Australian Dollar remains subdued as US Dollar appreciates ahead of PMI release

- The Australian Dollar loses ground as the US Dollar appreciates due to the rising likelihood of slower Fed rate cuts.

- Judo Bank Australian manufacturing activity improved in November but remained in contraction, while services activity slipped into negative territory.

- The US Dollar Index reached its fresh yearly high of 107.15 after the US Initial Jobless Claims released on Thursday.

The Australian Dollar (AUD) weakens against the US Dollar (USD) following the release of mixed Judo Bank Purchasing Managers' Index (PMI) data from Australia on Friday. However, the AUD benefited from a hawkish outlook by the Reserve Bank of Australia (RBA) regarding future interest rate decisions.

The Judo Bank Australia Manufacturing PMI rose to 49.4 in November from 47.3 in October, marking its 10th consecutive month of contraction, though the decline slowed to its weakest pace in six months. Meanwhile, the Services PMI fell to 49.6 from 51.0, signaling the first contraction in services activity in ten months.

Australia's four largest banks are predicting the Reserve Bank of Australia's (RBA) first rate cut. Westpac has revised its forecast for the first cut to May, up from February. National Australia Bank (NAB) also expects the cut in May. Meanwhile, Commonwealth Bank of Australia (CBA) and ANZ are both cautiously forecasting a rate cut in February.

The US Dollar Index (DXY), which tracks the USD against a basket of major currencies, trades near 107.00, just below its fresh yearly high of 107.15 recorded on Thursday. The US Dollar strengthened after the release of the previous week's Initial Jobless Claims data.

Futures traders now assign a 57.8% probability to the Federal Reserve cutting rates by a quarter point, a decrease from approximately 72.2% last week, according to data from the CME FedWatch Tool.

Daily Digest Market Movers: Australian Dollar appreciates due to hawkish RBA

- Traders await the flash US S&P Global Purchasing Managers’ Index (PMI) data and the final Michigan Consumer Sentiment report scheduled to be released on Friday.

- The Judo Bank PMI Composite Output Index dropped to 49.4 in November from 50.2 in October, indicating a modest contraction in private sector output for the second time in three months.

- US Initial Jobless Claims dropped to 213,000 for the week ending November 15, down from a revised 219,000 (previously 217,000) in the prior week and below the expected 220,000.

- The US Dollar gained ground due to the cautious remarks from Federal Reserve (Fed) officials. Additionally, market expectations suggest that the incoming Donald Trump administration will spur inflation, thereby slowing the rate cut trajectory from the Fed, lending support to the Greenback.

- A Reuters poll indicated that nearly 90% of economists (94 out of 106) anticipate a 25bps cut in December, lowering the fed funds rate to 4.25%-4.50%. Economists predict shallower rate cuts in 2025 due to the risk of higher inflation from President-elect Trump's policies. The fed funds rate is forecasted to be 3.50%-3.75% by the end of 2025, which is 50bps higher than last month’s projection.

- The Reserve Bank of Australia's November Meeting Minutes indicated that the central bank’s board remains vigilant about the potential for further inflation, stressing the importance of maintaining a restrictive monetary policy. Although board members noted no "immediate need" to alter the cash rate, they kept options open for future adjustments, emphasizing that all possibilities remain on the table.

- Federal Reserve Bank of Boston President Susan Collins stated on Wednesday that while more interest rate cuts are necessary, policymakers should proceed cautiously to avoid moving too quickly or too slowly, according to Bloomberg. Meanwhile, Fed Governor Michelle Bowman highlighted that inflation remained elevated over the past few months and stressed the need for the Fed to proceed cautiously with rate cuts.

- Australian Treasurer Jim Chalmers stated that "tumbling iron ore prices and a softening labor market have impacted government revenue," following his Ministerial Statement on the economy on Wednesday. Chalmers outlined Australia's tough fiscal outlook, citing the weakening of China, a key trading partner, and the slowdown in the job market as contributing factors.

- Fed Chair Jerome Powell downplayed the likelihood of imminent rate cuts, highlighting the economy's resilience, robust labor market, and persistent inflationary pressures. Powell remarked, "The economy is not sending any signals that we need to hurry to lower rates."

