AMC Share Price: Meme stock hits freefall as short squeeze continues to fade

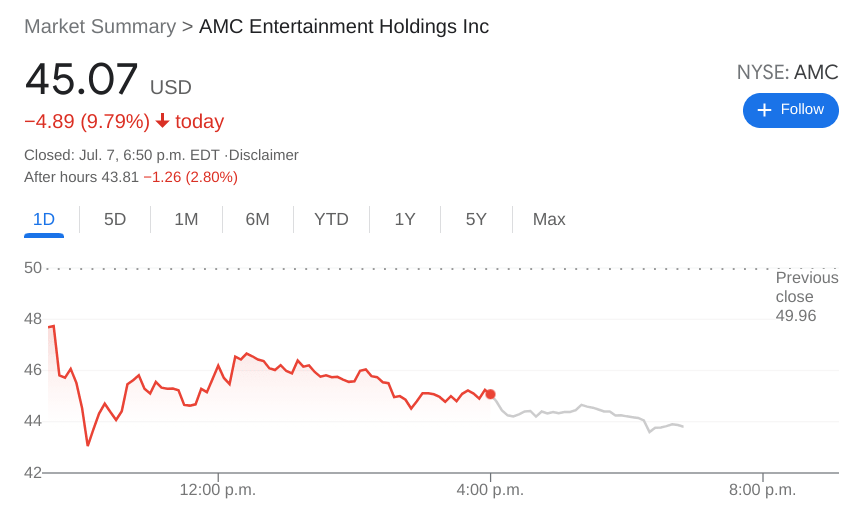

- NYSE:AMC dropped by 9.79% on Wednesday, as the meme stock slide continues.

- AMC officially falls below its 50-day moving average in after hours trading.

- AMC and GameStop could just be falling out of favor with younger investors.

NYSE:AMC is proving the old saying true: stocks take the stairs up but the elevator back down. While AMC’s rise may have been faster than most, the rapid descent hasn’t even given some investors time to take their profits. On Wednesday, AMC’s decline continued as the stock dropped by 9.79% to close the session at $45.07. It’s been a rough couple of weeks for meme stocks as the momentum from the short squeeze in early June has clearly tapered off, once again leaving many retail investors holding the bag after buying shares at a higher price.

Stay up to speed with hot stocks' news!

AMC saw some extended movement in after hours trading as the stock fell a further 2.64% at the time of this writing. This moves AMC below its 50-day moving average price of $44.14, which is a key level of support for stocks on a bearish downtrend. It will be interesting to see how AMC responds during Thursday’s session, but unless the stock finds support soon, AMC could be heading all the way back down. This would bring into question Tuesday’s decision by AMC CEO Adam Aron to not pursue a 25 million share stock sale at the higher price levels.

AMC stock forecast

The original meme stocks like AMC and GameStop (NYSE:GME) continue to fall out of favor with retail investors, as they look for other potential short squeeze stocks. Recently, companies like ContextLogic Inc. (NASDAQ:WISH) have found popularity amongst the Reddit crowd, although shares of Wish were also down sharply on Wednesday, falling by 7.91%. While they may all stress having diamond hands, the lower these stocks fall, the worse off these investors will be in the long-run.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet