EUR/JPY Price Analysis: Pulling back in the midst of a strong uptrend

- EUR/JPY is pulling back within a strong short, intermediate and long-term uptrend.

- If it continues declining the pull back could well find support at the 100 SMA.

- Any weakness will probably be short-lived given the overall bullish bias of the charts.

EUR/JPY is in an uptrend on all major timeframes and trading with a bullish bias over a short, intermediate and long time horizon. Given “the trend is your friend” EUR/JPY is more likely than not to continue rising.

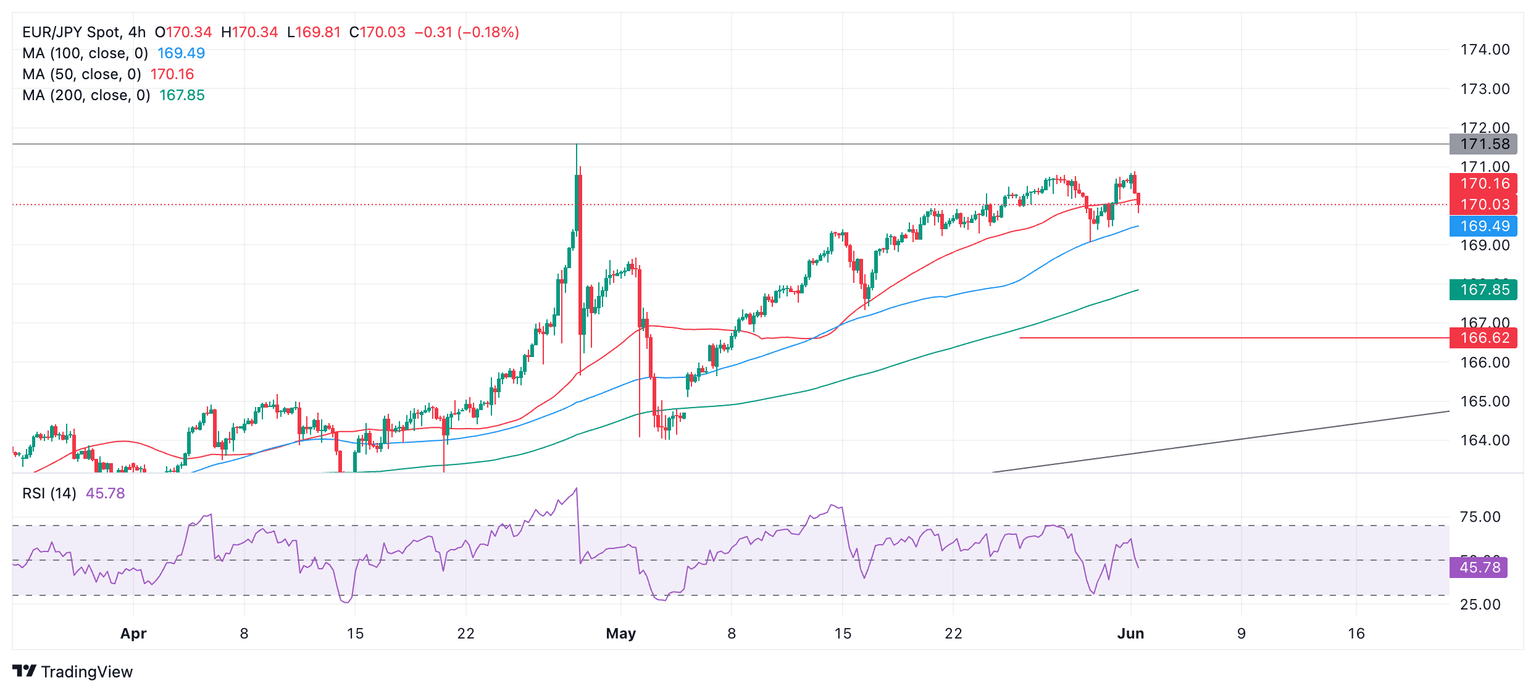

4-hour Chart

The pair has pulled back to the 50 Simple Moving Average (SMA) but the uptrend remains intact in the short-term, and it is expected to find its feet and resume going higher. There are currently no signs of a recovery and reversal in line with the dominant uptrend.

The 100 SMA (blue) at 168.49 has faithfully supported price on previous pull backs, suggesting it may do the same if price pulls back any lower.

A break above 170.89 (June 3 high) would establish a higher high and probably indicate a continuation of the uptrend. The next target to the upside is 171.60, the high of April 29.

The Relative Strength Index (RSI) is in the neutral zone suggests there is more room for upside before the pair becomes overbought.

EUR/JPY would need to fall to 166.62 (50-day SMA) to suggest a reversal of the dominant uptrend. It would need to break below the trendline at circa 164.50 for confirmation of a reversal of the trend.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.