Gold price sticks to negative bias; seems poised to register gains for the third straight week

- Gold price attracts some sellers as a modest USD strength prompts some profit-taking.

- Fed rate cut bets should cap the US recovery and support the non-yielding yellow metal.

- Trade jitter and rising geopolitical tensions could further limit losses for the XAU/USD.

Gold price (XAU/USD) rebounds from a three-day low touched during the early European session on Friday, though it retains the negative bias for the second straight day and currently trades just above the $3,030 level. The US Dollar (USD) stands firm in the wake of the Federal Reserve's (Fed) forecast for only two 25 basis points (bps) rate cuts by the end of this year. This, in turn, prompts traders to take some profits off and lighten their bullish around the commodity heading into the weekend.

Meanwhile, investors seem convinced that the US central bank will resume its rate-cutting cycle sooner than expected amid worries about a tariff-drive slowdown. This could act as a headwind for the USD and lend support to the non-yielding Gold price. Apart from this, the uncertainty over US President Donald Trump's trade policies and geopolitical risk should help limit any meaningful corrective fall for the XAU/USD pair, which seems poised to register gains for the third straight week.

Daily Digest Market Movers: Gold price remains depressed on stronger USD; lacks bearish conviction

- The US Dollar attracts some buyers for the third straight day and looks to build on this week's bounce from a multi-month low, exerting some downward pressure on the Gold price during the Asian session on Friday.

- Investors remain worried about US President Donald Trump's threatened reciprocal tariffs, which he said will come into effect on April 2. This comes on top of a flat 25% duty on steel and aluminum since February.

- US Senator Steve Daines will visit China for trade talks – marking the first high-level political meeting since President Donald Trump’s return –to revive stalled trade negotiations amid rising tariff tensions.

- Both Russia and Ukraine stepped up aerial attacks on Thursday amid truce talks, with Ukraine striking Russia’s Engels airbase in the Saratov region with attack drones, causing a fire and explosions in the area.

- Furthermore, Ukraine’s air force said on Thursday that Russia had launched 171 drones over its territory. Meanwhile, Russian and US officials are scheduled to hold talks on Ukraine in Saudi Arabia on Monday.

- Israel resumed heavy strikes across Gaza on Tuesday, breaking the ceasefire with Hamas that was in place since late January. Moreover, Hamas fired three rockets at Israel on Thursday, without causing casualties.

- The Federal Reserve indicated that it would deliver two 25 basis points rate cuts by the end of this year and also revised down its growth outlook amid the uncertainty over the impact of Trump's aggressive trade policies.

- Adding to this, Fed Chair Jerome Powell said that tariffs are likely to dampen economic growth. Investors now see the US central bank lowering borrowing costs at the June, July, and October monetary policy meetings.

- The prospects for further policy easing by the Fed might hold back the USD bulls from placing aggressive bets and act as a tailwind for the non-yielding yellow metal in the absence of any relevant US macro releases.

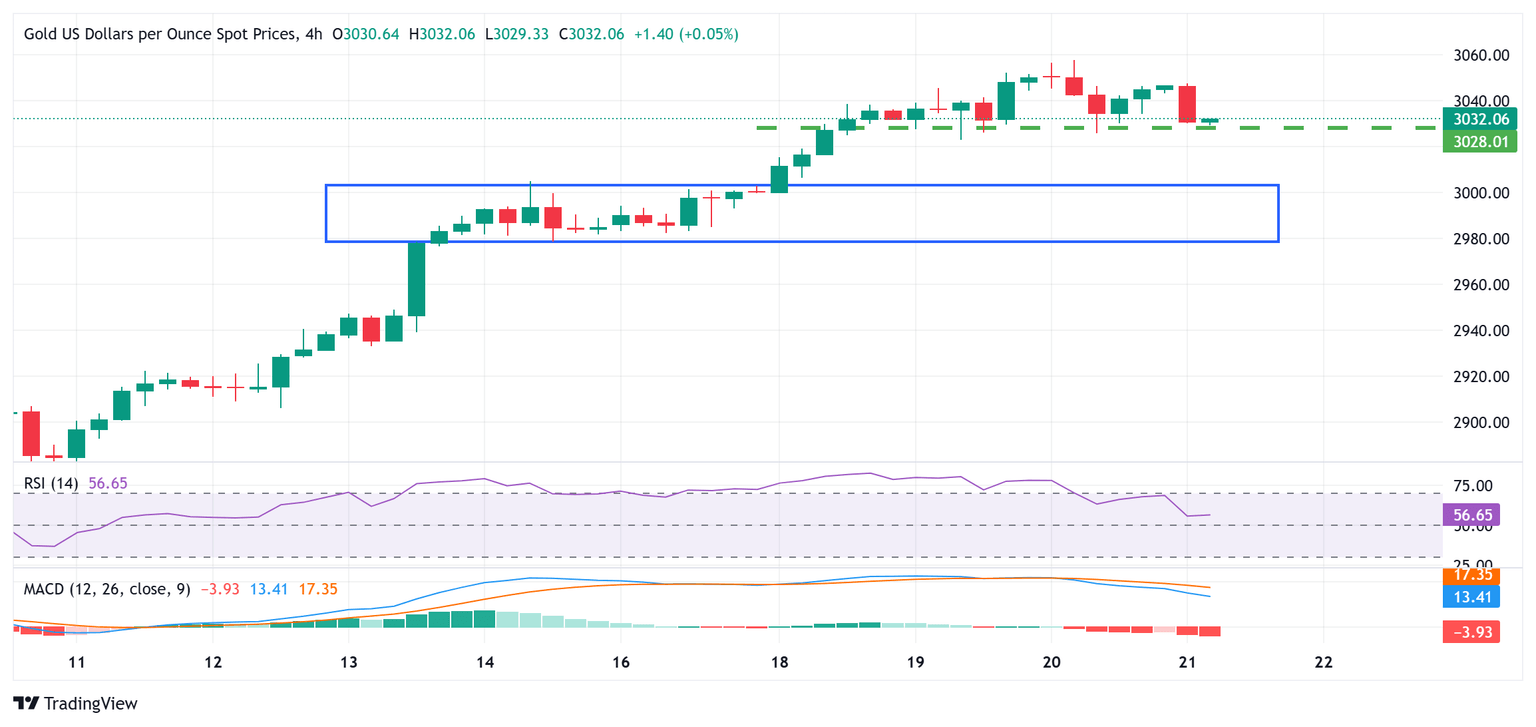

Gold price need to wait for break below $3,020 before traders start positioning for further losses

From a technical perspective, the corrective slide witnessed over the past two days could be attributed to some profit-taking amid slightly overbought conditions on the daily chart. That said, the lack of any follow-through selling warrants some caution for bearish traders and before confirming that the Gold price has topped out in the near term. Hence, any further decline below the $3,023-3,022 area might still be seen as a buying opportunity and remain limited near the $3,000 psychological mark.

The latter should act as a key pivotal point for short-term traders, which if broken decisively might prompt some technical selling and drag the Gold price to the $2,980-2,978 intermediate support en route to the $2,956 area. The downward trajectory could extend further towards the $2,930 support before the XAU/USD drops to the $2,900 mark and aims towards testing last week's swing low, around the $2.880 region.

On the flip side, the $3,057-3,058 zone, or the all-time peak touched on Thursday, now seems to act as an immediate hurdle. A sustained strength beyond will be seen as a fresh trigger for bullish traders and pave the way for an extension of the recent well-established uptrend witnessed over the past three months or so.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.