XLM price remains unchanged as buyers wait for Stellar to hit $0.55

- XLM price recovered all of the losses it experienced last week.

- Buyers bought all dips and continue to support XLM against any sell-off.

- Trapped short-sellers could become major catalysts to any upcoming rally.

XLM price continues to consolidate, but it may be nearing a fantastic bullish breakout zone ahead. The combination of a conversion to a bull market and the anticipated break of an inverse head-and-shoulders pattern has buyers waiting for confirmation before entering any long trades.

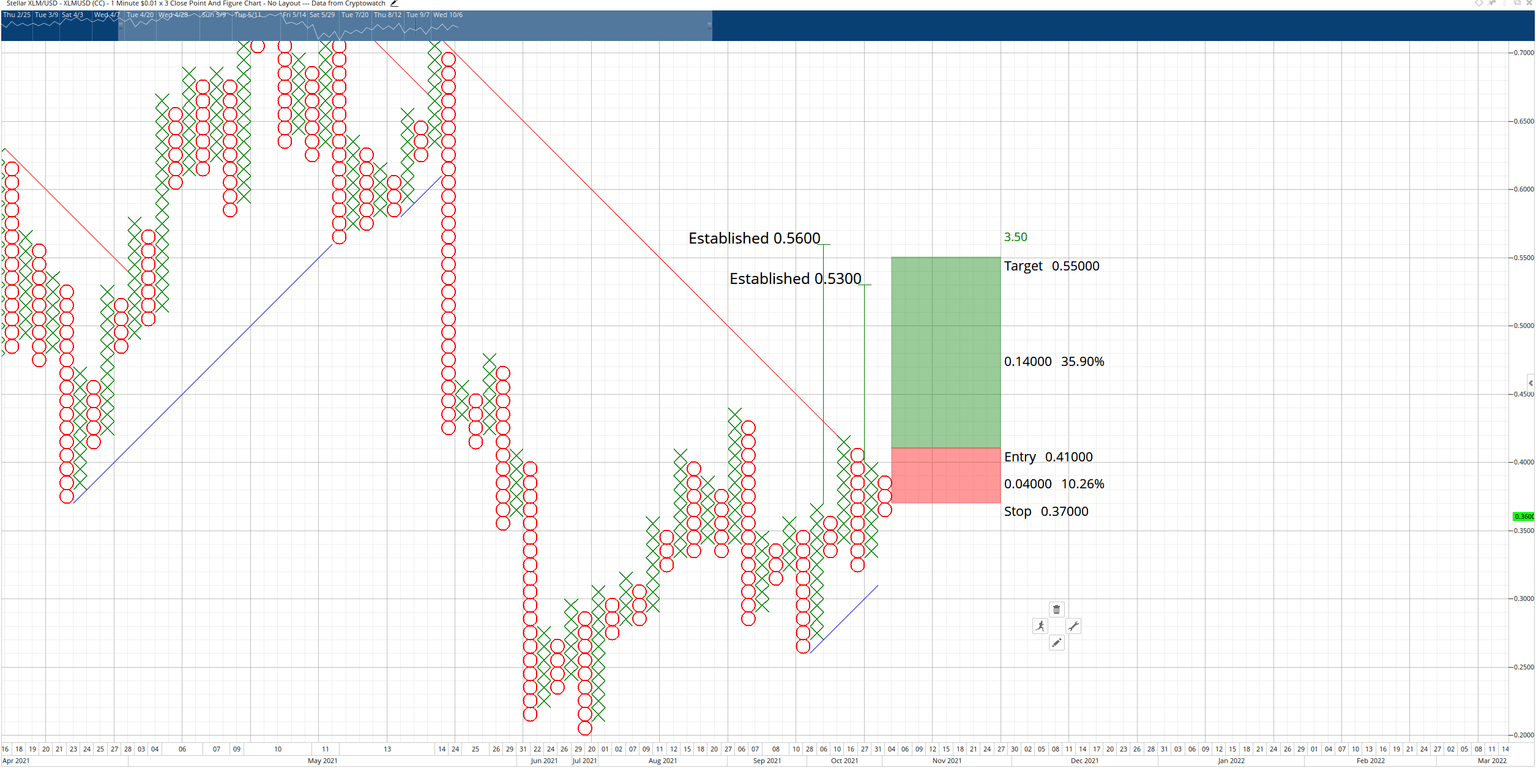

XLM price positioned for monster bullish bullish breakout if it can hit $0.41

XLM price presents two trade ideas for the long and short sides of the market. The first trade idea is a hypothetical buy stop at $0.41, a stop loss at $0.37 and a profit target at $0.55. This trade idea would accomplish two primary goals. First, it would confirm the conversion to a bull market by entering above the first pull-back zone. Second, it would deny the bear flag as a bearish continuation pattern, creating a sort of bear trap.

