Which coins can rise against the fall of Bitcoin (BTC)?

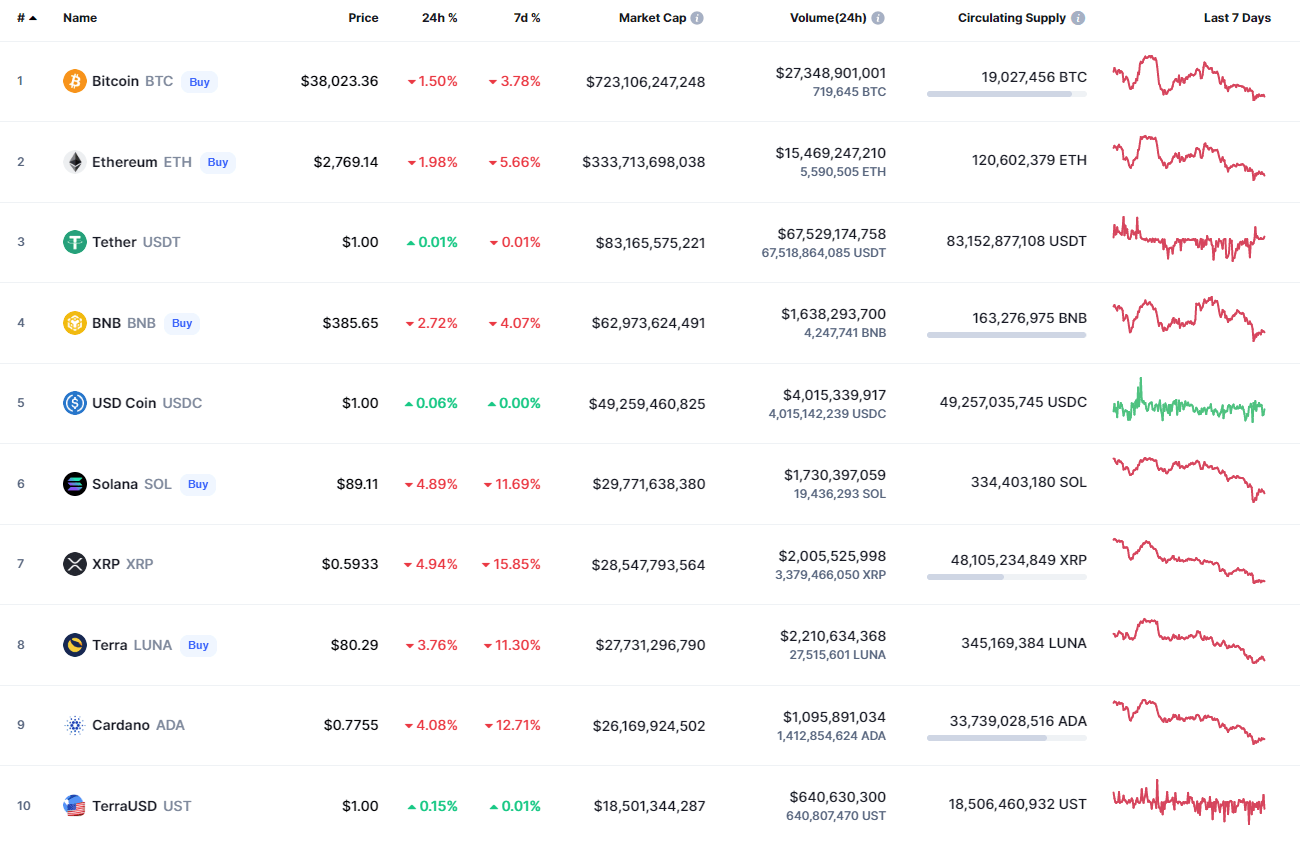

The weekend is ending bearish for the cryptocurrency market as all of the top 10 coins are in the red zone.

Top coins by CoinMarketCap

BTC/USD

The rate of Bitcoin (BTC) has declined by 3.76% over the last seven days.