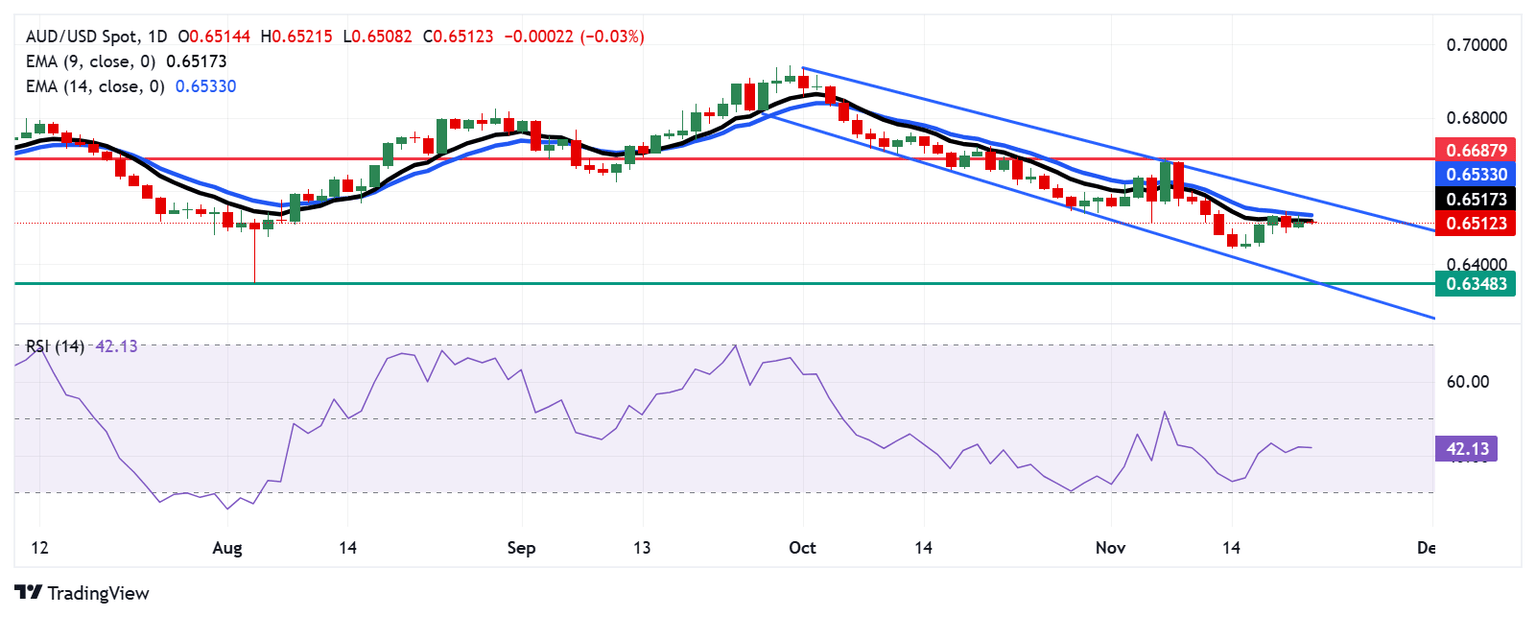

Technical Analysis: Australian Dollar tests nine-day EMA above 0.6500

AUD/USD hovers near 0.6510 on Friday, with technical analysis of the daily chart pointing to a bearish outlook. The pair remains within a descending channel, and the 14-day Relative Strength Index (RSI) sits below 50, reinforcing the negative sentiment.

On the downside, the AUD/USD pair may target the lower boundary of the descending channel at 0.6360, followed by its yearly low of 0.6348, which reached August 5.

On the upside, the AUD/USD pair faces resistance at the nine-day EMA of 0.6518 and the 14-day EMA of 0.6533. A break above these levels could diminish the bearish bias and pave the way for a rally toward the four-week high of 0.6687.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.11% | 0.20% | 0.22% | 0.10% | 0.36% | 0.57% | 0.04% | |

| EUR | -0.11% | 0.09% | 0.11% | 0.00% | 0.26% | 0.46% | -0.06% | |

| GBP | -0.20% | -0.09% | 0.04% | -0.10% | 0.16% | 0.36% | -0.17% | |

| JPY | -0.22% | -0.11% | -0.04% | -0.12% | 0.13% | 0.33% | -0.18% | |

| CAD | -0.10% | 0.00% | 0.10% | 0.12% | 0.25% | 0.46% | -0.07% | |

| AUD | -0.36% | -0.26% | -0.16% | -0.13% | -0.25% | 0.21% | -0.32% | |

| NZD | -0.57% | -0.46% | -0.36% | -0.33% | -0.46% | -0.21% | -0.53% | |

| CHF | -0.04% | 0.06% | 0.17% | 0.18% | 0.07% | 0.32% | 0.53% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

S&P Global Composite PMI

The S&P Global Composite Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging US private-business activity in the manufacturing and services sector. The data is derived from surveys to senior executives. Each response is weighted according to the size of the company and its contribution to total manufacturing or services output accounted for by the sub-sector to which that company belongs. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. The index varies between 0 and 100, with levels of 50.0 signaling no change over the previous month. A reading above 50 indicates that the private economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity is generally declining, which is seen as bearish for USD.

Read more.Next release: Fri Nov 22, 2024 14:45 (Prel)

Frequency: Monthly

Consensus: -

Previous: 54.1

Source: S&P Global

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.