Was today's dump a prerequisite for continued growth?

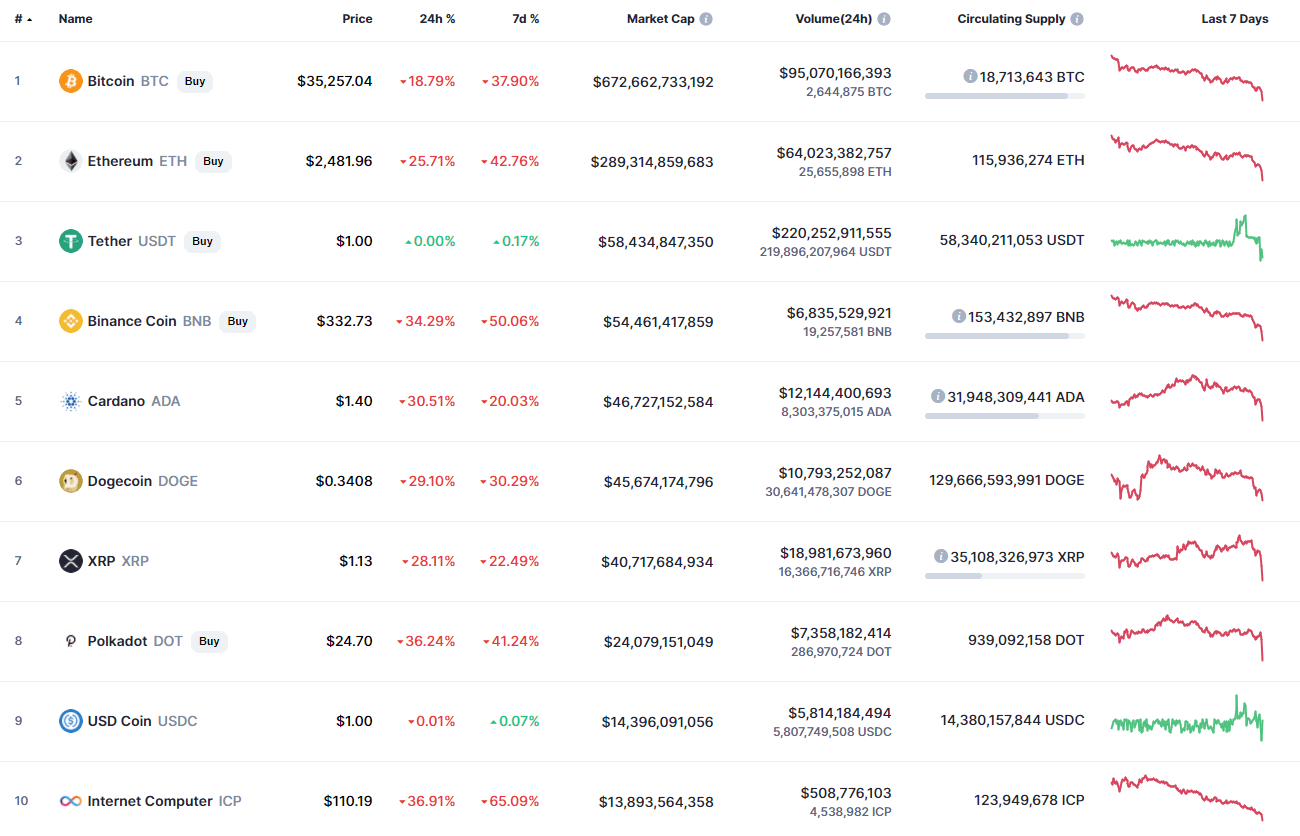

The market has faced a deep correction as all top 10 coins are located in the red zone. Bitcoin (BTC) has fallen the least among them, going down by 18% over the last 24 hours.

