Pound Sterling Price News and Forecast: GBP/USD clings to bullish stance

GBP/USD Forecast: Pound Sterling clings to bullish stance

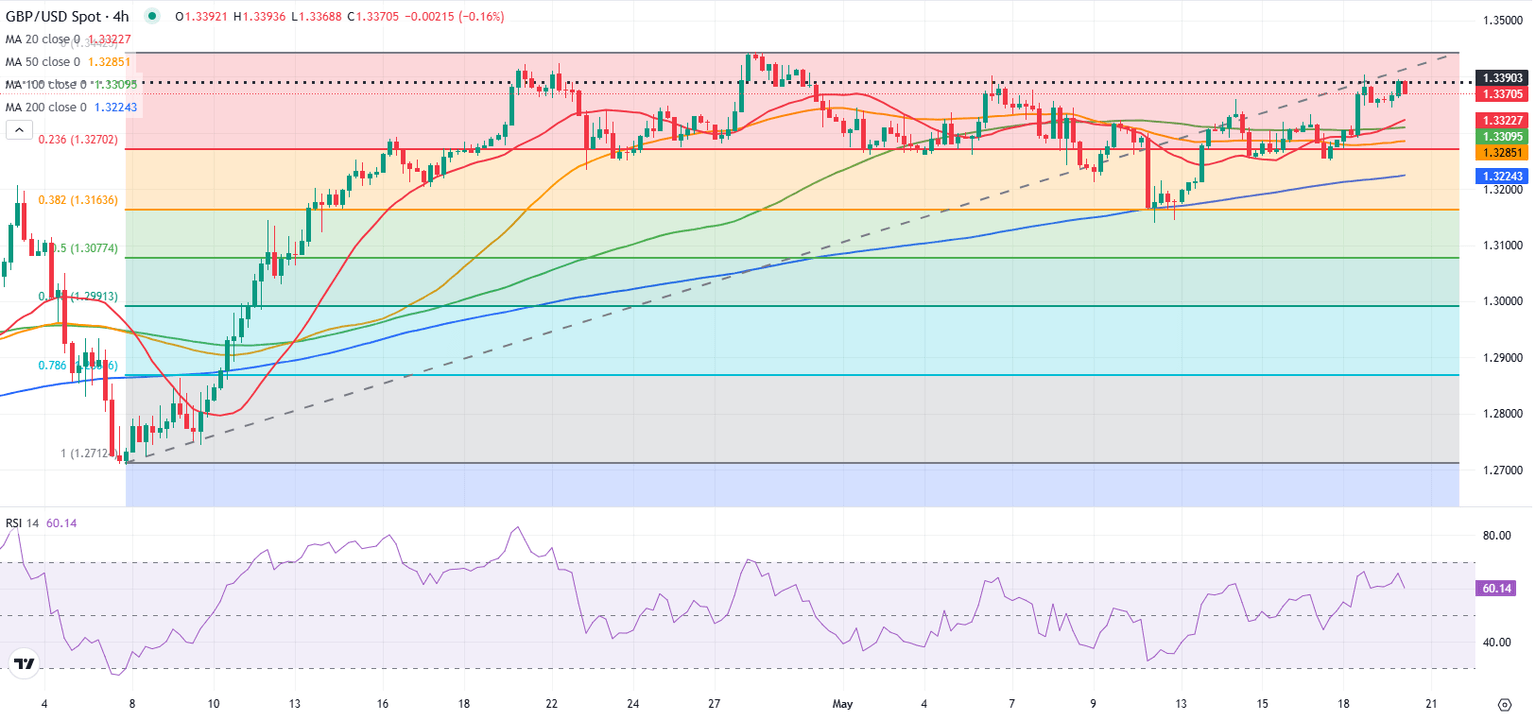

GBP/USD clings to small daily gains above 1.3350 early Tuesday after posting strong gains on Monday. The pair's technical outlook suggests that buyers could look to retain control in the near term.

The US Dollar (USD) came under bearish pressure to start the week and fuelled GBP/USD's rally on Monday, as markets reacted to Moody's decision to downgrade the United States' sovereign credit rating, citing an unsustainable deficit. Read more...

