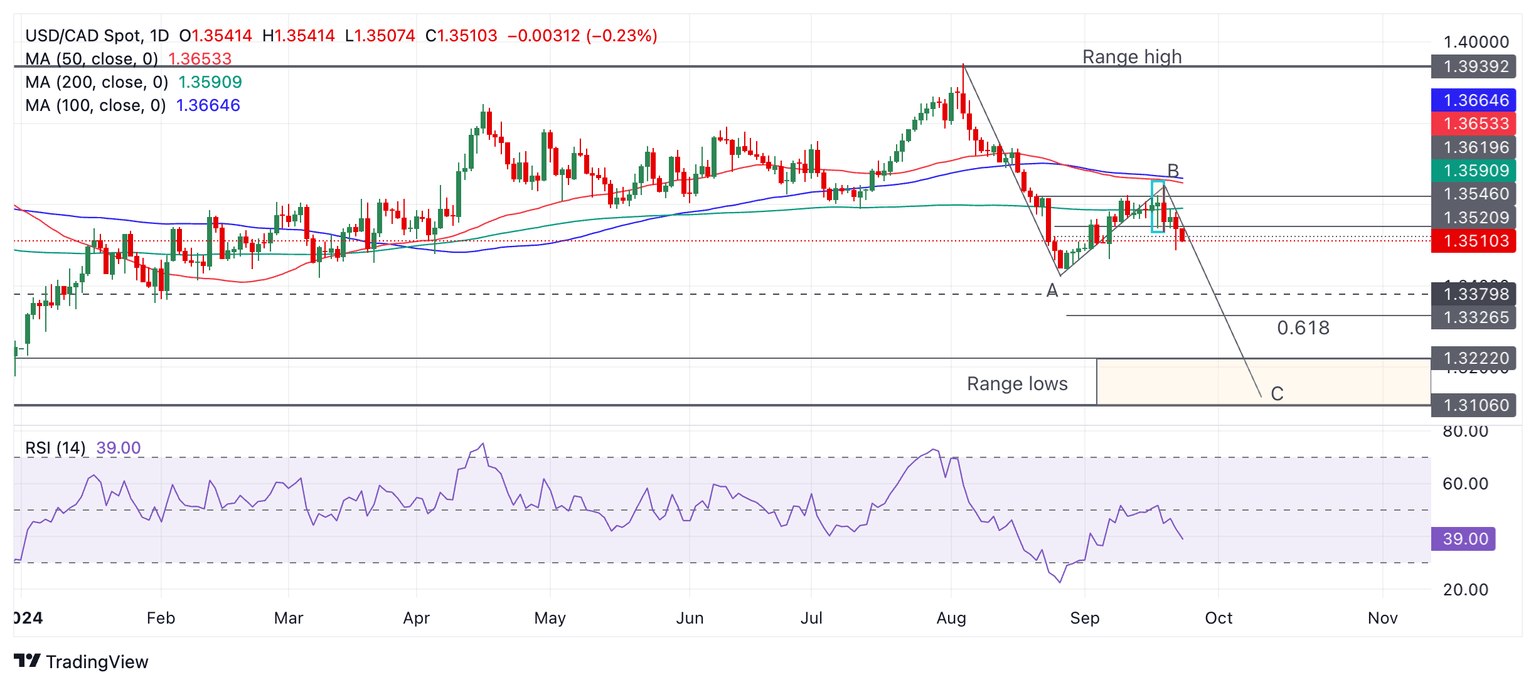

USD/CAD Price Prediction: Wave C of Measured Move probably unfolding

- USD/CAD has reversed trend and started to decline.

- It is probably forming the wave C of a large ABC or Measured Move pattern.

USD/CAD has rolled over and is beginning to fall in a new down-leg. It is probable in a short-term downtrend now, leaning the odds in favor of more selling. A break below 1.3487 (September 23 low) would probably confirm more downside to targets towards the base of the range (see below).

USD/CAD Daily Chart

USD/CAD’s move down from the range high, which started on August 5, looks like an ABC pattern, or “Measured Move” (see labels on chart above). Such patterns are like large zig-zags. The wave C usually reaches a similar length to wave A, or at a minimum a Fibonacci 61.8% of A.

As USD/CAD now seems to be forming an ABC pattern, wave C is probably about to unfold and go substantially lower. Such a down leg would probably fall to the zone of the range lows (orange shaded rectangle on chart above). The more conservative 61.8% target, meanwhile, lies at 1.3326.

A break below 1.3466 (September 6 low) more solid bearish confirmation.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.