EUR/GBP steady around 0.8650 as traders eye key EU, UK data and Trump-Putin talks

- EUR/GBP flats near 0.8650 in early North American trade.

- Market mood upbeat ahead of expected Trump-Putin meeting on Ukraine.

- Focus on the upcoming EU and Germany ZEW Survey, French inflation and EU GDP.

- UK GDP due Thursday, with Retail Sales and jobs data scheduled earlier.

The EUR/GBP pair remains virtually unchanged as Monday’s North American session kicks in, exchanging hands at around 0.8650 as traders brace for the release of crucial economic data in Europe and in the United States (US).

Geopolitical optimism lifts Euro while markets eye inflation, ZEW sentiment, and UK growth outlook

Market mood is upbeat as depicted by Wall Street. The release of inflation figures in the US keeps flows muted. At the same time, the Euro (EUR) seems to be propelled by geopolitical developments as market players await the Trump-Putin meeting to discuss the Ukraine conflict.

On the data front, the European Union (EU) economic docket revealed that inflation in Italy came as expected at 1.7% YoY in July, unchanged from June, a justification for the European Central Bank (ECB) that the job on price stability is done. Besides this, EUR traders will eye the EU and Germany ZEW Survey for August, French inflation, and growth data for the bloc.

In the UK, traders continued to digest the recent hawkish cut by the Bank of England (BoE). The central bank updated its forecasts, painting a stagflationary scenario with prices continuing their uptrend, while growth remains stagnant as Gross Domestic Product (GDP) figures will be revealed on Thursday.

Further data will be announced, including Retail Sales and employment data.

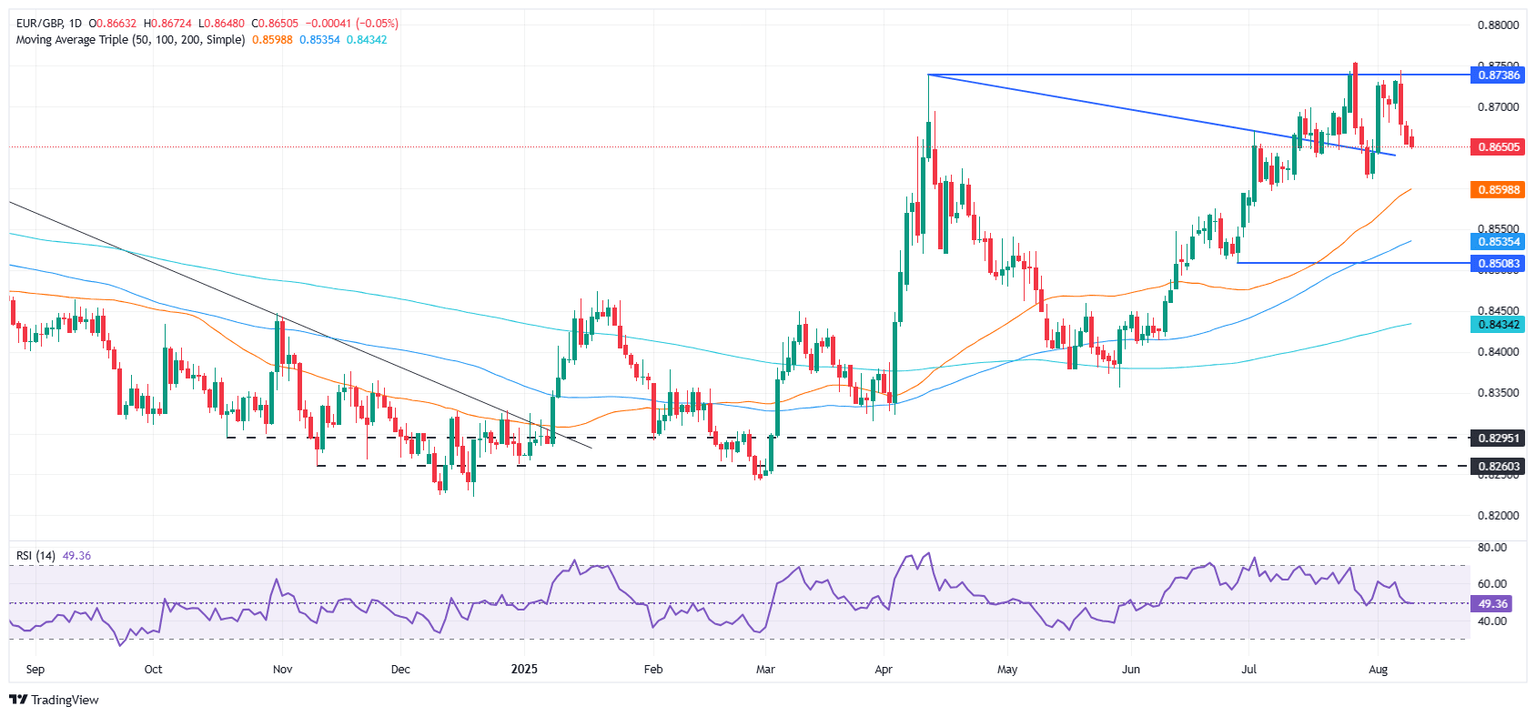

EUR/GBP Price Forecast: Technical outlook

In the short term, EUR/GBP turned neutral to downward biased as sellers pushed the spot price below the 20-day Simple Moving Average (SMA) at 0.8677. If the cross-pair ends daily below 0.8650, expect a test of the 50-day SMA below the 0.86 handle at 0.8598. Once those levels are cleared, the next stop will be the 100-day SMA at 0.8535.

Conversely, the first key resistance is the 0.8700 mark. If surpassed, this paves the way for challenging the YTD high at 0.8756.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.45% | 0.34% | 0.31% | 0.27% | 0.30% | 0.50% | 0.52% | |

| EUR | -0.45% | -0.11% | -0.14% | -0.17% | -0.15% | -0.00% | 0.08% | |

| GBP | -0.34% | 0.11% | -0.06% | -0.06% | -0.04% | 0.11% | 0.19% | |

| JPY | -0.31% | 0.14% | 0.06% | -0.01% | 0.02% | 0.25% | 0.35% | |

| CAD | -0.27% | 0.17% | 0.06% | 0.00% | 0.03% | 0.16% | 0.23% | |

| AUD | -0.30% | 0.15% | 0.04% | -0.02% | -0.03% | 0.15% | 0.23% | |

| NZD | -0.50% | 0.00% | -0.11% | -0.25% | -0.16% | -0.15% | 0.08% | |

| CHF | -0.52% | -0.08% | -0.19% | -0.35% | -0.23% | -0.23% | -0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.