Yearn.Finance Price Analysis: Only this crucial level separates YFI from reaching $40,000

- Yearn.Finance price is currently bounded inside an ascending parallel channel.

- The digital asset faces a strong resistance barrier between $31,000 and $32,000.

- YFI price can quickly climb towards a high of $40,000.

YFI is currently trading at $30,000 and has been moving sideways for the past week. It seems that one crucial resistance level is separating Yearn.Finance from a massive breakout towards a high of $40,000.

YFI price on the way to a massive breakout towards $40,000

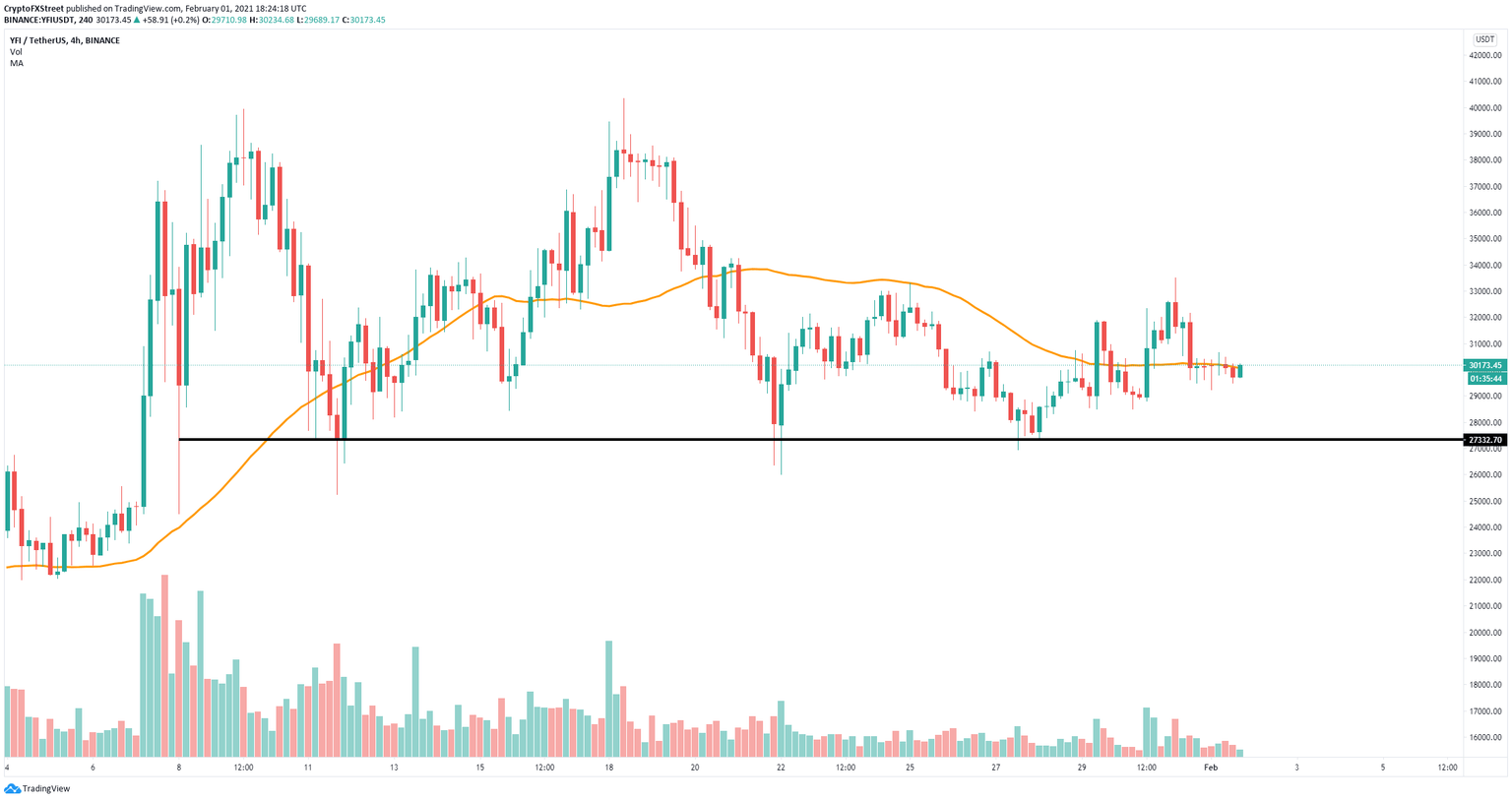

YFI has established a long-term ascending parallel channel on the 12-hour chart and bulls have defended the lower trendline support at $26,000 in the past week. The 50-SMA level at $31,500 is acting as a strong resistance level.

