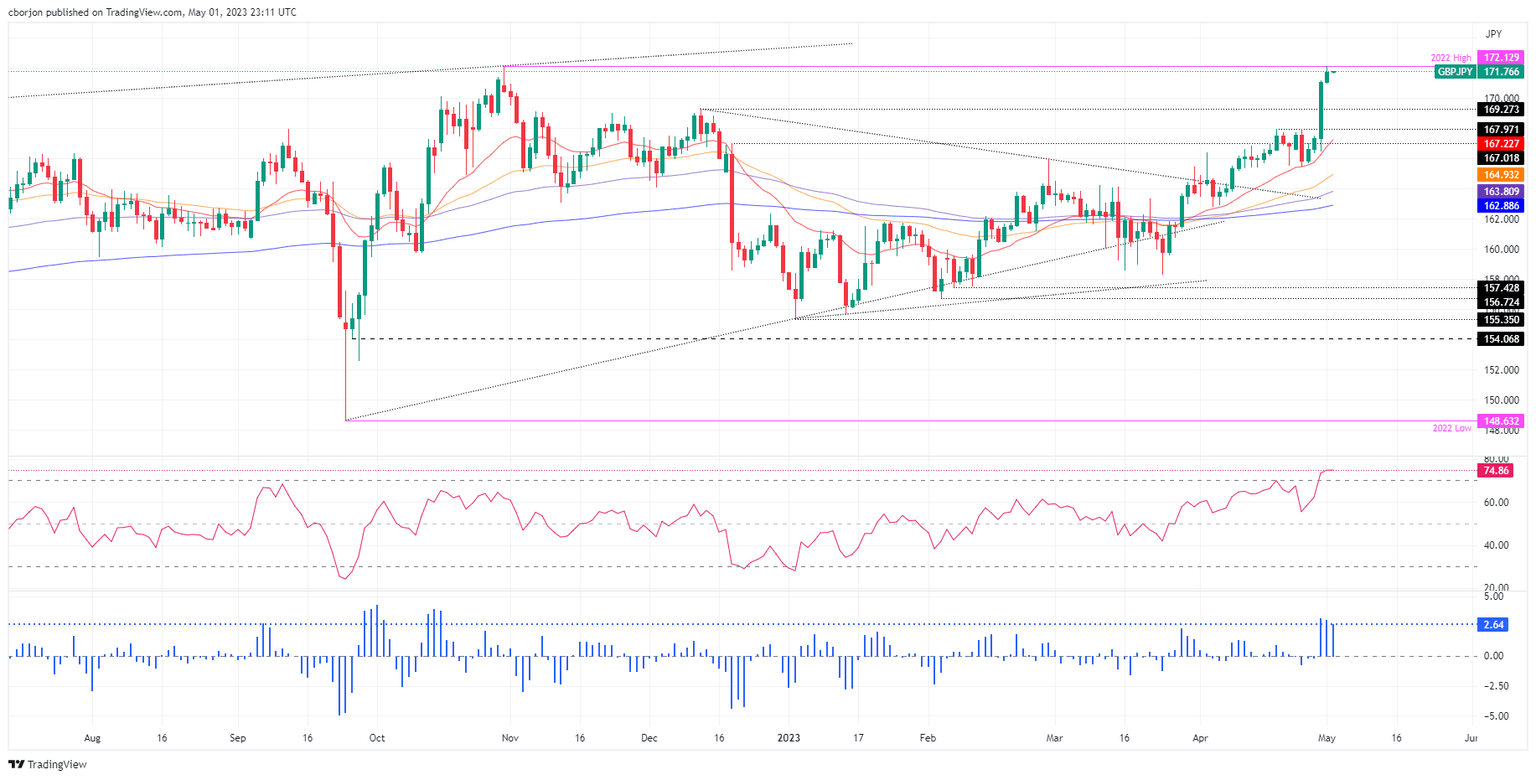

GBP/JPY Price Analysis: Tests last year’s high but retraced as RSI turns overbought

- GBP/JPY tests last year’s high at 172.13, as oscillators turned overbought.

- The GBP/JPY first resistance is at 172.00, next target is at 172.09.

- A bearish engulfing candle pattern could exacerbate GBP/JPY fall.

The GBP/JPY surged and tested the last year’s high at around 172.13, though it retraced slightly and remained below the 172.00 mark. As the Asian session starts, the GBP/JPY is trading at 171.74, posting minuscule gains of 0.02%.

GBP/JPY Price Action

The daily GBP/JPY chart portrays the pair in a solid uptrend, though the cross-currency pair fell shy of reaching the last year’s high. However, oscillators like the Relative Strength Index (RSI) indicator are overbought. Meanwhile, the Rate of Change (RoC) shows buyers remain in charge. But it should be said that when the RoC reached current levels twice, it was followed by some pullbacks before continuing the uptrend.

If GBP/JPY breaks 172.00, the next resistance would be the YTD high at 172.09. A breach of the latter will expose the last year’s high at 172.13, followed by the 173.00 figure.

Conversely, if the GBP/JPY registers a bearish engulfing candle pattern, that would exacerbate a fall toward the 20-day EMA at 167.22. But firstly, the GBP/JPY pair must cross below the 170.00 figure. Once cleared, the next demand area defended by buyers will be December’s 13 swing high turned support at 169.27 before testing 169.00. A breach of the latter will expose the 20-day EMA at 167.22.

GBP/JPY Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.