Gold Price Analysis: XAU/USD’s weekly close above $1729 keeps buyers hopeful – Confluence Detector

The recovery in Gold (XAU/USD) from multi-month lows gathered steam on Thursday after the US dollar tumbled in tandem with the Treasury yields. Gold rallied over 1% to settle the holiday-shortened week above the critical resistance at $1729.

Investors cheered strong US manufacturing data and President Biden’s infrastructure plan, which boosted global stocks at the expense of the safe-haven gold. Technically, gold’s recovery seems to have some legs but its fate hinges on the US NFP release and next week’s FOMC minutes.

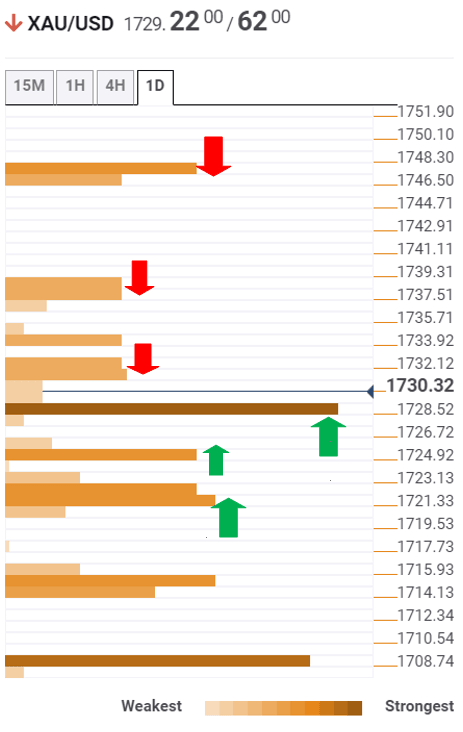

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold faces immediate resistance at $1732, which is the Fibonacci 38.2% one-week.

A dense cluster of resistance is seen around the $1737 area, which is the confluence of SMA200 four-hour and Fibonacci 61.8% one-week.

The bulls will then look to challenge powerful resistance at $1747, the convergence of the previous week high, pivot point one-day R2 and pivot point one-week R1.

Alternatively, a sustained break below the $1929 support – the intersection of the Fibonacci 23.6% one-week and Fibonacci 61.8% one-month - could revive the downside bias.

The next relevant support is seen around $1725, the confluence of the SMA10 one-day and Fibonacci 23.6% one-day.

Further south, $1720 could likely test the bearish commitments. At that point, the Fibonacci 38.2% one-day coincides with the previous week low.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.