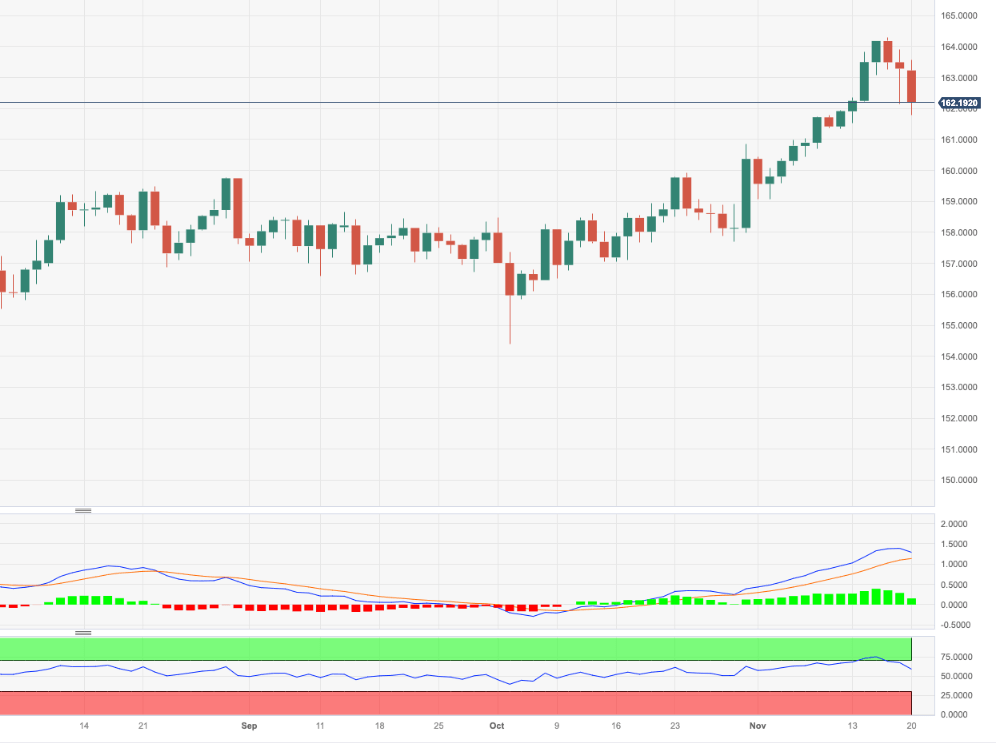

EUR/JPY Price Analysis: Next on the downside comes 158.90

- EUR/JPY drops to multi-day lows in the sub-162.00 area.

- Further south comes the 55-day SMA near 158.90.

EUR/JPY extends the decline below the 162.00 support at the beginning of the week.

Further downside appears well on the cards for the cross in the short-term horizon. That said, losses could then accelerate to the provisional 55-day SMA at 158.87 ahead of the interim 100-day SMA at 158.02.

So far, the longer term positive outlook for the cross appears favoured while above the 200-day SMA, today at 152.79.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.