Japanese Yen gains on hawkish BoJ outlook, Russia-Ukraine peace hopes might cap gains

- The Japanese Yen attracts some intraday buyers on Tuesday, though it lacks follow-through.

The divergent BoJ-Fed policy expectations offer some support to the lower-yielding JPY.

Hopes for a Russia-Ukraine peace deal undermine and cap gains for the safe-haven JPY.

The Japanese Yen (JPY) builds on its steady intraday ascent against a mildly negative US Dollar (USD) and touches a fresh daily top heading into the European session on Monday. The Bank of Japan (BoJ) upwardly revised its inflation forecast at the end of the July meeting and left the door open for an imminent interest rate hike by the end of this year. This, along with a slight deterioration in the global risk sentiment, drives some safe-haven flows towards the JPY.

Meanwhile, the BoJ's hawkish outlook marks a significant divergence in comparison to expectations that the Federal Reserve (Fed) will resume its rate-cutting cycle in September. This, in turn, acts as a headwind for the USD and further benefits the lower-yielding JPY, leading to the USD/JPY pair's intraday pullback of around 50 pips. However, hopes for a Russia-Ukraine peace deal might cap the JPY amid the uncertainty over the likely timing of the next BoJ rate hike.

Japanese Yen benefits from cautious market mood, modest USD downtick

- The Bank of Japan revised its inflation forecast at the end of the July meeting and reiterated that it will raise interest rates further if growth and inflation continue to advance in line with its estimates. Adding to this, data released last week showed that Japan's economy expanded more than expected in the second quarter despite US tariff headwinds, keeping the door open for an imminent BoJ rate hike by the end of this year.

- Meanwhile, traders tempered their bets for more aggressive policy easing by the Federal Reserve amid signs of momentum in price pressures. However, the CME Group's FedWatch Tool indicated a nearly 85% chance that the US central bank would lower borrowing costs in September. Moreover, the possibility of two 25 basis points rate cuts by the Fed in 2025 marks a significant divergence in comparison to the BoJ's hawkish outlook.

- On the geopolitical front, US President Donald Trump announced on Monday that he had begun preparations for a face-to-face meeting between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelensky. This followed a summit with Zelensky and the European leaders earlier in the day, fueling hopes for an early peace deal to end Europe's deadliest war in 80 years and denting demand for safe-haven assets.

- The ruling Liberal Democratic Party’s loss in Japan's upper house election in July adds a layer of uncertainty amid concerns about the potential negative impact of higher US tariffs on the domestic economy. This, in turn, suggests that the prospects for the BoJ rate hike could be delayed, which, so far, has held back traders from placing bullish bets around the Japanese Yen and might continue to act as a tailwind for the USD/JPY pair.

- Tuesday's US economic docket features the release of housing market data – Building Permits and Housing Starts. This, along with speeches by influential FOMC members, might provide some impetus to the USD. The focus, however, will remain glued to FOMC meeting Minutes on Wednesday and Fed Chair Jerome Powell's speech at the Jackson Hole Symposium, which will be looked for cues about the future rate-cut path.

- Apart from this, traders this week will confront the release of the flash global PMIs on Thursday, which might contribute to infusing volatility in the financial markets and providing some meaningful impetus to the USD/JPY pair. Meanwhile, the aforementioned mixed fundamental backdrop warrants some caution before positioning for a firm near-term direction.

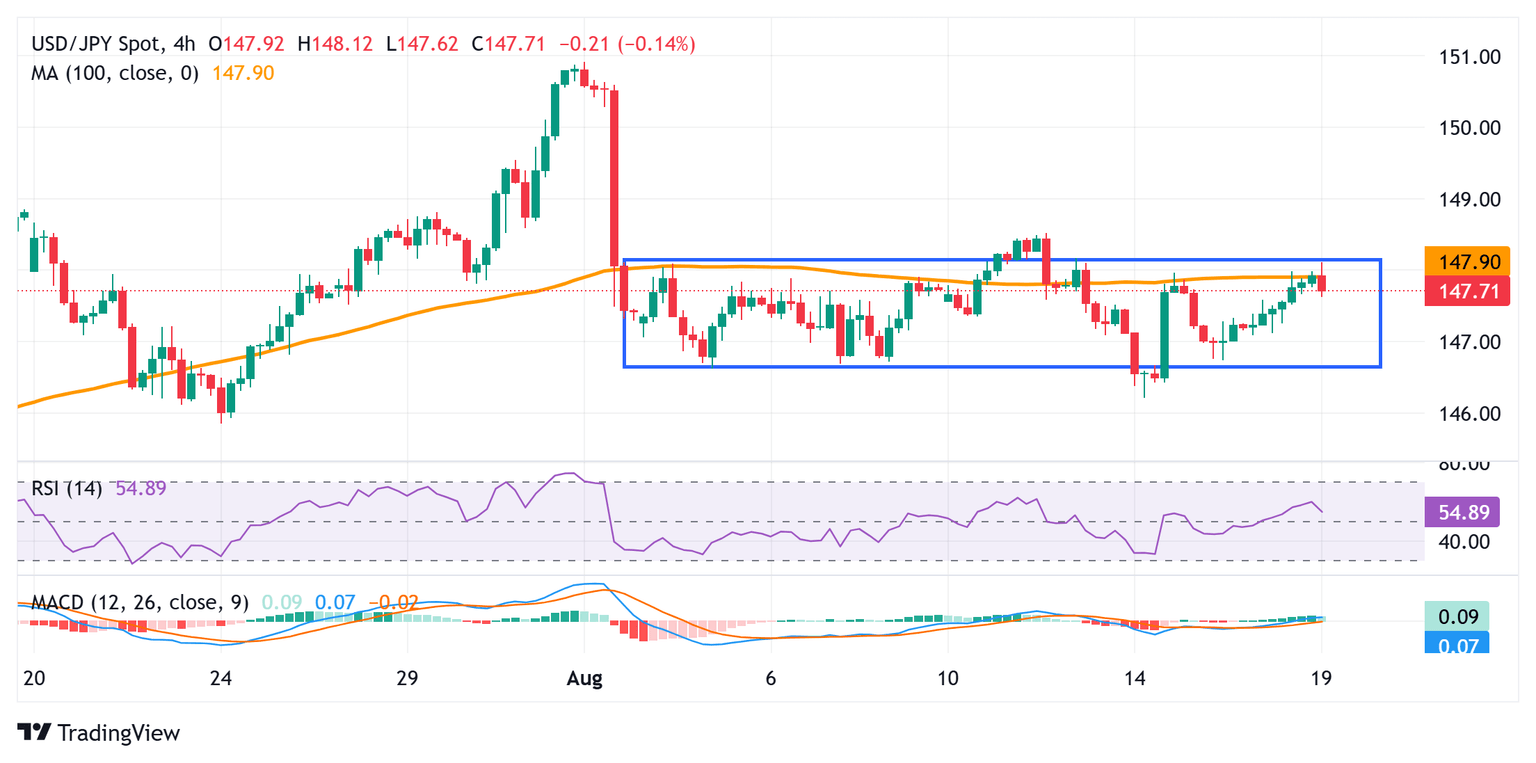

USD/JPY remains confined in familiar range; 148.00 holds the key for bulls

The USD/JPY pair's range-bound price action witnessed over the past two weeks or so might be categorized as a consolidation phase amid neutral technical indicators on the daily chart. Hence, it will be prudent to wait for an eventual break on either side before positioning for the next leg of a directional move.

Meanwhile, a sustained strength and acceptance above the 148.00 mark would be seen as a key trigger for the USD/JPY bulls. This should pave the way for gains towards the 148.55-148.60 region, or the 50% retracement level of the downfall from the monthly high, en route to the 149.00 round-figure mark.

On the flip side, any corrective slide could find decent support near the 147.10-147.00 area. A convincing break below could make the USD/JPY pair vulnerable to retest the multi-week low, around the 146.20 zone, touched last Thursday. A subsequent slide below the 146.00 mark might shift the bias in favor of bearish traders.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.