Top coins by CoinMarketCap

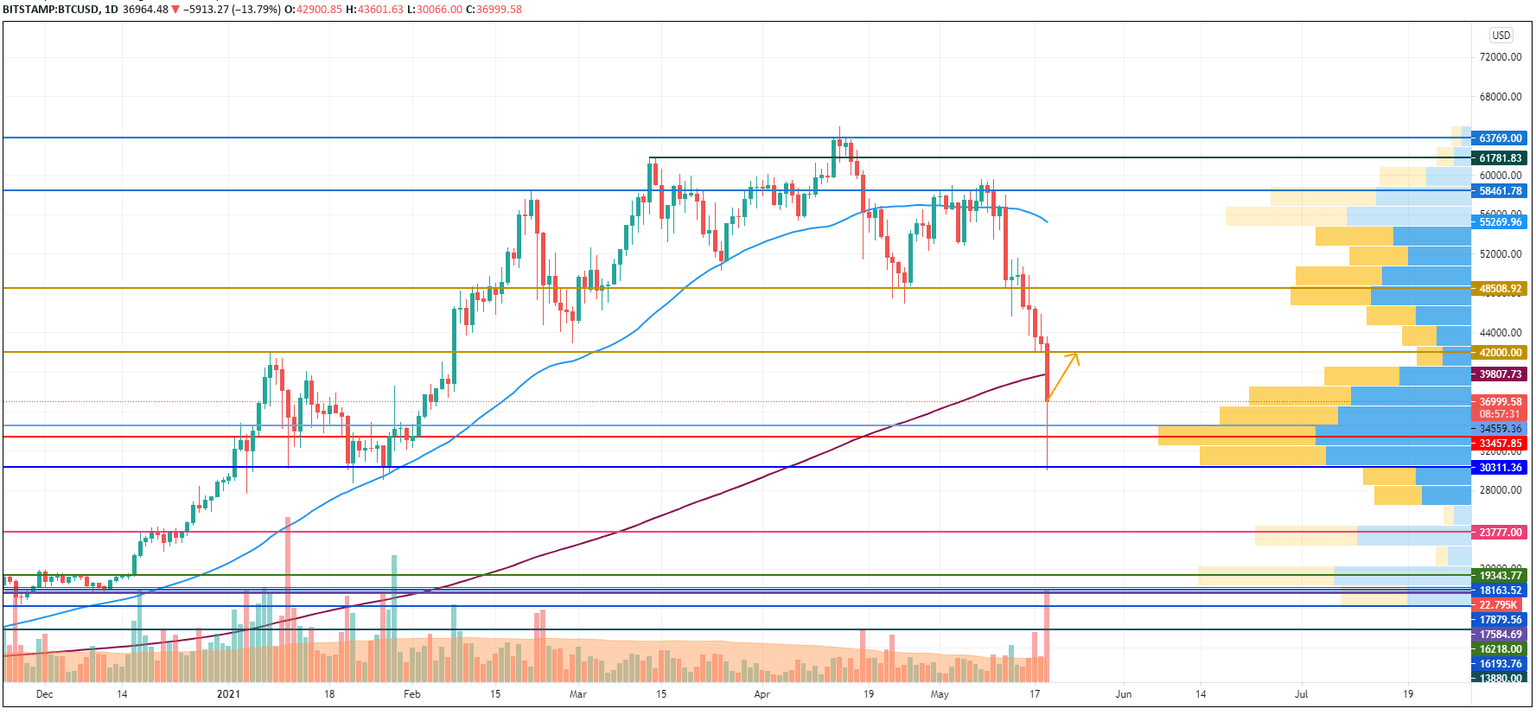

BTC/USD

The rate of Bitcoin (BTC) has dropped by 15% since yesterday, having touched the mark of $30,000.

BTC/USD chart by TradingView

Bitcoin (BTC) has tested the zone of $30,000 where most of the liquidity is focused. In addition, it crossed the MA 200 on the daily chart that confirms ongoing bearish pressure. However, one may expect a short-term bounceback from the current levels to the nearest resistance at $42,000 soon.

But this does not mean that the bullish trend is about to come back as the selling trading volume remains high.

Bitcoin is trading at $36,900 at press time.

