EUR/USD consolidates losses with markets awaiting US inflation figures

- The Euro hovers around 1.1700 after retreating from 1.1780 highs following reports of Russian drones in Poland's airspace.

- The US Dollar Index bounces from lows as the focus shifts to US inflation figures.

- In Europe, the ECB is widely expected to leave interest rates unchanged on Thursday.

The EUR/USD has been wavering around 1.1700 during most of Wednesday's European session, with investors cautious amid news of frictions between Poland and Russia, and waiting on US inflation releases for a better assessment of the Federal Reserve's (Fed) monetary easing pace.

Earlier in the day, news reporting that Poland shot down drones, allegedly Russian, near its border with Belarus, has raised concerns about an extension of the conflict in Ukraine. The impact of the event has been muted so far, but fears of escalating frictions between Russia and North Atlantic Treaty Organization (NATO) members are likely to curb investors' appetite for risk and weigh on the Euro (EUR).

US inflation figures, with the Producer Prices Index (PPI) coming out later on the day and the Consumer Prices Index (CPI) due on Thursday, are likely to be the main market mover this week. With the Federal Reserve (Fed ) monetary policy meeting around the corner, inflation numbers are the last piece of the puzzle to assess the pace of the Fed's monetary easing cycle.

The weak US labour market, confirmed by the sharp downward revision of Nonfarm Payrolls figures, has practically confirmed a Fed rate cut in September, and at least another one before the end of the year, but hot inflation figures, stemming from higher tariffs on imports, might complicate the central bank's rate-setting efforts. Such a scenario would bring back stagflation concerns and might add negative pressure on the US Dollar (USD).

Before the Fed, the European Central Bank (ECB) is expected to keep its benchmark interest rate unchanged on Thursday. The main interest of the event will be on ECB President Christine Lagarde's press conference to see if the central bank has reached its terminal rate or there is still room for further monetary easing.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | -0.08% | 0.10% | 0.09% | -0.18% | -0.20% | -0.02% | |

| EUR | -0.05% | -0.13% | -0.02% | 0.03% | -0.29% | -0.26% | -0.07% | |

| GBP | 0.08% | 0.13% | 0.16% | 0.18% | -0.14% | -0.12% | 0.10% | |

| JPY | -0.10% | 0.02% | -0.16% | 0.07% | -0.34% | -0.31% | 0.18% | |

| CAD | -0.09% | -0.03% | -0.18% | -0.07% | -0.33% | -0.32% | -0.08% | |

| AUD | 0.18% | 0.29% | 0.14% | 0.34% | 0.33% | 0.03% | 0.24% | |

| NZD | 0.20% | 0.26% | 0.12% | 0.31% | 0.32% | -0.03% | 0.38% | |

| CHF | 0.02% | 0.07% | -0.10% | -0.18% | 0.08% | -0.24% | -0.38% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: Investors await US inflation data

- Major currencies are trading within narrow ranges on Wednesday, with all eyes on US inflation figures. Wednesday's PPI and Thursday's CPI figures will be analysed carefully to assess the pace of the widely awaited Federal Reserve rate cuts, and are likely to set the near-term direction for US Dollar crosses.

- On Tuesday, the US Bureau of Labor Statistics (BLS) reported that the US economy created 911,000 fewer jobs than previously estimated during the 12 months before March 2025. These figures practically confirm a 25 basis point Fed rate cut next week and keep the chances of a jumbo cut alive.

- Later on Wednesday, US PPI figures are expected to show that producer inflation eased to 0.3% in August, from 0.9% in July, while the year-on-year (YoY) rate remained steady at 3.3%. The core PPI is foreseen growing at a 0.3% pace on the month and 3.5% YoY, down from 0.9% and 3.7%, respectively, in the previous month.

- US consumer prices, due on Thursday, are seen accelerating to 0.3% in August, from 0.2% in July, and to a 2.9% yearly rate, from July's 2.7% reading. The core inflation, however, is seen steady at 0.3% on the month and 3.1% YoY in August, unchanged from July's figures.

- In Europe, the calendar is practically void, but the saber-rattling on its eastern border is likely to add a new source of weakness for the Euro. The drone incident in Poland, at a moment when the peace process between Ukraine and Russia staggers, is likely to spook investors away from the Euro, towards safe havens like the US Dollar.

