Gold price hits all-time high at $2,956 as trade uncertainty lingers

- Gold climbs as Trump’s trade policies fuel investor uncertainty.

- US 10-year Treasury yield dips slightly, providing a tailwind for bullion.

- Overbought conditions suggest bulls may face exhaustion near record levels.

Gold's price rose to a new record high of $2,956 in early trading on Monday during the North American session as the Greenback stayed firm and US yields remained virtually unchanged.

XAU/USD extends rally despite firm US Dollar and stable yields

Uncertainty keeps bullion prices underpinned as investors consider trade policies proposed by US President Donald Trump. It is the last week of February, and we should see tensions rising within the US, Canada, and Mexico after Trump delayed tariffs. Countries agreed to cooperate with the US in stopping fentanyl traffic and illegal immigration.

The US 10-year Treasury note yield has tumbled one basis point to 4.443%, a tailwind for the precious metal. US Real yields, as measured by the yield in the US 10-year Treasury Inflation-Protected Securities (TIPS), stay firm near 2.017%.

Last Friday, business activity data in the United States (US) was mixed, with the S&P Global Manufacturing PMI expanding while the Services PMI shrank. Also, inflation expectations rose, and consumer sentiment deteriorated, revealed the University of Michigan (UoM)

Given the backdrop, XAU/USD is set to extend its gains, even though bulls seem exhausted, as depicted by oscillators that are overbought.

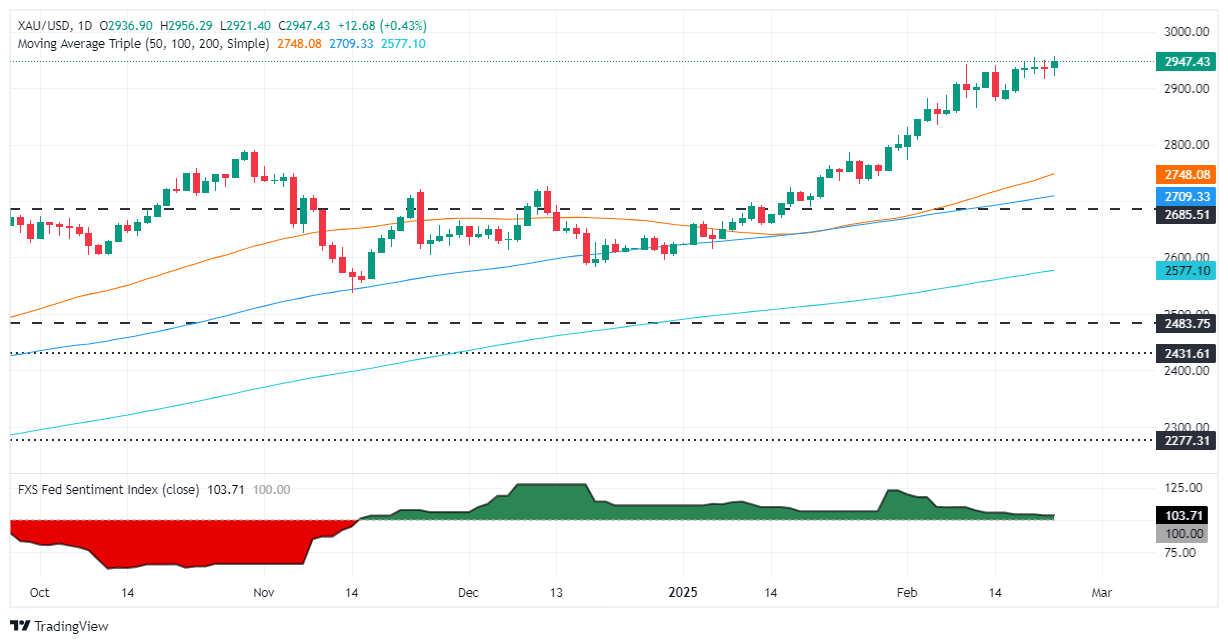

XAU/USD Price Forecast: Technical outlook

Gold’s uptrend remains intact, but buyers would likely push prices steadily without aggressive movements. The Relative Strength Index (RSI) is overbought, which could cap XAU/USD’s advance and pave the way for a retracement.

However, if XAU/USD climbs past the all-time high of $2,956, the next resistance would be $3,000. On the other hand, if bullion prices fall below the February 21 low of $2,916, XAU/USD could challenge $2,900 in the near term.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.