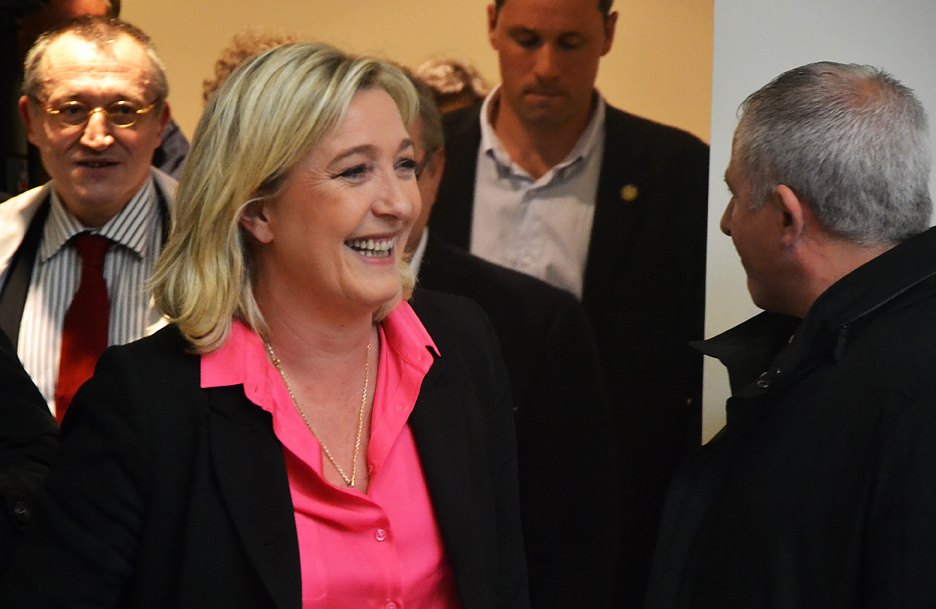

French Elections: Odds of Marine Le Pen wining the second round are very low – Deutsche Bank

The analysis team at Deutsche Bank suggests that the odds of Marine Le Pen wining the second round of French elections are very low assuming a normal scenario.

Key Quotes

“Under abnormal circumstances, she still has a chance though it is declining rapidly driven by lower voter support in the second round. Her likely target will be Melenchon’s supporter to avoid damaging her party for the June election. In essence, the battle has already shifted there.”

“Emmanuel Macron shows no clear vulnerability for the second round. Marine Le Pen has generally retreated after some significant inroads, though she is holding on to gains for example in rural areas and within the public sector. Her platform remains geared to a population that is below high school level and in some cases dependent on social outlays and her victory speech did not deviate from that line. She has hit a glass ceiling repeatedly, has had difficulties with her campaign as she slid in the polls while her unconventional remarks did not help her. Going forward, she may rebound by moderating her message to widen her appeal, but it might hinder the chances of her party in the June parliamentary election making it a difficult risk to reward exercise. Targeting Jean-Luc Melenchon’s supporters might be a less damaging alternative. 12 to 22% would vote for her while 23 to 37% would vote blank (source IFOP and Opinionway).”

“Emmanuel Macron will need to motivate disenfranchised voters on the left and right to come and vote for him. The opinionway poll showed a sharp drop of 3% from 64 to 61% with the bitter after effect of the first round poll fresh in the minds. This effect should fade in the coming days. Monitoring attendance in the second round is going to be of some importance.”

“Note that Opinionway releases first to second round vote transitions including those of Dupont Aignan. These are surprisingly far more in favor of Emmanuel Macron than one would have expected. Even more importantly, first round blank voters would vote 20% Marine Le Pen 33% Emmanuel Macron and 47% Blank.”

Author

Sandeep Kanihama

FXStreet Contributor

Sandeep Kanihama is an FX Editor and Analyst with FXstreet having principally focus area on Asia and European markets with commodity, currency and equities coverage. He is stationed in the Indian capital city of Delhi.