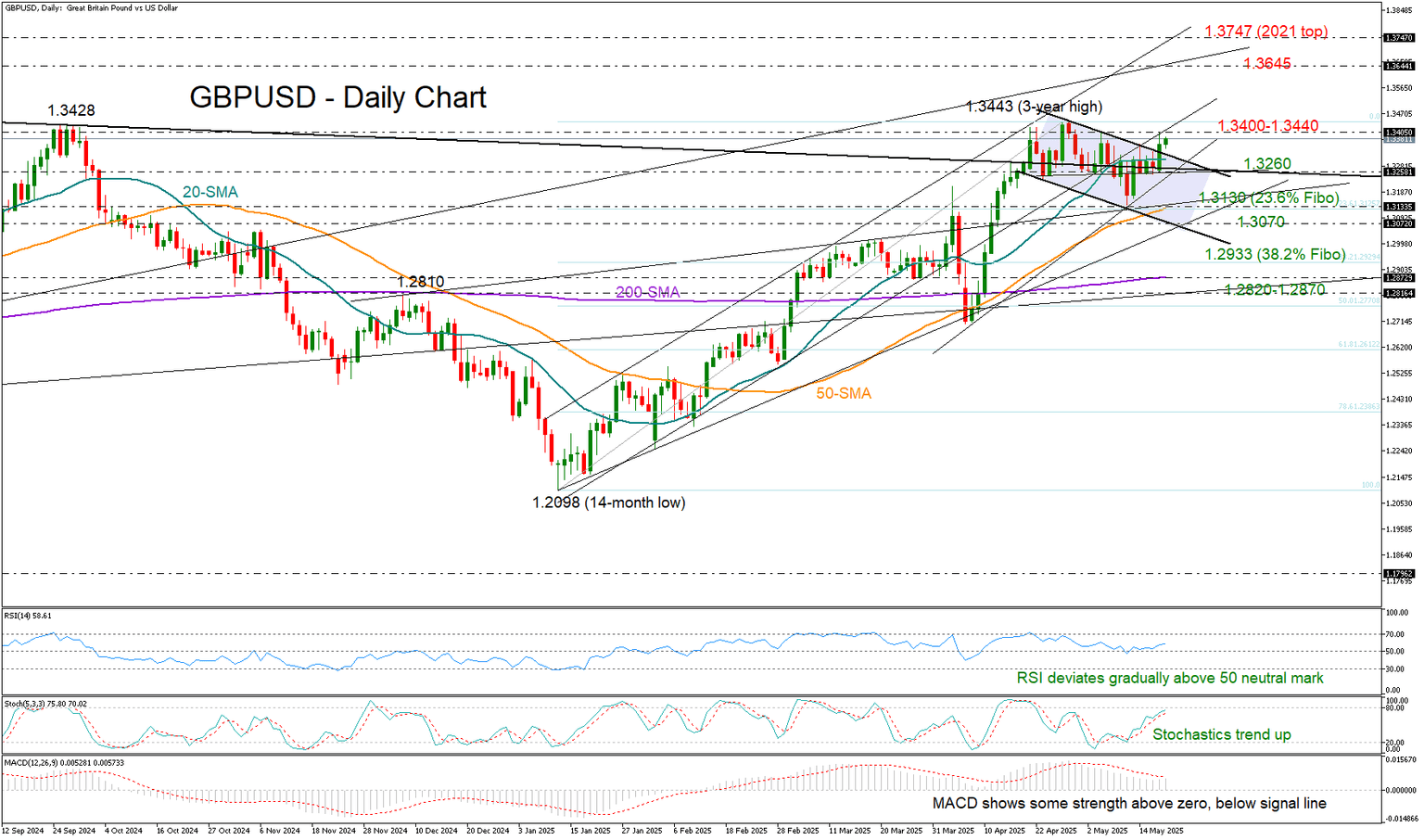

GBP/USD exits bearish channel

GBPUSD has broken above a bearish channel, as Moody’s credit downgrade of the US economy and improving EU-UK trade relations have brought bullish momentum into play.

A close above the 20-day simple moving average (SMA), along with a positive slope in the momentum indicators, continues to favor the bulls. However, the 1.3400–1.3440 resistance zone could still pose a challenge. A decisive break above this ceiling is likely needed to trigger a swift rally toward the 1.3645 resistance zone. Beyond that, the 1.3750 level - aligned with the 2021 high - may be the next obstacle before the 1.3830 barrier. Read more...

Author

FXStreet Team

FXStreet