EUR/JPY Price Analysis: Euro climbs toward session highs with bullish trend intact

- EUR/JPY rose toward the 164.00 area, closing in on daily highs ahead of the Asian session.

- Bullish bias is confirmed by trend indicators despite neutral short-term momentum.

- Key moving averages and MACD support further upside, with nearby support holding firm.

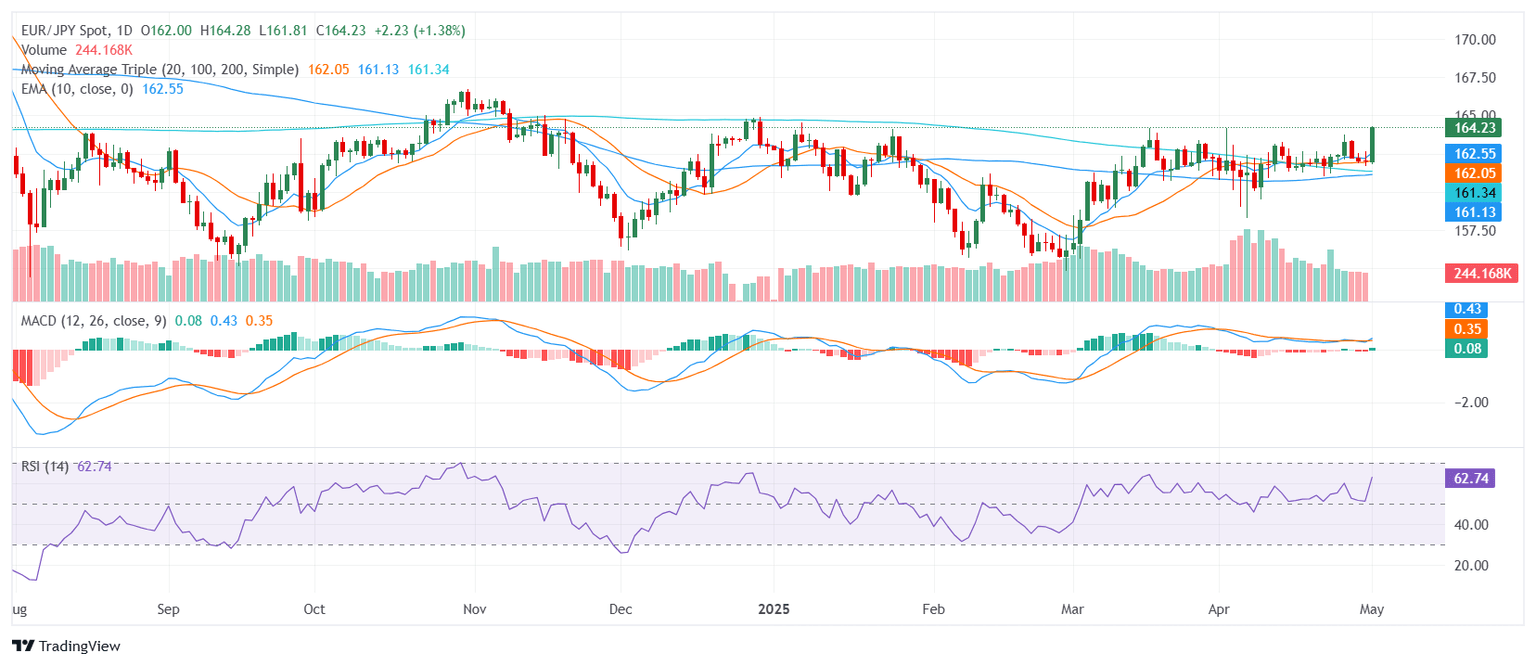

The EUR/JPY pair extended its rally on Thursday, pushing toward the 164.00 zone after a strong advance during the European session. The pair sits near the top of the day’s range as it enters the Asian session, reflecting sustained demand despite a flattening in momentum indicators. While some short-term tools remain neutral, the overall technical structure leans decisively bullish, backed by a solid base of upward-trending averages.

From a technical perspective, EUR/JPY is flashing a clear bullish signal. The Moving Average Convergence Divergence shows a buy indication, supporting the recent rally. The Relative Strength Index hovers near 63, a neutral-to-positive level that suggests momentum still has room to grow. Other tools such as the Stochastic RSI Fast and the Average Directional Index remain neutral, highlighting that price action, while strong, isn’t yet overstretched.

Trend-following indicators provide the foundation for the bullish stance. The 10-day Exponential and Simple Moving Averages continue to climb and are positioned below the current price. The 20-day, 100-day, and 200-day Simple Moving Averages are similarly aligned in favor of further gains, with all three pointing upward and reinforcing buyers' control over the broader trend.

Support is now seen at 162.70, 162.55, and 162.44. A confirmed break above the 164.00 zone could expose further resistance levels in upcoming sessions.

Daily Chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.