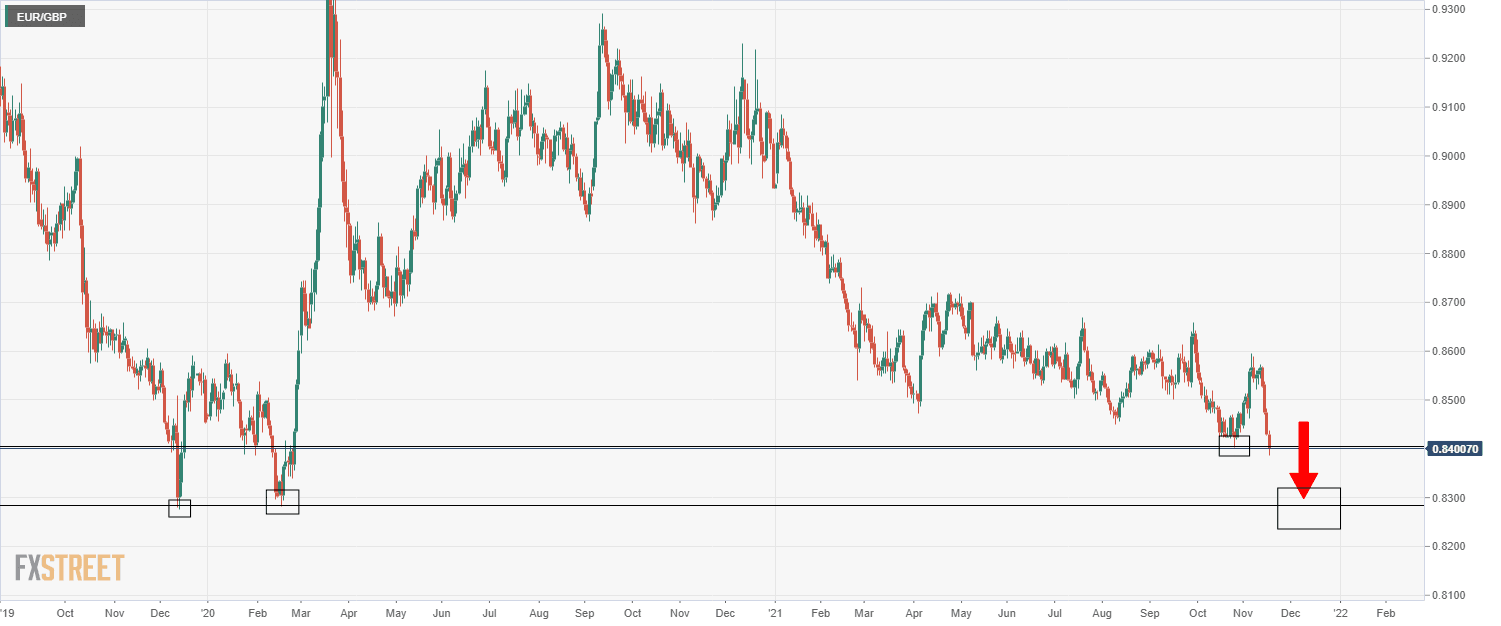

EUR/GBP falls back under 0.8400, prints fresh 21-month lows, as hot UK inflation weighs

- EUR/GBP has printed fresh 21-month lows in recent trade under 0.8390.

- On Wednesday the pair was weighed down by strong UK inflation data.

- But the euro is also suffering from its own problems.

Over the last few hours, EUR/GBP has reversed lower, with the pair crossing back below the 0.8400 level in recent trade and printing new 21-month lows under the 0.8390 level. The pair has been trading heavily on Wednesday due to a hotter than expected UK Consumer Price Inflation (CPI) report for October. Headline UK CPI rose to 4.2%, above expectations for a rise to 3.9%. Analysts broadly agreed that the inflation data supported the case for a BoE rate hike in December. According to Lloyds, though CPI “is still generally expected to start to ease back from H2 2022 onwards... an extended period of above-target inflation and indications that the labour market remained strong after the furlough scheme ended means that a Bank of England interest rate rise next month remains in play”.

After a second consecutive day of positive UK data surprises (recall that jobs data released on Tuesday was broadly seen as better than expected), traders are clearly viewing EUR/GBP as a sell on rallies. That likely explains why traders faded EUR/GBP's attempt to rally back towards the mid-0.8400s early in the European session. Now that the pair has cleared the previous year-to-date low from back in October at just above 0.8400 to the downside, technicians will be asking what is next. The next target for bears is likely to be the late 2019/early 2020 lows just below 0.8300.

Euro weakness

Traders and analysts are noting the vulnerability of the euro on multiple fronts. Firstly, ECB rhetoric has maintained a resolutely dovish tone, meaning the ECB monetary policy normalisation timeline remains well behind that of the Fed and the BoE’s. Secondly, Covid-19 infections and hospitalisations are rising sharply in the Eurozone, prompting some countries to reimpose restrictions on day-to-day life, risking an economic slowdown in Q4 2021 and Q1 2022. Finally, European gas prices (the bloc is dependent on imports) are surging following the news of a delay to the approval process of the Nord Stream Two pipeline, which is now not expected by analysts to start pumping gas until the end of winter, after demand has peaked.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset