Gold Price Forecast: XAU/USD slides as USD regains confidence post NFP

- US NFP labor report eases expectations of a Fed rate cut, pushing XAU/USD prices lower.

- USD receives a boost from easing US-China tensions and better-than-expected US employment data on Friday, capping Gold gains.

- Gold prices threaten channel support with psychological resistance at $3,350.

Gold prices are extending losses against the US Dollar (USD) on Friday, falling below prior psychological support, now resistance, at $3,350, after the US Nonfarm Payrolls (NFP) report showed a resilient labour market.

After a week of data suggesting a softening US labor market, the Nonfarm Payrolls (NFP) report for May surprised to the upside. The US economy added 139,000 new jobs, beating analysts’ expectations of a 130,000 increase.

Meanwhile, the Unemployment Rate remained unchanged at 4.2%, offering a mixed but slightly more optimistic view of labor market conditions. The stronger-than-expected headline figure has provided temporary relief for the US Dollar, easing concerns that the Federal Reserve (Fed) may need to act quickly with rate cuts. However, underlying softness in other employment metrics earlier in the week continues to warrant caution in the broader policy outlook.

According to the CME FedWatch Tool, the probability of a July rate cut has dropped sharply to 16.5%, down from 33.9% prior to the release. The data has temporarily eased pressure on the Fed to act swiftly, suggesting that policymakers may adopt a more patient stance in the near term.

Trade and tariff developments continue to sway Gold prices

Although Thursday’s phone call between Chinese and US presidents helped ease immediate fears of an escalating trade war, tariff uncertainties and broader trade tensions remain a key concern for global investors.

The US decision to double tariffs on steel and aluminum imports to 50%, which was enforced on Wednesday, has drawn sharp criticism from key trade partners, including India, Canada, the European Union and Mexico, all of whom have threatened retaliatory measures.

With trade negotiations expected to continue into next week, the risk of prolonged disputes looms. Should talks break down or tensions escalate further, the global economy could face renewed headwinds, potentially weakening equity markets and driving demand for safe-haven assets such as Gold.

Gold daily digest: Trade talks, interest rates, and the economic outlook

- Ongoing trade discussions between the US and China are providing an additional headwind for Gold prices as trade talks remain in focus.

- Following the positive phone call between US President Donald Trump and Chinese President Xi Jinping on Thursday, they agreed to restart high-level economic talks. The agenda includes resolving tariff disputes and improving relations, but there's skepticism among investors about how much progress will be made.

- Economic data released from the Eurozone on Friday shows that Gross Domestic Product (GDP) exceeded analyst forecasts for the first quarter on both a monthly and annual basis. GDP grew by 0.6% QoQ, exceeding estimates of 0.4%. YoY figures showed a 1.5% rise, which was also above the estimated 1.2%.

- Eurozone’s Retail Sales rose by 2.3% YoY, above the 1.4% estimate, while the monthly reading was in line with expectations of a 0.1% rise.

- On Thursday, the European Central Bank (ECB) cut its interest rate by 25 basis points (bps), a move that was already priced into the market. ECB President Christine Lagarde suggested that the rate-easing cycle may be nearing its end in the short term.

- According to the CME FedWatch Tool, market participants expect the Fed to leave interest rates unchanged within the current 4.25% to 4.50% range at the June 18 meeting.

- The ADP Employment report, which was released on Wednesday, disappointed to the downside, with the private sector adding 37,000 jobs in May, below analyst expectations of a 115,000 increase.

- Thursday’s Jobless Claims data also provided signs of a slowdown in the strength of the US labour situation, with Initial Claims rising to 247,000 last week, above analyst estimates of a 235,000 rise.

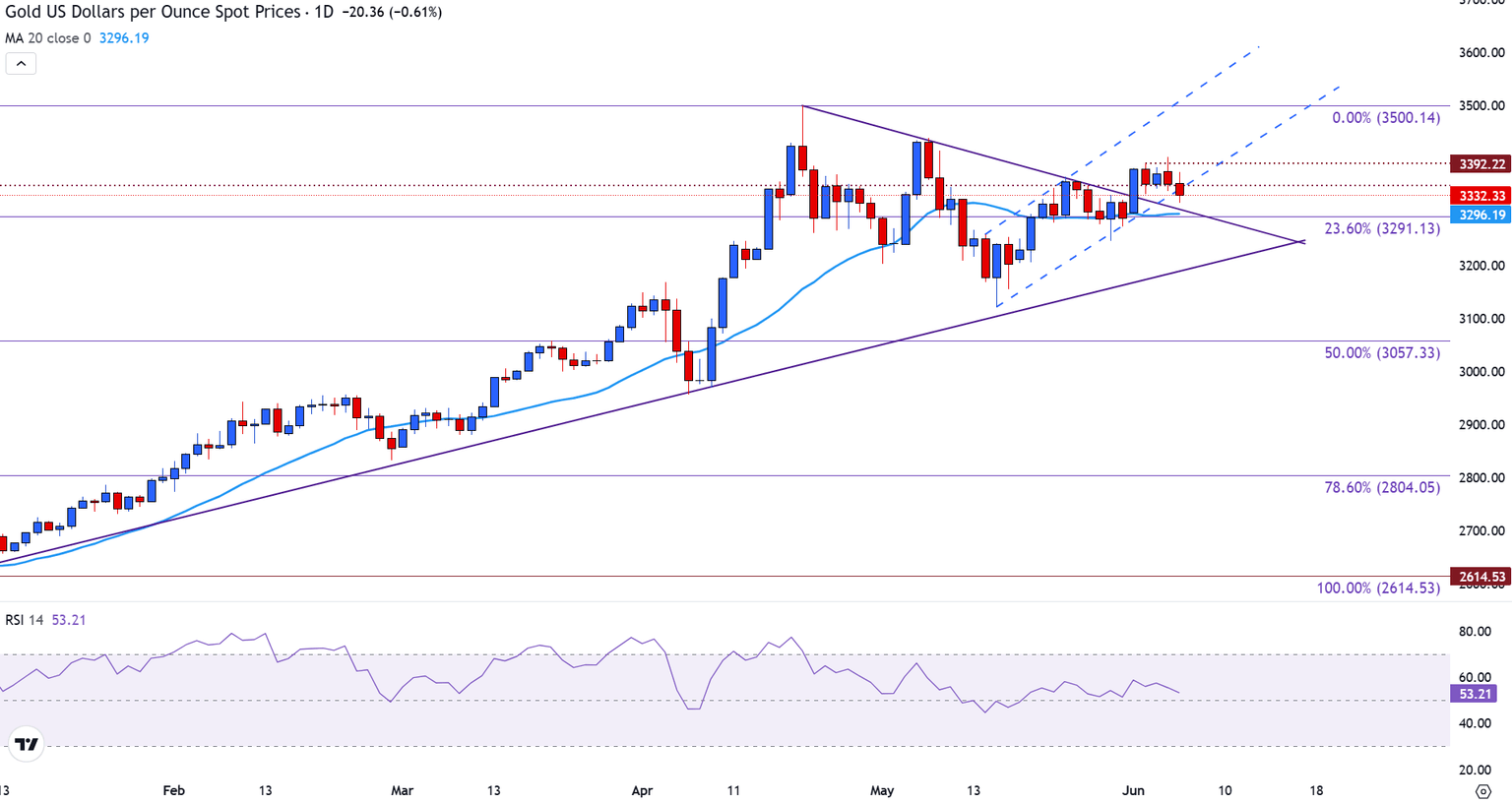

Gold prices move below critical psychological support at $3,350

Gold has broken below the $3,350 psychological level of support on Friday, with prices testing $3,330 at the time of writing. With prices still confined to a narrow range that has been building over the past four days, the whipsaw price action and broader geopolitical developments leave Gold prices vulnerable to any fundamental shifts that could impact the direction of prices next week.

With the $3,350 level now providing near-term resistance, short-term support is seen at the $3,300 psychological level, resting just above the 20-day Simple Moving Average (SMA) at $3,291.

The pullback in prices has also pushed the Relative Strength Index (RSI) lower, with a reading of 52 suggesting that bulls may be losing steam.

For the upside to prevail, a move above $3,350 and above the $3,370, which provided resistance for Friday's move, could see prices recover, bringing the $3,400 psychological level back into play.

Gold daily chart

For an upside move, the Gold price has a few technical hurdles to clear. The $3,392 resistance level has limited the bullish potential throughout the week, followed by the $3,400 psychological level. If bulls clear this zone and bullish momentum gains traction, a move toward the April all-time high at $3,500 may be possible.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.