BTC/USD chart by TradingView

On the daliy chart, bulls are trying to hold the interim $37,700 level against the declining trading volume. If they manage to do that by the end of the day, the upcoming week might be bullish for the leading cryptocurrency. In another case, the breakout of $37,700 may be a prerequisite for a sharp drop to the area around $36,000.

Bitcoin is trading at $37,991 at press time.

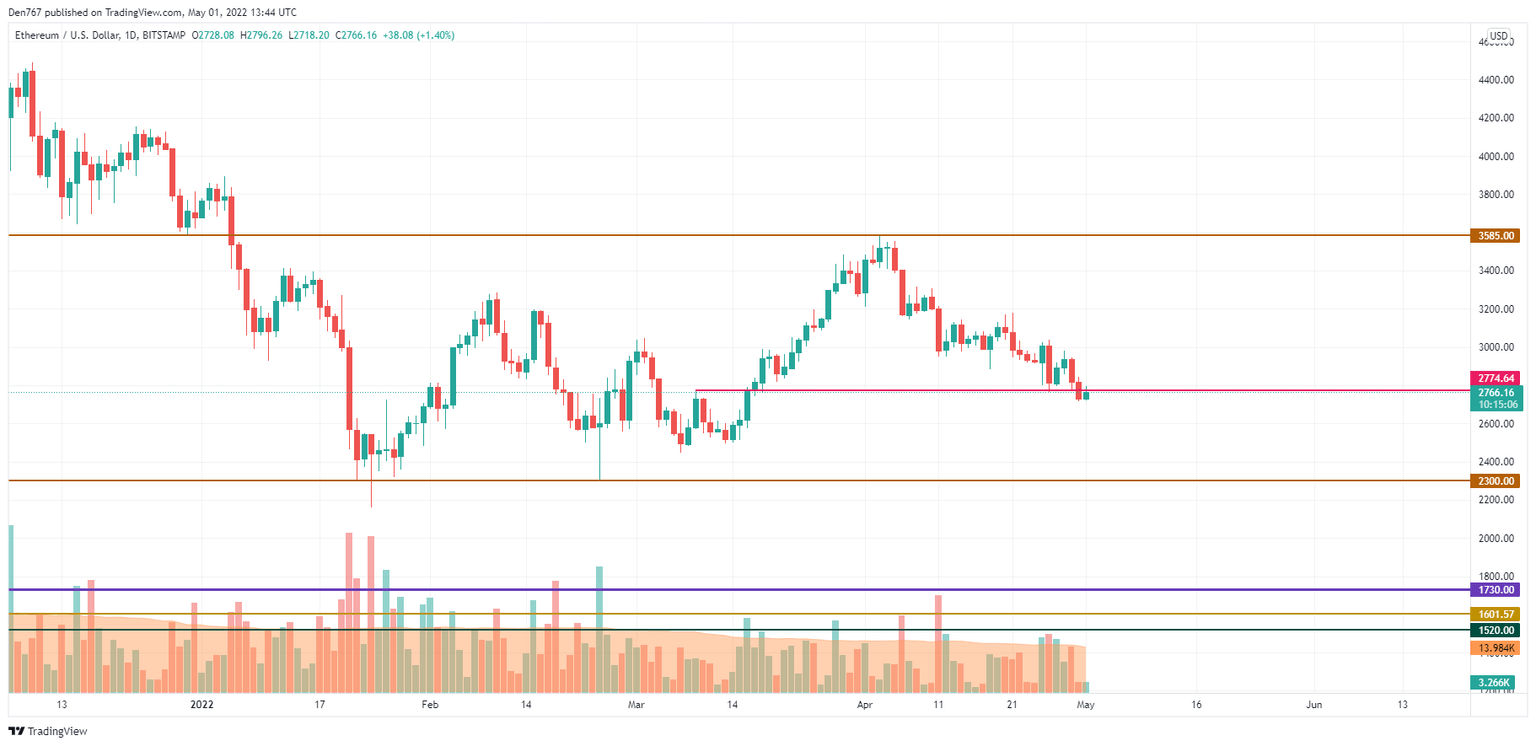

