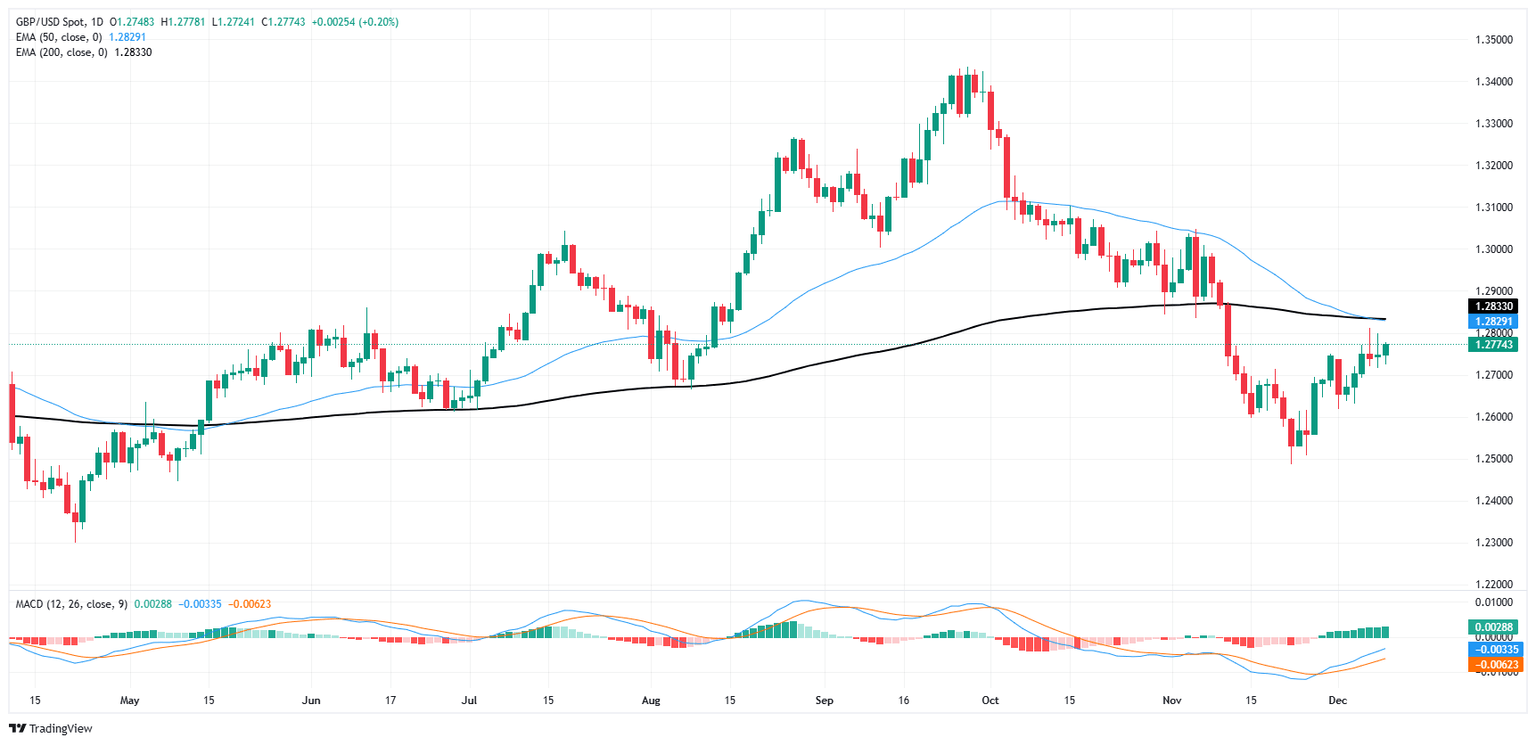

Pound Sterling Price News and Forecast: GBP/USD extends its winning streak for the third successive session

GBP/USD steadies near 1.2800 as traders expect BoE to maintain current interest rates

GBP/USD extends its winning streak for the third successive session, trading around 1.2780 during the Asian hours on Wednesday. The Pound Sterling (GBP) gains support against its major peers as traders become increasingly confident that the Bank of England (BoE) will keep its interest rates unchanged at 4.75% in December’s monetary policy decision.

Most BoE officials are expected to vote to keep interest rates unchanged, as UK headline inflation has risen again after briefly dipping below the bank's 2% target. The central bank had earlier predicted a rebound in inflation following its temporary alignment with the target range. Read more...

GBP/USD tries to push north through near-term congestion

GBP/USD found some room on the high side on Tuesday, gaining almost 0.2% and inching back toward the 1.2800 handle, grasping for the key price level that has flummoxed bullish momentum in recent days. Cable traders are buckling up for the wait to Wednesday’s US Consumer Price Index (CPI) inflation update.

GBP-centric data is limited this week, with the UK showing strictly mid-tier economic releases on the calendar, leaving Cable to singularly face this Wednesday’s CPI inflation print, which serves as one of the last key data releases before the Federal Reserve’s (Fed) last policy meeting in 2024. Signs that progress on inflation has stalled could kill hopes for a third consecutive rate cut on December 18. At the current cut, Wednesday’s US CPI inflation for November is expected to rise slightly to 2.7% YoY from the previous 2.6%, while core annualized CPI is forecast to hold steady at 3.3%. Read more...

Author

FXStreet Team

FXStreet