NZD/USD Price Analysis: Pair faces resistance at 20-day SMA, momentum persists

- NZD/USD declined to 0.5895 on Thursday.

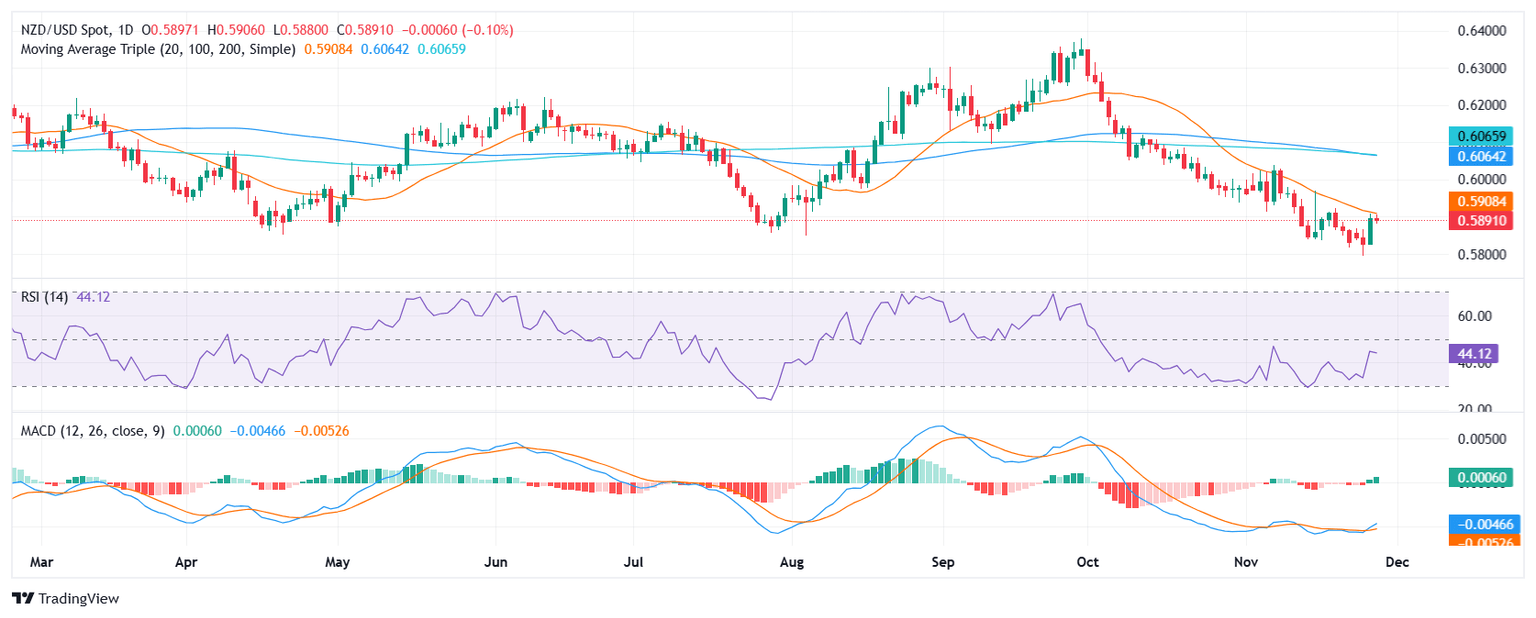

- Pair rejected at 20-day SMA and indicators lost some steam, but may have momentum to conquer the SMA.

- As long as the pair holds below the 20-day SMA, the outlook for the short-term will be negative.

The NZD/USD declined slightly in Thursday's session, reaching a low of 0.5895, before recovering some ground. Overall, the momentum seems to be mixed. The pair has been in a downtrend since late September, and the short-term outlook remains negative as long as it remains below the 20-day Simple Moving Average (SMA).

The technical indicators present conflicting signals. The Relative Strength Index (RSI) is currently at 47, indicating that it is in negative territory and suggests that selling pressure is present. On the other hand, the Moving Average Convergence Divergence (MACD) histogram is green and rising, indicating that buying pressure is rising. This divergence suggests that while there may be some selling pressure, there is also significant buying interest in the market.

Despite facing resistance at the 20-day SMA, NZD/USD maintains momentum from recent gains, with indicators suggesting both buying and selling pressure present. However, the downward trend continues as long as the pair remains below the mentioned SMA. When American traders return from Thanksgiving’s holiday, the pair may see further volatility which might set the direction of the pair.

NZD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.