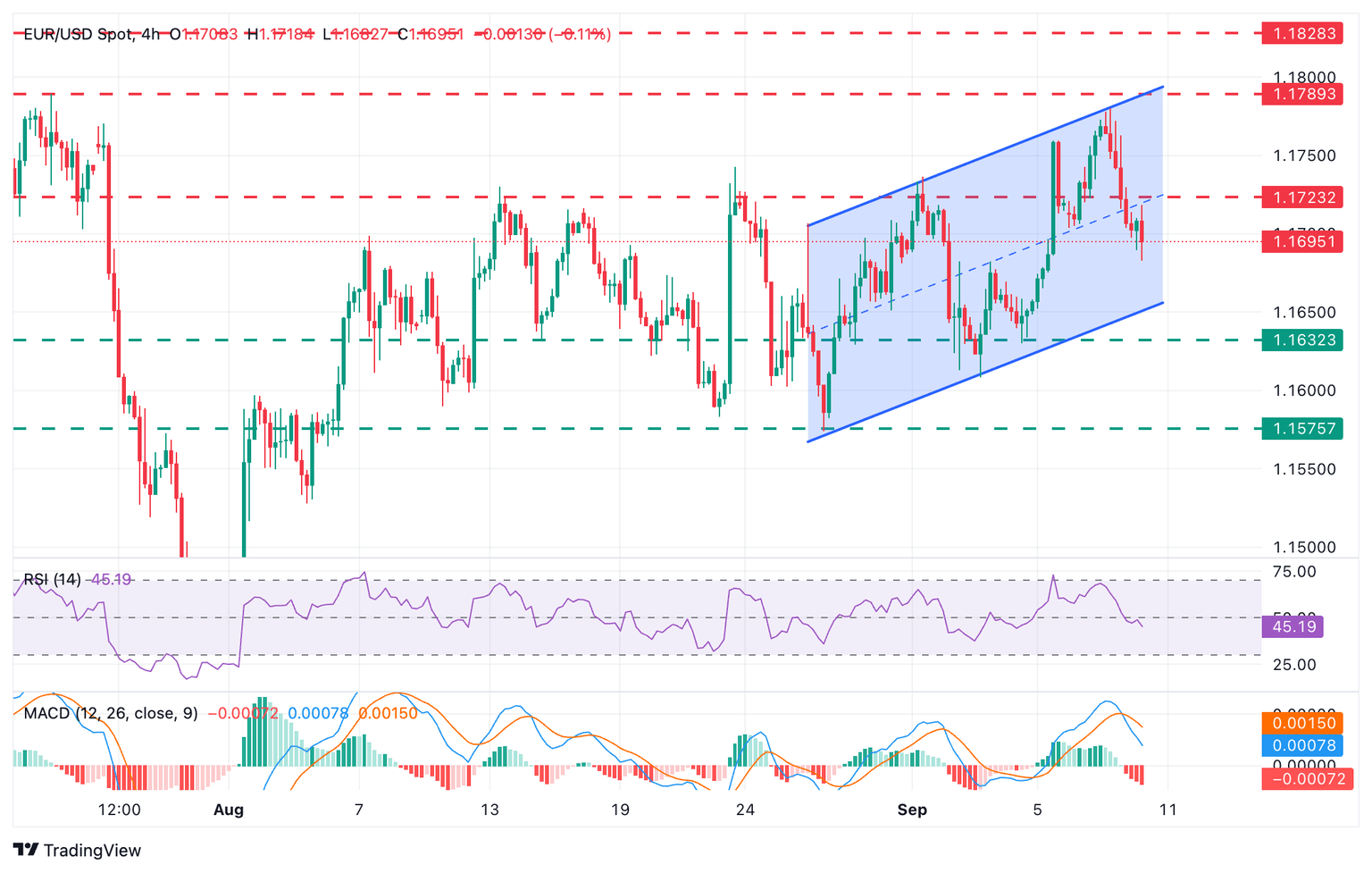

Technical Analysis: EUR/USD keeps the previous range after failing below 1.1790 resistance

EUR/USD is looking weaker on Wednesday, following a reversal from the 1.1780 area on Tuesday. The immediate trend remains positive, although technical indicators have turned lower. The 4-hour Relative Strength Index (RSI) has plunged below the 50 level, and the Moving Average Convergence Divergence (MACD) crossed below the signal line, showing scope for further depreciation.

The 1.1700 round level is being pierced at the moment, with bears looking at the bottom of the near-term ascending channel, now at 1.1650, ahead of the September 4 low, near 1.1630. To the upside, the intra-day high at 1.1720 is likely to challenge bulls, ahead of the July 24 high near 1.1790, the last resistance area before the July 1 high at 1.1830.

Economic Indicator

Producer Price Index (YoY)

The Producer Price Index released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Changes in the PPI are widely followed as an indicator of commodity inflation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Next release: Wed Sep 10, 2025 12:30

Frequency: Monthly

Consensus: 3.3%

Previous: 3.3%

Source: US Bureau of Labor Statistics

Economic Indicator

Producer Price Index ex Food & Energy (YoY)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Next release: Wed Sep 10, 2025 12:30

Frequency: Monthly

Consensus: 3.5%

Previous: 3.7%

Source: US Bureau of Labor Statistics

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.