Gold Price Forecast: XAU/USD plunges below $1,800, next support located at $1,780

- Gold came under strong selling pressure in the American session.

- Rising US Treasury bond yields provide a boost to the USD.

- A daily close below $1,800 could open the door for additional losses.

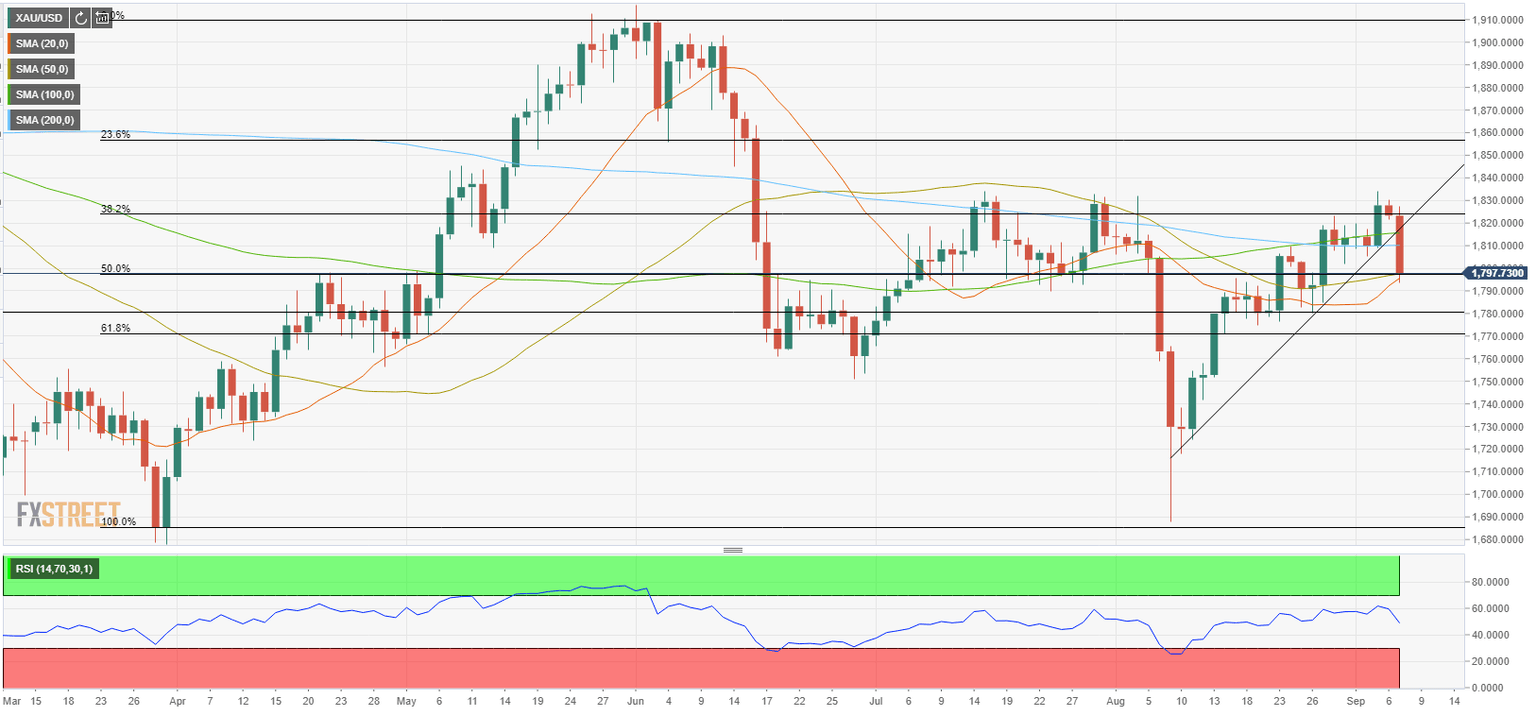

The XAU/USD pair closed the first trading day of the week in the negative territory and continued to edge lower during the first half of the day on Tuesday. With the gold price breaking below the 200-day SMA, which is currently located at $1,810, the bearish pressure ramped up and caused the precious metal to extend its slide. As of writing, the pair was trading at $1,797, losing 1.4% on a daily basis.

In the absence of high-tier macroeconomic data releases and fundamental drivers, rising US Treasury bond yields provided a boost to the greenback and weighed heavily on XAU/USD. Currently, the benchmark 10-year US T-bond yield is sitting at its highest level since mid-July at 1.385, rising nearly 3% on the day while the US Dollar Index is rising 0.35% at 92.52.

In the meantime, the Dow Jones Industrial Average and the S&P 500 indexes are down 0.8% and 0.4%, respectively, allowing the safe-haven USD to preserve its strength.

Later in the session, the 3-year US Treasury note auction that will take place at 1700 GMT will be watched closely by market participants. On Wednesday, the IBD/TIPP Economic Optimism Index data for September, July JOLTS Job Openings figures and the 10-year US Treasury note auction will be featured in the US economic docket.

Gold technical outlook

In case gold fails to reclaim the 200-day SMA, sellers could remain in control of the price in the near term. Reflecting the bearish shift in the technical outlook, the Relative Strength Index (RSI) indicator on the daily chart fell below 50 and the price broke below the ascending trend line coming from early August.

On the downside, the next static support is located at $1,780 ahead of $1,770 (Fibonacci 61.8% retracement of the April-June uptrend).

On the other hand, $1,800 (psychological level) aligns as interim resistance before $1,810 (200-day SMA) and $1,815 (100-day SMA).

Additional levels to watch for

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.