XLM/USD $0.01/3-box Reversal Point and Figure Chart

The long trade idea would be invalidated if the XLM were to drop below $0.31.

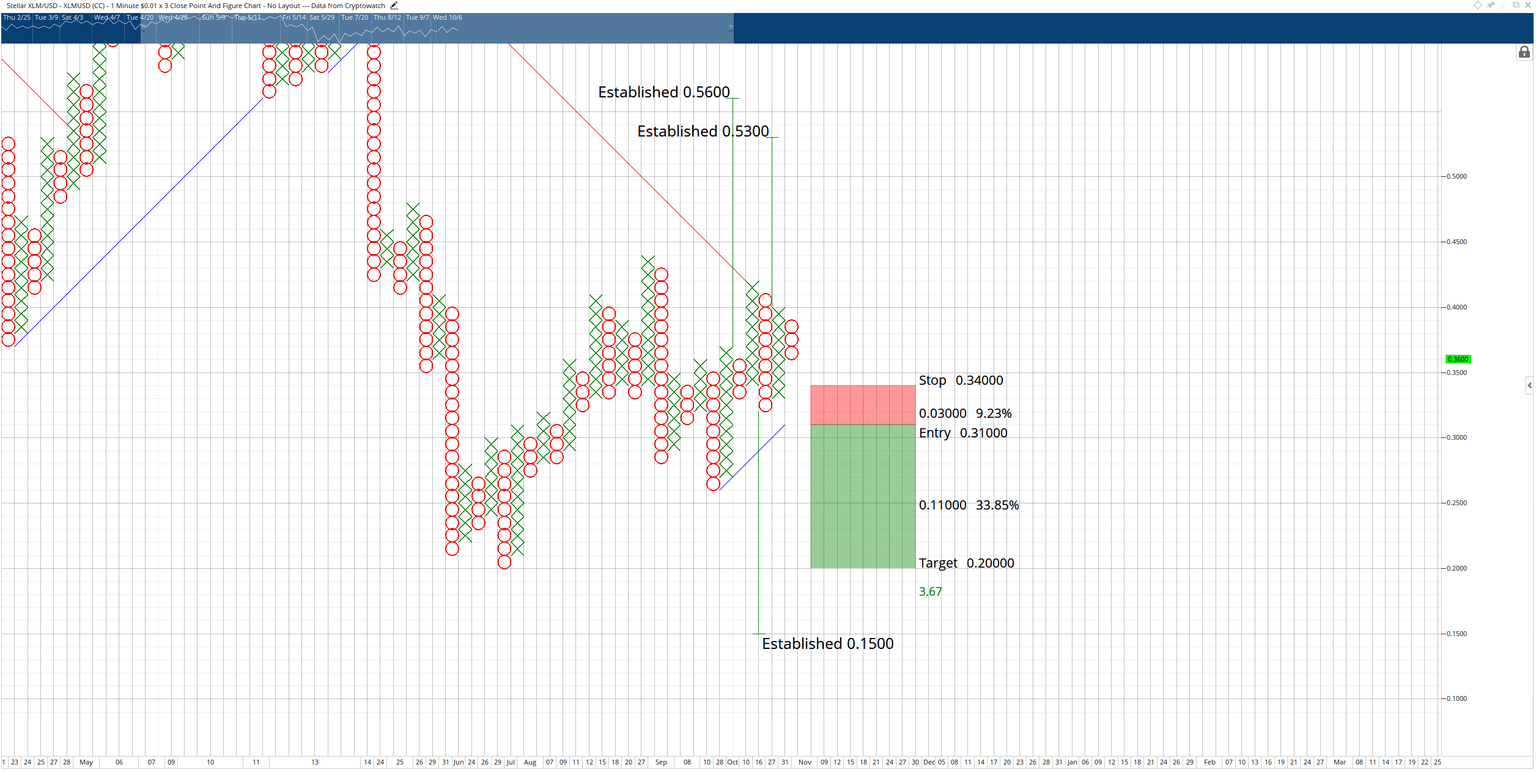

The short side of the trade is a little tricker and requires more active management of the trade. If the current column of Os dropped to a double bottom at $0.32, XLM price might find support at a high volume node in the volume profile and the dominant bull market angle (blue diagonal line). Therefore, developing a triple-bottom or a split triple-bottom at $0.32 would be necessary for a hypothetical short entry at $0.31. The short entry idea is a sell stop at $0.31, a stop loss at $0.34 and a profit target at $0.20 – again, only if there is a triple-bottom or split-triple bottom.

XLM/USD $0.01/3-box Reversal Point and Figure Chart

However, the short idea is the least likely to occur. The Vertical Profit Target Method indicates that the profit zone is at $0.15 – but that has a very low probability of occurring. It is more likely that the lows on any sell-off would be limited to the Volume Point of Control for 2021 and the prior support zone at the $0.20 value area. The theoretical short idea will be invalidated if the long trade above is activated.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.