GBP/USD Price Forecast: Clings to daily gains below 1.2700

- GBP/USD sees over 1.2% weekly gain but faces resistance near 1.2700, risking pullback to 1.2600.

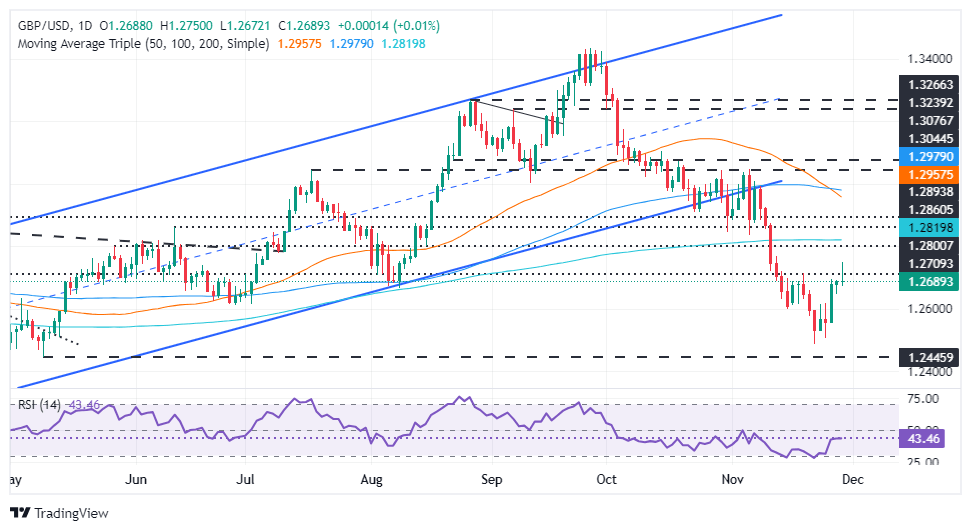

- Oscillators like RSI suggest growing buyer momentum yet remain below the neutral threshold.

- Break above 1.2700 could target 200-day SMA at 1.2818, with this week’s high at 1.2749 as immediate hurdle.

The Pound Sterling clings to earlier gains yet trades off the weekly highs, which reached around 1.2749 during the European session. At the time of writing, the GBP/USD trades at 1.2684, virtually unchanged.

GBP/USD Price Forecast: Technical outlook

Although the GBP/USD is set for weekly gains of over 1.2%, price action suggests Cable didn’t find acceptance above 1.2700, which could exacerbate a pullback toward the 1.2600 figure. In that outcome, the pair’s next support would be the November 27 daily low of 1.2564, followed by the November 26 low of 1.2506. On further weakness, the November 22 pivot low of 1.2486 is on the cards.

Conversely, if GBP/USD finishes the week above 1.2700, this could pave the way for testing the 200-day Simple Moving Average (SMA) at 1.2818. However, buyers must clear the current week’s peak of 1.2749.

Oscillators such as the Relative Strength Index (RSI) hint that buyers are gathering momentum, even though the RSI remains below its neutral line.

Therefore, in the short-term, the GBP/USD upside is seen if it clears at 1.2700.

GBP/USD Price Chart – Daily

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.06% | -0.01% | -0.93% | 0.07% | -0.12% | -0.44% | -0.08% | |

| EUR | -0.06% | -0.06% | -1.01% | 0.01% | -0.18% | -0.50% | -0.14% | |

| GBP | 0.00% | 0.06% | -0.97% | 0.07% | -0.12% | -0.44% | -0.08% | |

| JPY | 0.93% | 1.01% | 0.97% | 1.02% | 0.81% | 0.48% | 0.86% | |

| CAD | -0.07% | -0.01% | -0.07% | -1.02% | -0.20% | -0.51% | -0.15% | |

| AUD | 0.12% | 0.18% | 0.12% | -0.81% | 0.20% | -0.32% | 0.04% | |

| NZD | 0.44% | 0.50% | 0.44% | -0.48% | 0.51% | 0.32% | 0.36% | |

| CHF | 0.08% | 0.14% | 0.08% | -0.86% | 0.15% | -0.04% | -0.36% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.