NIO Stock News: Sichuan earthquake helps Nio shares slide ahead of Wednesday earnings

- NYSE:NIO fell by 9.82% during last week’s trading.

- Nio is reporting its second quarter earnings on Wednesday.

- BYD falls in Asian trading as Daiwa predicts Buffett will sell his whole stake.

UPDATE: NIO stock has shed 2% at the start of trading on Tuesday after the Labour Day weekend. An earthquake in Sichuan province has killed at least 65 people, according to reports. Shares are changing hands down 2.2% at $17.30 at the time of writing. The market still appears to be factoring in the lockdowns in China related to new cases of covid. New reports suggest that the lockdowns, which began in Chengdu, are affecting about 65 million Chinese. Additionally, rivals Li Auto and XPeng do not seem to have benefited greatly from their quarterly earnings releases. Then, of course, there is the macro headwinds that are leaving many large players to take a break from the equity markets at the moment. More than 2,200 call contracts have traded this morning for the $18 strike price expiring this Friday. The contract last traded for $0.56 a share.

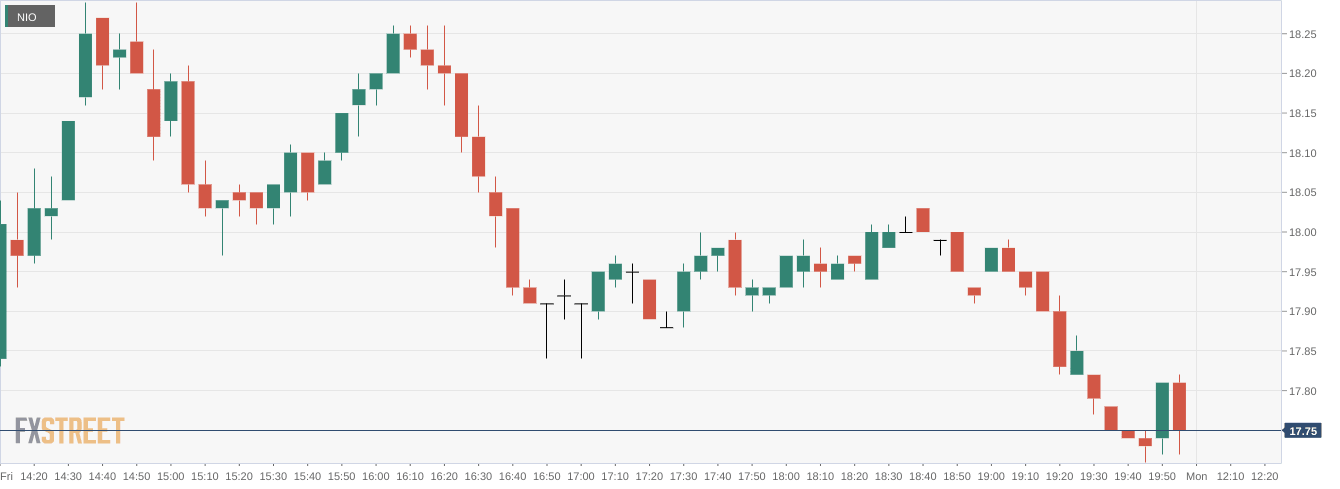

NYSE:NIO kicks off a pivotal week after the Labour Day long weekend as the Chinese EV maker prepares to report its earnings on Wednesday. Last week, shares of Nio sank lower by nearly 10% and closed the trading week at a price of $17.73. Stocks posted their third straight losing week to start off September as the downturn from Fed Powell’s speech at Jackson Hole continued. Overall, the Dow Jones fell by about 3.0%, the S&P 500 sank by 3.3%, and the NASDAQ fell for the sixth consecutive day on Friday and posted a 4.2% loss for the week.

Stay up to speed with hot stocks' news!

At long last for Nio investors, the company is set to report its second quarter earnings on Wednesday before the markets open. Nio is the last of the major Chinese EV makers that are listed on the US markets after both Li Auto (NASDAQ:LI) and XPeng (NYSE:XPEV) reported earlier in the quarter. For August, Nio reported a more than 81% YoY growth in deliveries and was easily the best performing company of the three.

NIO stock price

Chinese EV leader BYD saw its stock tumble during Asian trading hours on Monday as shares fell by nearly 7.0% at one point. The stock was declining after a Daiwa analyst noted that the firm believes Warren Buffett will completely exit his stake in BYD at some point. It was believed that Buffett had sold his stake earlier in the summer and the stock dipped then as well. Daiwa reiterated that it believes the company’s fundamentals will remain intact whether Buffett owns the stock or not.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet