Understanding IRAs: An essential pillar of retirement planning

Faced with the uncertainties surrounding retirement and the sustainability of Social Security, Individual Retirement Accounts (IRAs) are emerging as a great option for building a solid financial future.

But what is an IRA, and how does it really work? Let’s take a look at a key retirement tool.

What is an Individual Retirement Account?

An Individual Retirement Account (IRA) is a tax-advantaged retirement savings account that can be opened by anyone with an income. Unlike a 401(k), which depends on an employer, an IRA is managed directly by the saver, via a bank, brokerage firm or financial advisor. It allows you to invest in a wide range of assets like stocks, bonds, mutual funds, ETFs, etc.

IRAs are designed to encourage long-term savings for retirement, offering tax advantages either on entry or exit, depending on the type chosen.

Two main types: Traditional IRA and Roth IRA

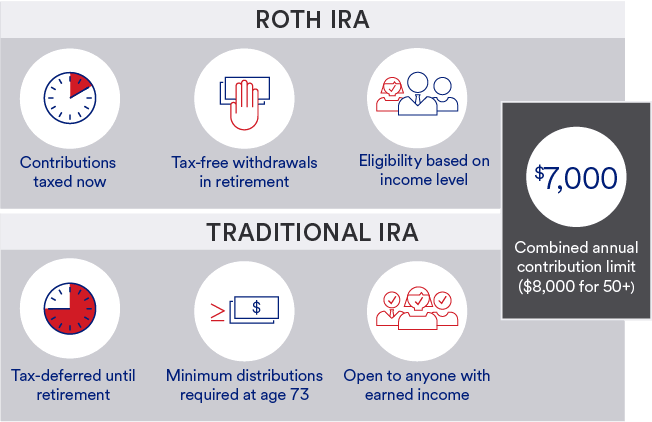

IRAs come in several versions, but the most common are the Traditional IRA and the Roth IRA. Their main difference lies in their tax advantages.

Traditional IRA: The immediate tax advantage

With a Traditional IRA, contributions may be tax-deductible (depending on your income and retirement coverage at work). On the other hand, withdrawals at retirement are taxed as ordinary income.

The major advantage is tax-deferred growth. Your investments grow tax-free until you withdraw them. This mechanism can lead to faster capital accumulation.

From age 73, holders are required to start making mandatory withdrawals, known as Required Minimum Distributions (RMDs).

Roth IRA: tax-deferred, withdrawals tax-free

The Roth IRA works in reverse. Contributions are made with money that is already taxed, but withdrawals at retirement are totally tax-free, provided certain conditions are met (being over 59½ years old and having held the account for at least five years).

Another advantage is that Roth IRAs are not subject to RMDs during your lifetime, making them an excellent inheritance or long-term tax planning tool.

Source: USBank

Contribution limits for IRAs

The IRS imposes contribution limits on all IRAs (Traditional + Roth combined). In 2025, the annual limit is set at :

- $7,000 for those aged under 50

- $8,000 with the catch-up contribution for those aged 50 and over.

Income limits also exist to determine eligibility for tax deductions (Traditional IRA) or to contribute to a Roth IRA. These thresholds vary according to tax status (single, married, etc.) and the presence of a retirement plan at work.

Why open an IRA, even when having a 401(k)?

Many people feel that their 401(k) is sufficient to prepare for retirement. But according to Fidelity, you'll need between 70% and 80% of your pre-retirement income to maintain your standard of living after you leave the workforce. Social Security only covers part of this amount, and 401(k)s often have limited investment options.

An IRA allows you to diversify your investments, complement a corporate plan and access more flexible tax planning strategies. You can also rollover from an old 401(k) to an IRA when you change employers, to consolidate and better manage your assets.

Withdrawal and tax rules

Withdrawing money from an IRA before age 59½ generally incurs a 10% penalty, in addition to applicable taxes (with exceptions, such as medical expenses or the purchase of a first home). That's why IRAs are designed for the long term.

A more comprehensive retirement planning

One option for an effectively planned retirement is to combine several sources of savings: 401(k), IRAs, taxable accounts and Social Security.

Having an IRA, whether traditional or Roth, allows you to balance the taxation of your future income and better manage your withdrawals according to your needs and tax bracket.

Whether you're employed, self-employed or an entrepreneur, Individual Retirement Accounts (IRAs) offer a solution for anticipating the future.

Their flexibility, accessibility and tax advantages make them a good tool for securing your retirement, especially at a time when the future of Social Security is uncertain and company plans are often no longer sufficient.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.