YFI/USD 12-hour chart

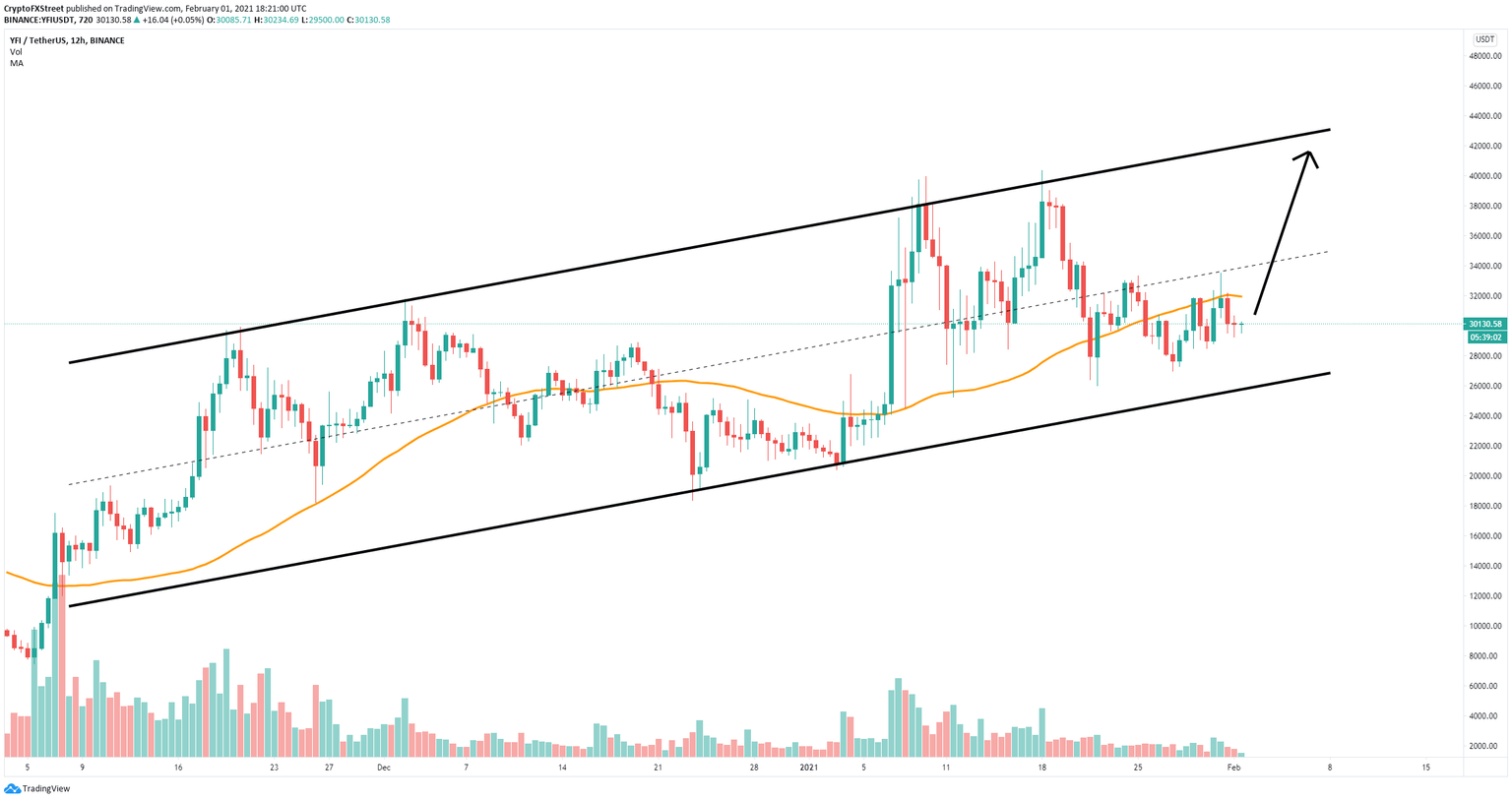

The In/Out of the Money Around Price (IOMAP) chart shows only one crucial resistance area between $30,190 and $31,000 which coincides with the 50-SMA, adding a lot of credence to the breakout of this resistance. Climbing above this point will push YFI price towards $40,000 as there are no other barriers on the way up.

YFI IOMAP chart

However, since January 20, the number of whales holding between 100 and 1,000 coins ($3,000,000 and $30,000,000) has dropped by six, indicating that large holders are no longer interested in YFI and are exiting the network.

YFI Holders Distribution chart

This could lead to a notable increase in selling pressure as whales exit the network. On the 1-hour chart, a crucial support level at $27,300 has been formed since January 11. The 50-SMA support at $30,200 is holding YFI price from falling towards $27,300.

YFI/USD 1-hour chart

The IOMAP chart also shows that the area between $29,200 and $30,140 with 7,540 YFI in volume is the strongest. A breakdown below this point will push YFI down to $27,300. However, losing this critical support level can send YFI down to $22,000.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B19.29.48%2C%252001%2520Feb%2C%25202021%5D-637478014409734565.png&w=1536&q=95)