Stock market: Three Islands of strength in a sea of red

There is a very great chance the S&P 500 (NYSEARCA: SPY) could fall another 25% or more but the news is not bad for all stocks. The hurricane predicted by Jamie Dimon is upon us, some others say the economy is broken, and yet there are sectors, industries, and individual stocks that are still seeing positive activity from the analysts.

Those are stocks investors should be paying attention to because names like FedEx (NYSE: FDX), which just reported a big miss while predicting a global recession, are seeing a massive round of downgrades and moving lower.

Morgan Stanley likes miners

Morgan Stanley (NYSE: MS) just issued a sweeping change to its mining outlook by upgrading a number of names in the group. The firm upgraded Alcoa (NYSE: AA), Teck Resources (NYSE: TECK), and Nexa Resources (NYSE: NEXA) to Overweight and Southern Copper Corporation (NYSE: SCCO) to Equal Weight while upping the price targets for most.

The analyst says the group is offering a value and comes with the prospect of earnings strength as well. "We are selectively turning more positive on mining equities as most stocks in our coverage trade at increasingly attractive stock valuations," wrote Carlos de Alba in his report.

And this activity is not limited to Morgan Stanley, either. The targets for all the stocks in the group are down on a YOY basis but the sentiments and price targets are firming.

The stock with the lowest consensus target as indicated by Marketbeat.com data is Southern Copper Corporation at 13% but Morgan Stanley sees 17% of upside and all of its new targets are indicating a double-digit upside. Alcoa and Nexa Resources are both tapped for 85% gains per the consensus figures while Tech should see at least 40%.

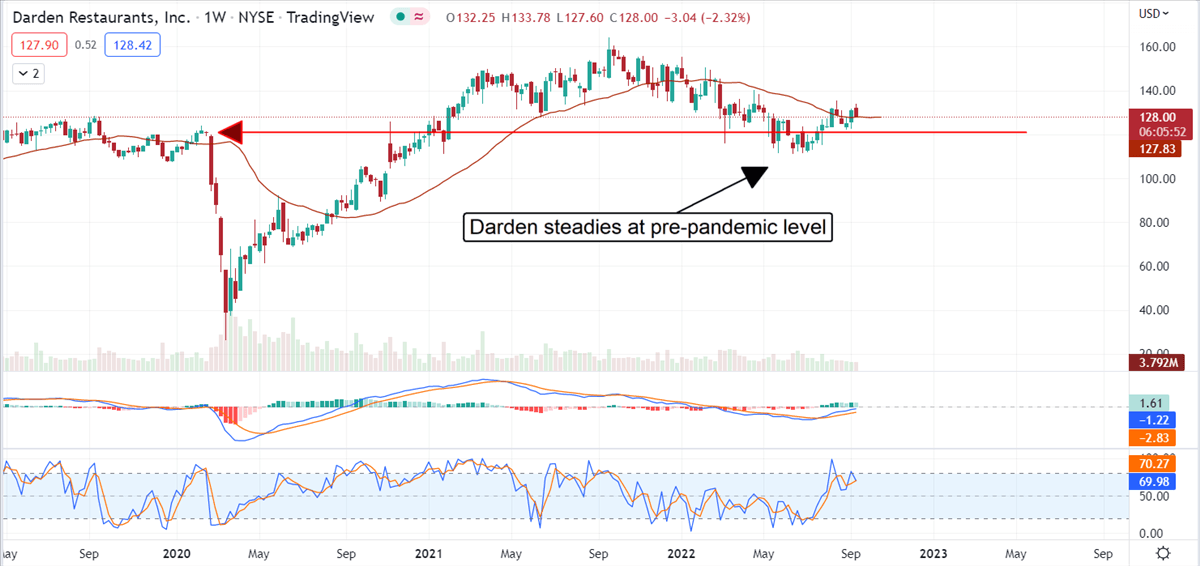

The sentiment firms for Darden Restaurants

Darden Restaurants, Inc (NYSE: DRI) is slated to report earnings next week and is getting upgraded ahead of the news. The latest channel checks from Baird have restaurant sales up 6% in the first week of September and trending in the +18% to 20% range in the 3-year stack which bodes well for this operator.

The company’s chains are not only well known but well loved and command significant portions of a market that has seen competition evaporate over the past two years. The company has received at least four commentaries this month alone including 3 boosted targets and 1 initiated coverage at Outperform with a price target above the broad Marketbeat.com consensus estimate which is projecting about 10% of upside for the stock.

Darden Restaurants also offers an interesting dividend as well. The stock is paying about 3.70% with shares trading near $128 and there is a positive outlook for distribution growth as well. The payout ratio is a little high near 60% but the outlook for sustainability is positive and should support additional increases if not at the recent 15% CAGR the company has been running.

Cowen calls out Shoals Technology Group

Shoals Technology (NASDAQ: SHLS) just got an upgrade from Cowen to Outperform that came with a price target roughly 50% above the current consensus estimate. The consensus is projecting about 12% of upside but has been firming over the past few months along with the sentiment which indicates a firm Hold verging on Buy at this time.

The latest news from the green energy sector is the tax-and-climate bill is supportive of the industry and the rise in energy prices certainly helps as well.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.