NZD/USD crawls towards Wednesday highs in the 0.7170s as APac trade gets underway

- NZD/USD put in a solid performance in line with other risk-sensitive currencies on Wednesday.

- The pair rallied from just above the 0.7100 level to current levels close to highs of the day in the 0.7170s.

- Risk appetite seems to remain broadly underpinned by hopes that the Biden administration will deliver economic recovery boosting stimulus.

NZD/USD put in a solid performance in line with other risk-sensitive currencies on Wednesday, rallying from just above the 0.7100 level to current levels close to highs of the day in the 0.7170s. The pair closed Wednesday FX trade with gains of around 0.7% or over 50 pips, having ridden a risk on wave that saw US equities (which were led by large Tech names) surge to all-time high levels as the US transition of power from the Trump to Biden administration went through without any hiccups.

Driving the day

Risk appetite seems to remain broadly underpinned by hopes that the Biden administration will deliver economic recovery boosting stimulus over the coming months, from which commodity export-exposed small open trading economies such as New Zealand stand to benefit amongst the most. But a few cracks did appear and the broader market tone wasn’t screaming risk on; USD finished the session flat amid weakness in European currencies and crude oil stumbled and gave back early gains to finish the session flat.

Pandemic nerves seem still to be present after Germany and the Netherlands toughened lockdown restrictions and following a concerning report that US President Joe Biden’s team is increasingly worried the coronavirus pandemic is spiralling out of control and there is concern that this might imperil his promise to contain the outbreak. Biden’s team is reportedly particularly worried about lagging vaccinations and the spread of a more transmissible strain in the country.

Nonetheless, NZD keeps gradually advancing even though the Dollar Index is flat. Westpac (one of the most widely followed antipodean banks) released an update to its OCR forecast in 2021 and now no longer sees the RBNZ taking interest rates into negative territory. This may well support NZD as more desks digest the bank’s latest update and Asia Pacific flow arrives.

Westpac no longer calling for RBNZ rate cuts

Westpac now expect the RBNZ to keep the OCR on hold for the foreseeable future (a change from their call for two cuts this year). The bank maintains that the RBNZ needs to keep the OCR very low due to low inflation and high unemployment, but gives three reasons as to why it does not need to go any lower;

“(1) The economy has weathered the Covid storm better than anticipated, and GDP has already recovered to its pre-Covid level. True, very recent indicators suggest that GDP growth in the December 2020 and March 2021 quarters will be very low or even negative, mainly because of the lack of international tourists over the normally-busy summer months. But even if GDP does decline over summer, the economy will still be operating at a far healthier level than previously anticipated.”

“(2) The housing market has outstripped even our very bullish expectations. We now predict that annual house price inflation will peak at 20% later this year (previously 16%). And looking at 2021 as a whole, we are now forecasting that house prices will rise 15%, on top of the 12% increase over 2020. The reason for this surge in prices is the sudden drop in mortgage rates engineered by the RBNZ.”

“(3) Global supply and distribution of goods has been disrupted by Covid-19. Supply shortages could temporarily boost inflation in New Zealand. On a related note, global oil prices have risen in recent months, along with prices for other key global commodities – again, this could help to boost inflation in New Zealand.”

In terms of exchange rates, the bank says; “to date, we have been forecasting that the NZD/AUD exchange rate would fall this year and that the NZD would rise only a little against the USD, in an environment where most currencies are expected to rise against the USD. However, given that we are no longer expecting OCR cuts, we now see more scope for the NZD to rise.”

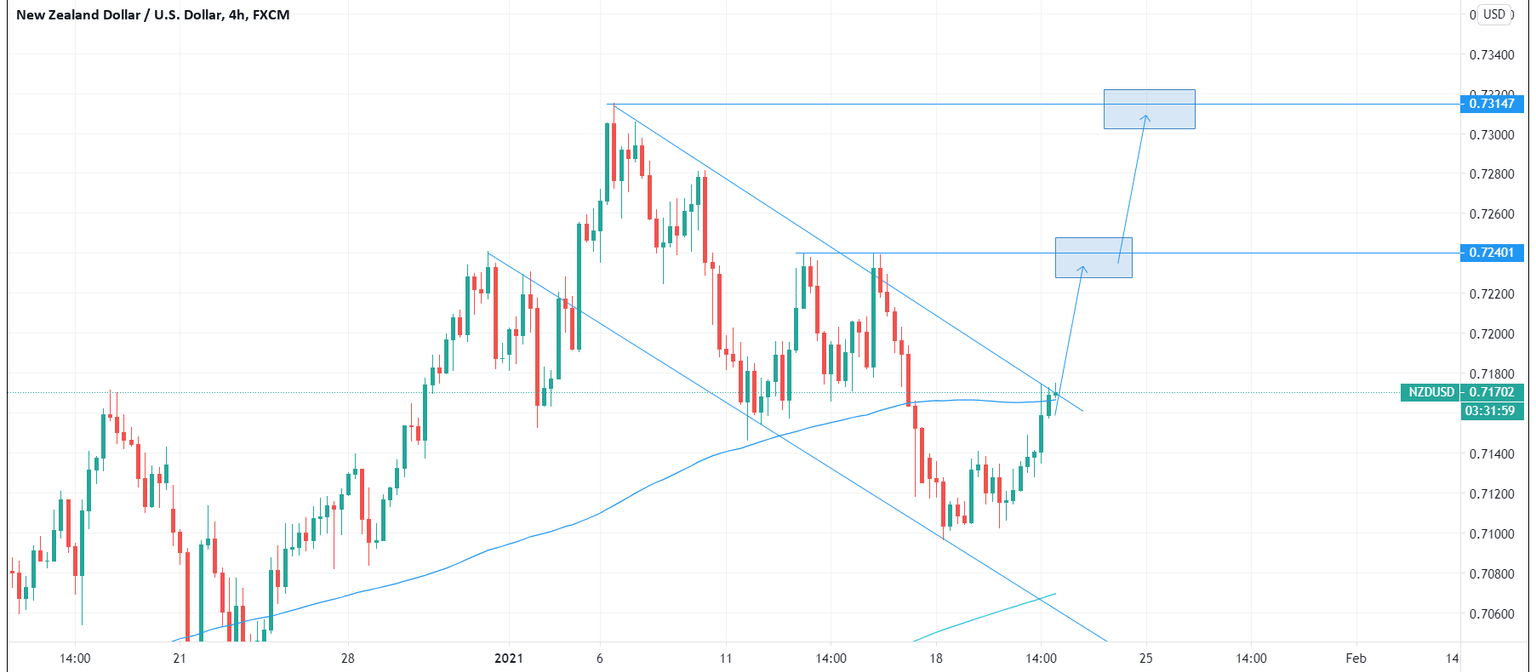

NZD/USD testing key downtrend and 21DMA

NZD/USD’s gains were halted on Wednesday at the 21-day moving average which currently resides at 0.71667. Since reaching the level, the pair has struggled to advance further, perhaps because it has also run into a key downtrend linking the 6, 8 and 14 January highs. A break above this key downtrend will open the door to a move back towards last week’s highs around 0.7240 and then perhaps onto the annual highs just above 0.7300.

NZD/USD four hour chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset