Nasdaq futures rebound from lower structure as central pivot is reclaimed

Price responds to predefined levels after another failed attempt above 26036, keeping the broader structure intact.

Nasdaq futures desk update

Rebound From Lower Structure Reclaims Central Pivot as Daily Framework Holds.

January 23, 2026.

Context: Follow-up to January 14 desk report

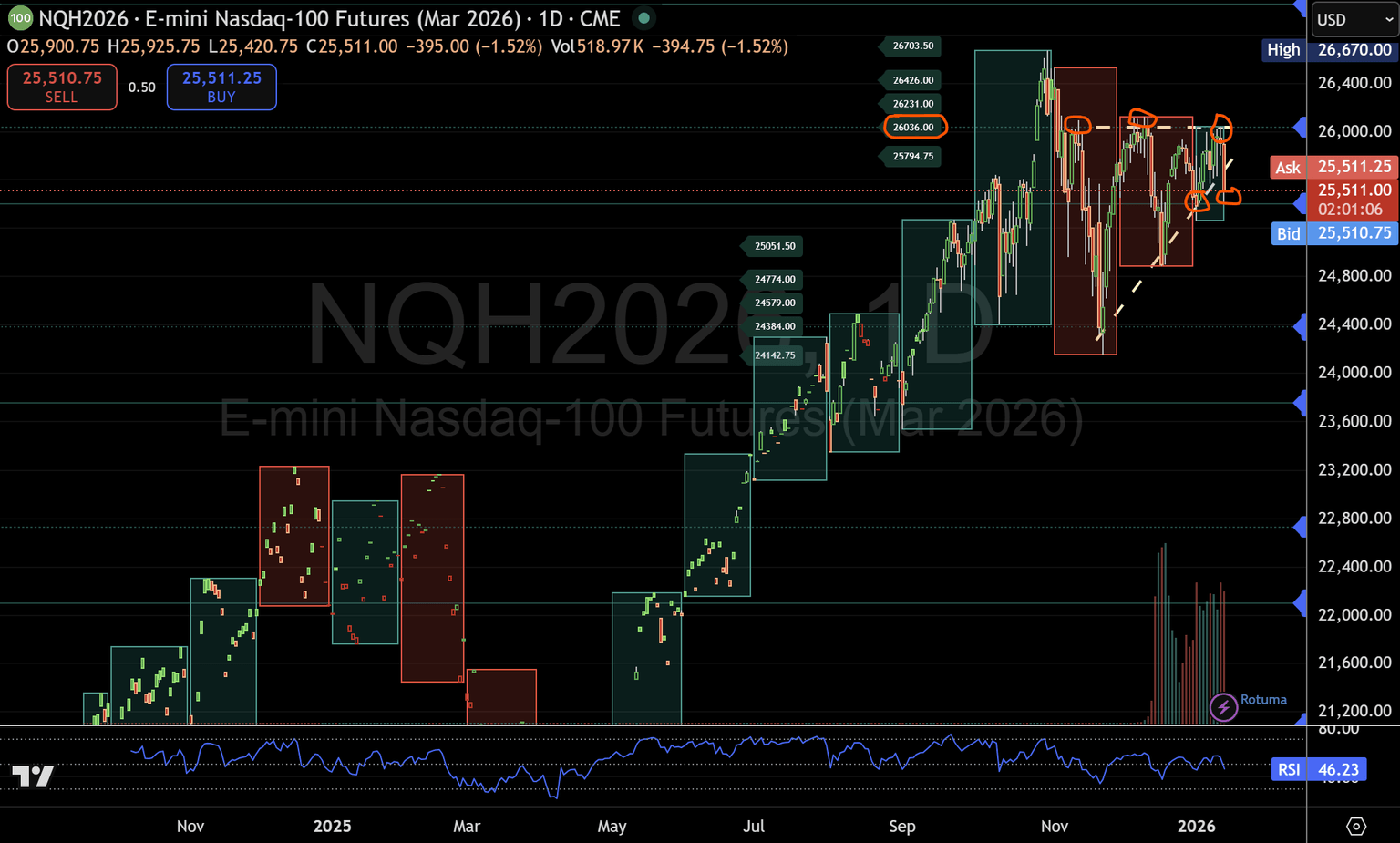

This update follows the January 14 desk report, where price failed to complete a rotation through the upper structure after another rejection at 26036 on the daily timeframe.

Importantly, the macro price structure remains unchanged since the first desk report published on December 30. The framework, levels, and structural boundaries identified then continue to guide price behaviour. What has changed is not the structure, but how price is responding within it.

Daily structure: Higher lows within a defined ceiling

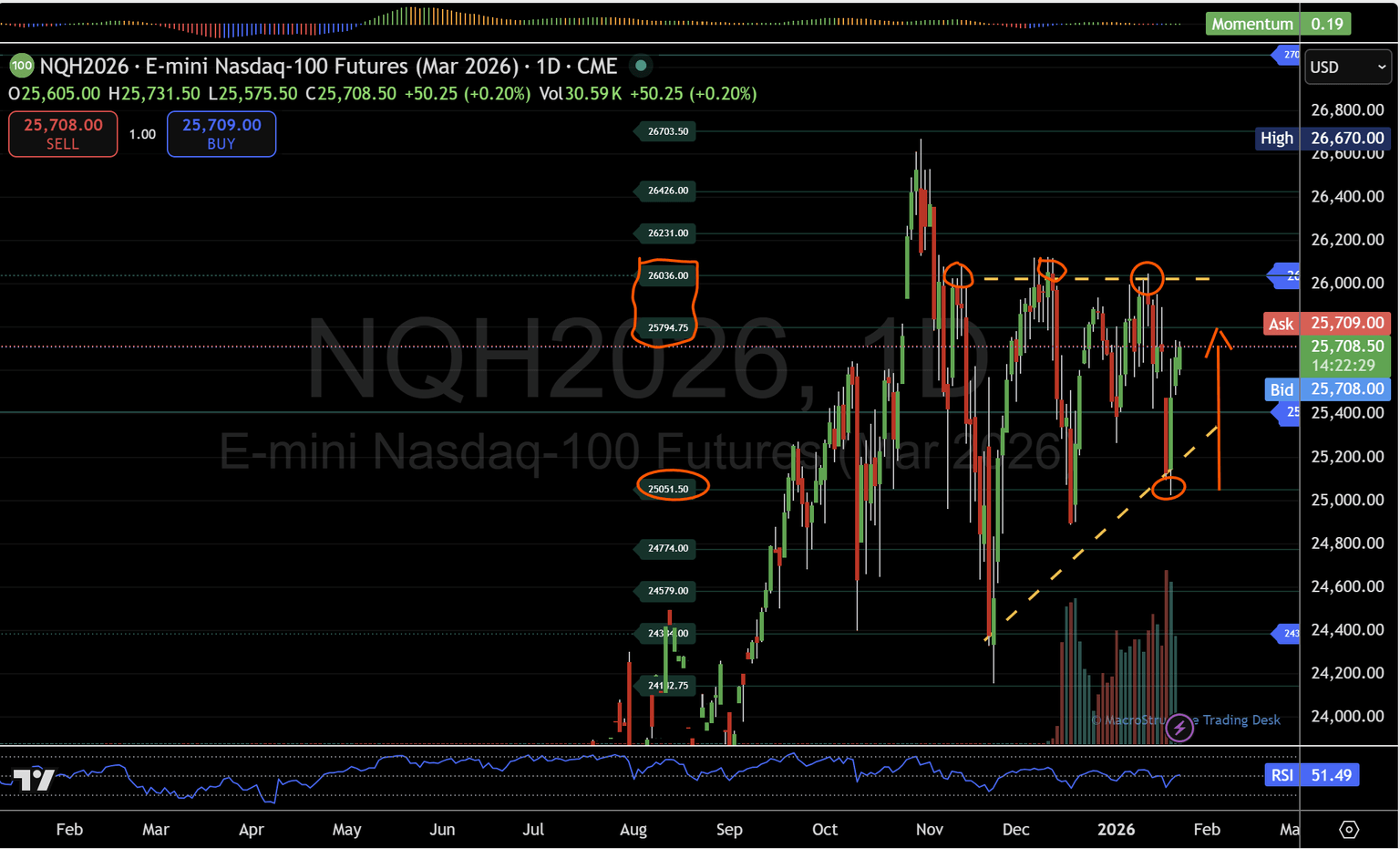

On the daily chart, Nasdaq Futures rebounded from 25051, successfully reclaiming the 25405 central pivot, following the most recent failed attempt to rotate through 26036.

Since November 2025, price has attempted to rotate through the upper structure on three separate occasions. Each rejection has resulted in a rotation back into the lower structure, yet notably, each pullback has produced a higher low. This behaviour continues to reinforce the same two-way structural environment rather than signalling a completed trend change.

The recurring resistance band between 25794 and 26036 remains the defining obstacle preventing a full rotation into the upper structure. Until price accepts above this zone, the market continues to operate within a balanced, state-dependent framework.

Current location: Structure in balance heading into London

As we approach the London session, the index trades around 25706, positioned above the reclaimed central pivot and inside the upper half of the current structural range.

Ahead, 25794 and 26036 remain historically proven resistance bands. This zone has repeatedly capped upside progress and continues to define the ceiling of the current structure. Acceptance above 26036 would open the path toward the next predefined micro levels between 26231 and 26703, completing a rotation into the upper structure.

Failure to do so keeps the prior rotational behaviour intact, with the central pivot at 25405 remaining the key downside reference for any renewed pullback.

Structure in Focus: Watching How Price Responds

At this stage, the focus stays on how price reacts around the key levels already in place.

If price can hold above 26036, it would suggest the structure is opening up toward the next phase. If that level continues to reject, as it has in prior attempts, the market remains in rotation between the established bands, with higher lows still shaping the broader structure.

For now, the desk is simply tracking price behaviour at these reference points, letting the structure guide the read rather than forcing an outcome.

The desk remains focused on how price behaves at these levels, not on anticipating direction ahead of confirmation.

Summary

Nasdaq Futures continue to respect the same two-way structural framework identified in late December. The rebound from 25051 and reclaim of the 25405 central pivot confirms that buyers remain active within the structure, while repeated failures near 26036 continue to cap upside progress.

The structure defines the battlefield.

Price now determines whether this rotation resolves upward — or repeats the prior path back toward balance.

Desk note

These desk updates document a structure-first process, observing how price accepts or rejects predefined levels over time. Coverage spans futures, commodities, forex, bonds, crypto, stocks, and indices, with structure providing context before direction.

This observation is for informational purposes only and does not constitute financial advice.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.