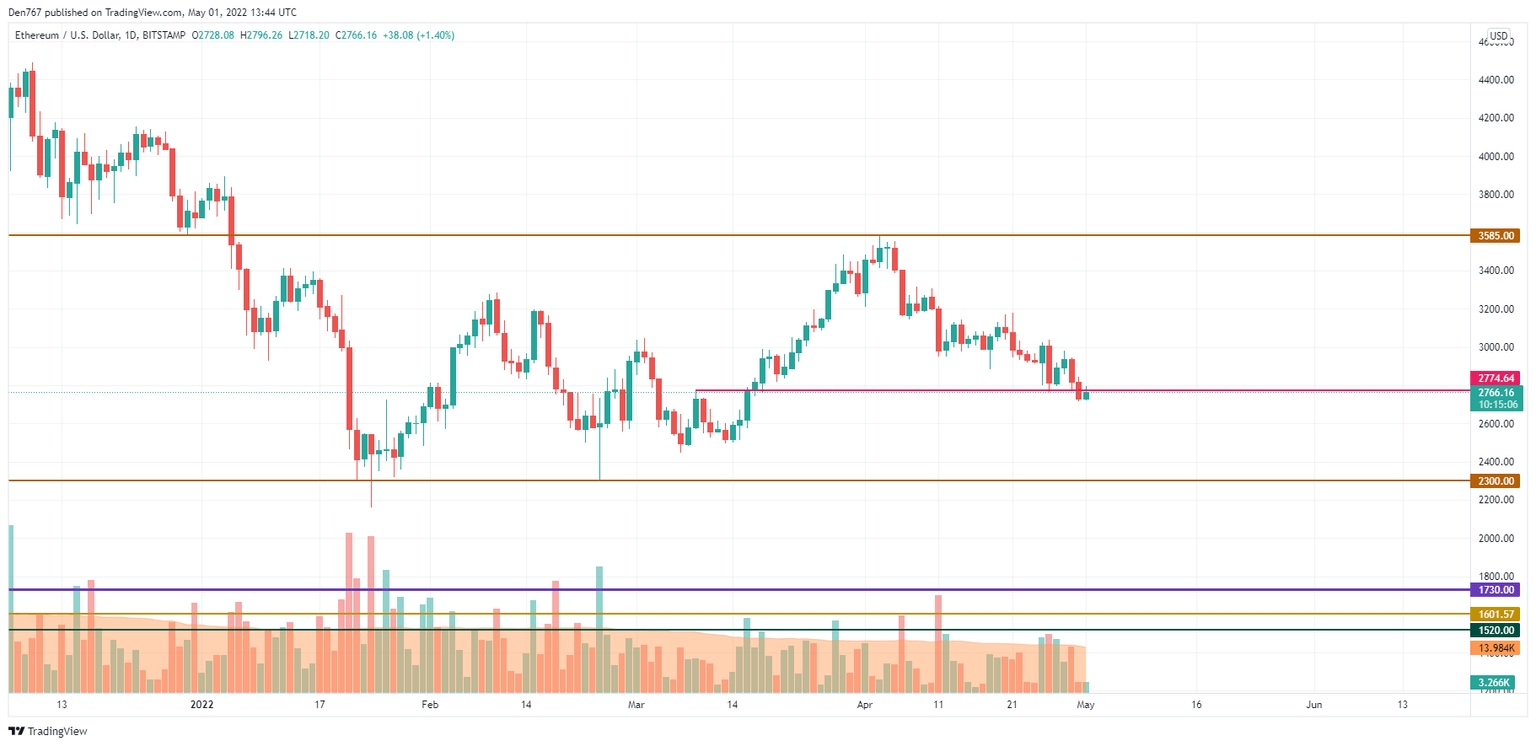

ETH/USD

Ethereum (ETH) is more bearish than Bitcoin (BTC) as the rate of the main altcoin has dropped by 5.53% since the beginning of the week.

ETH/USD chart by TradingView

Analyzing the daily chart, Ethereum (ETH) has dropped below the $2,774 level. If buyers cannot seize the initiative and the weekly candle fixes below it, the fall may continue to the $2,500-$2,400 zone by mid-May.

Ethereum is trading at $2,764 at press time.

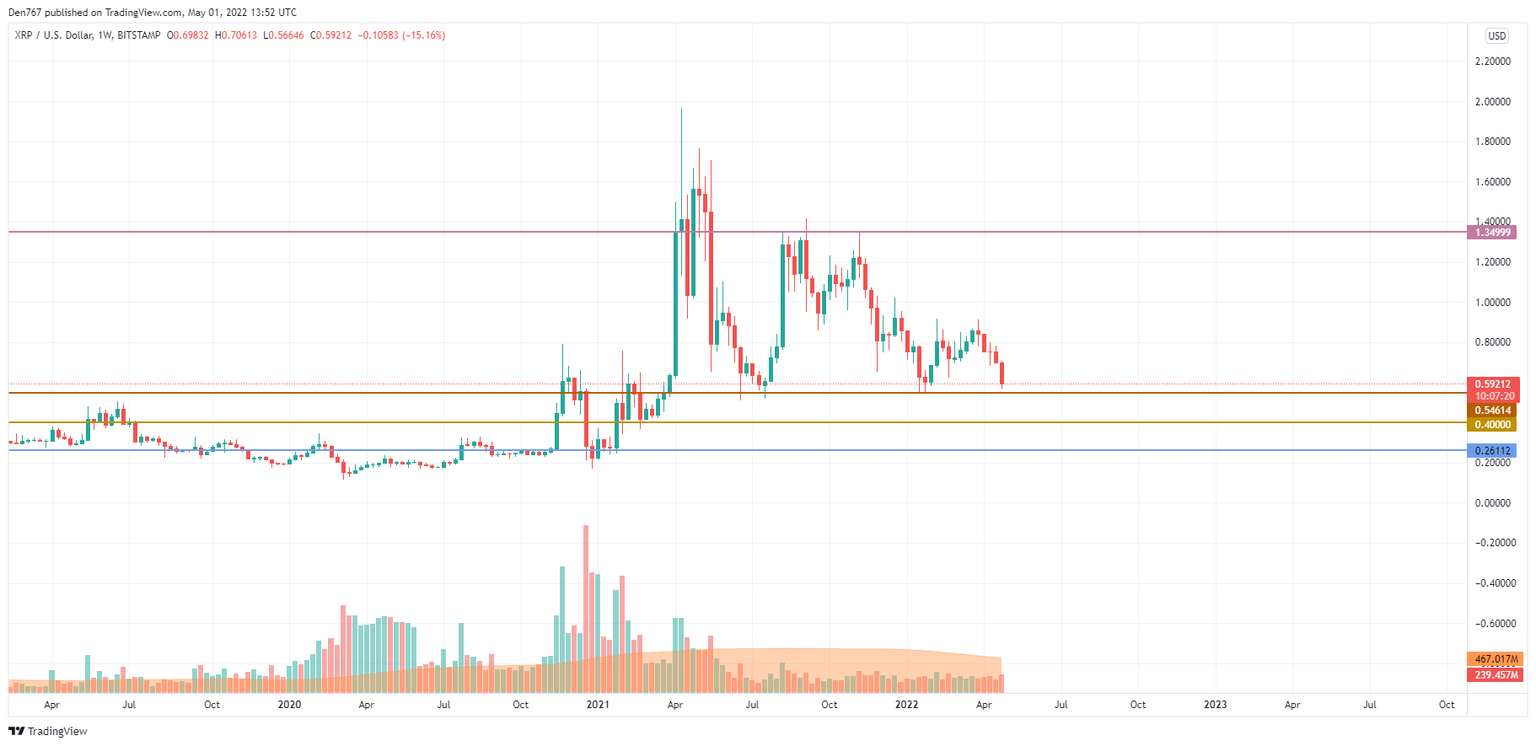

XRP/USD

XRP is the biggest loser from the list, falling by 15% over the last week.

XRP/USD chart by TradingView

On the weekly chart, the price is coming back to the support level of the wide channel against the increased trading volume. If bears' pressure continues, the following week might begin with a further decline of XRP. In this regard, there is a high possibility to see the test of the $0.40 level soon.

XRP is trading at $0.5918 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.