NZD/USD Price Analysis: Bears take a breather, yet maintain a clear domination

- NZD/USD slightly rebounds, hovering near the 0.5900 mark, but remains under a clear bearish influence.

- The pair lost more than 4% in July, underscoring a strong bearish outlook.

- The 0.5850 area is the last barrier against the sellers.

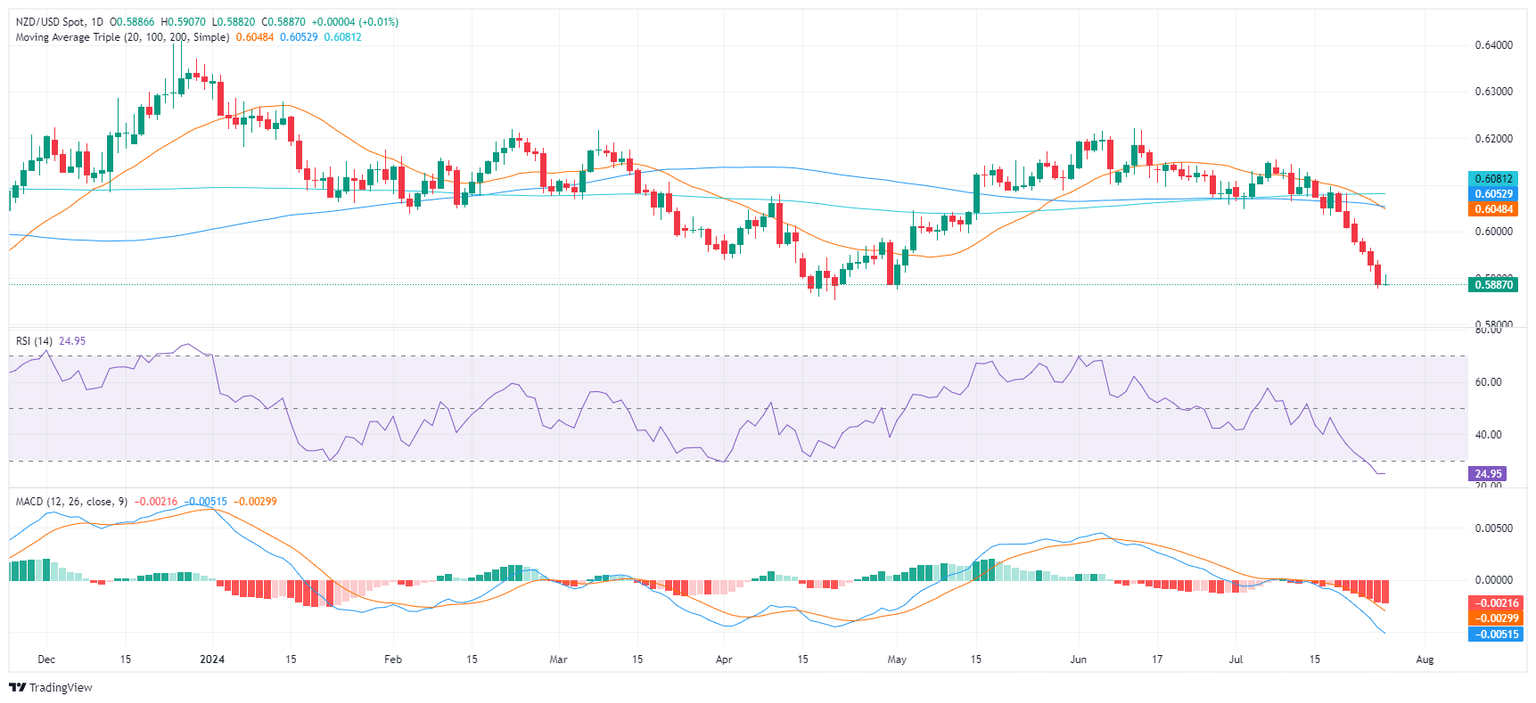

In Friday's session, the NZD/USD took a slight break from its continual downward trajectory, mildly rebounding to 0.5890. This brief respite comes after a six-day losing streak that led to a significant bearish turnaround for the currency pair. The overall picture still reveals a strongly bearish influence, given the pair lost over 4% in July, and the bearish crossover of the 20-day Simple Moving Average (SMA) at 0.6050 with the 100-day SMA, which might just inspire the bears further.

The daily technical indicators continue to signal a bearish trend. The Relative Strength Index (RSI) stands at 24, nestled firmly within oversold territory, which indicates intense selling pressure. Additionally, the Moving Average Convergence Divergence (MACD) with its flat red bars lends further support to a bearish outlook. As the RSI descends further into the oversold region, there may be a possible corrective momentum on the horizon.

NZD/USD daily chart

From a daily chart perspective, strong support is noticed at the 0.5880 level and slightly below that at May lows around 0.5850. On the flip side, resistance can now be spotted at the former support level of 0.6000, followed by 0.6050.

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.