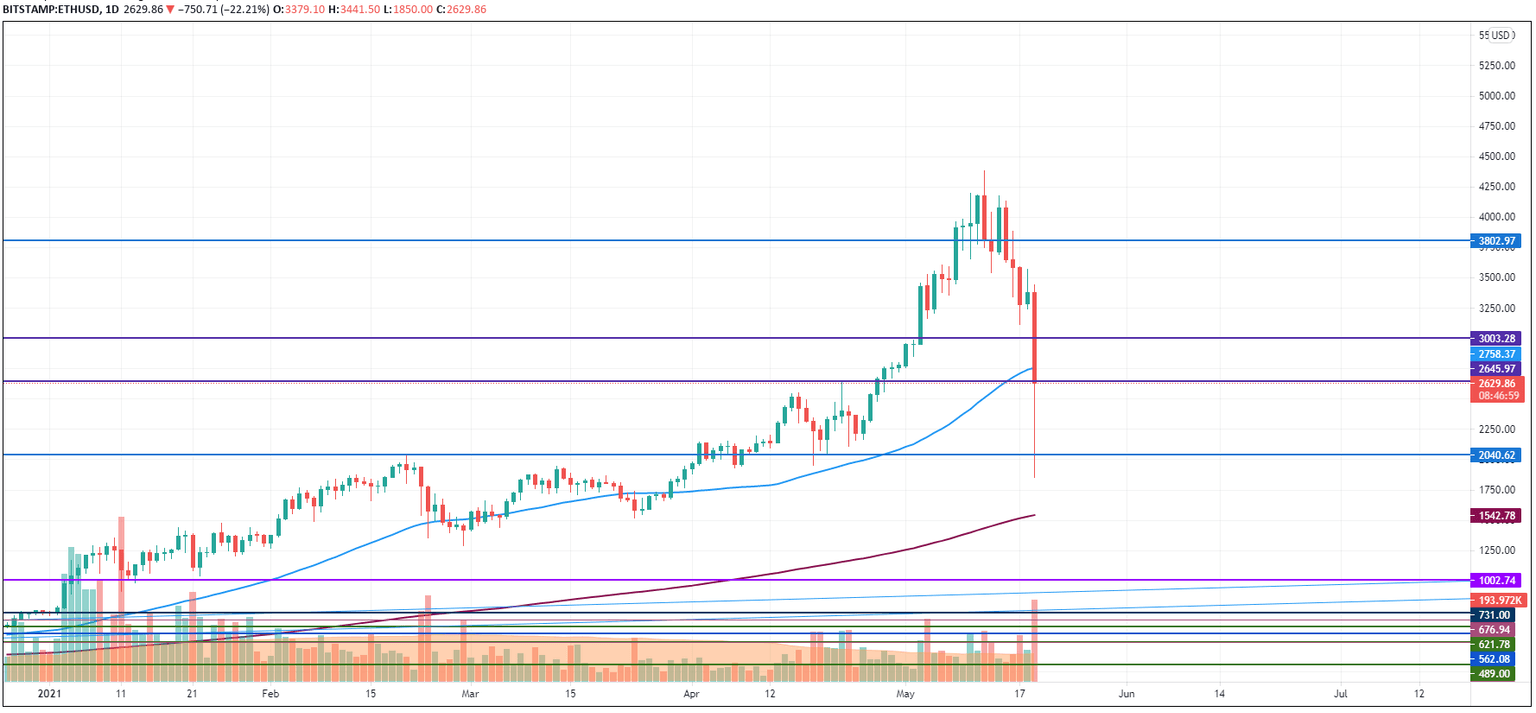

ETH/USD

Ethereum (ETH), as well as other altcoins, is more bearish than Bitcoin (BTC) as it has dropped by a whopping 21%.

ETH/USD chart by TradingView

Despite the sharp dump of Ethereum (ETH), the rate has successfully bounced off the levels around $2,000. From a technical point of view, the situation is similar to Bitcoin (BTC), as the bulls may seize the initiative now and return the rate of the chief altcoin to $3,000.

Ethereum is trading at $2,674 at press time.

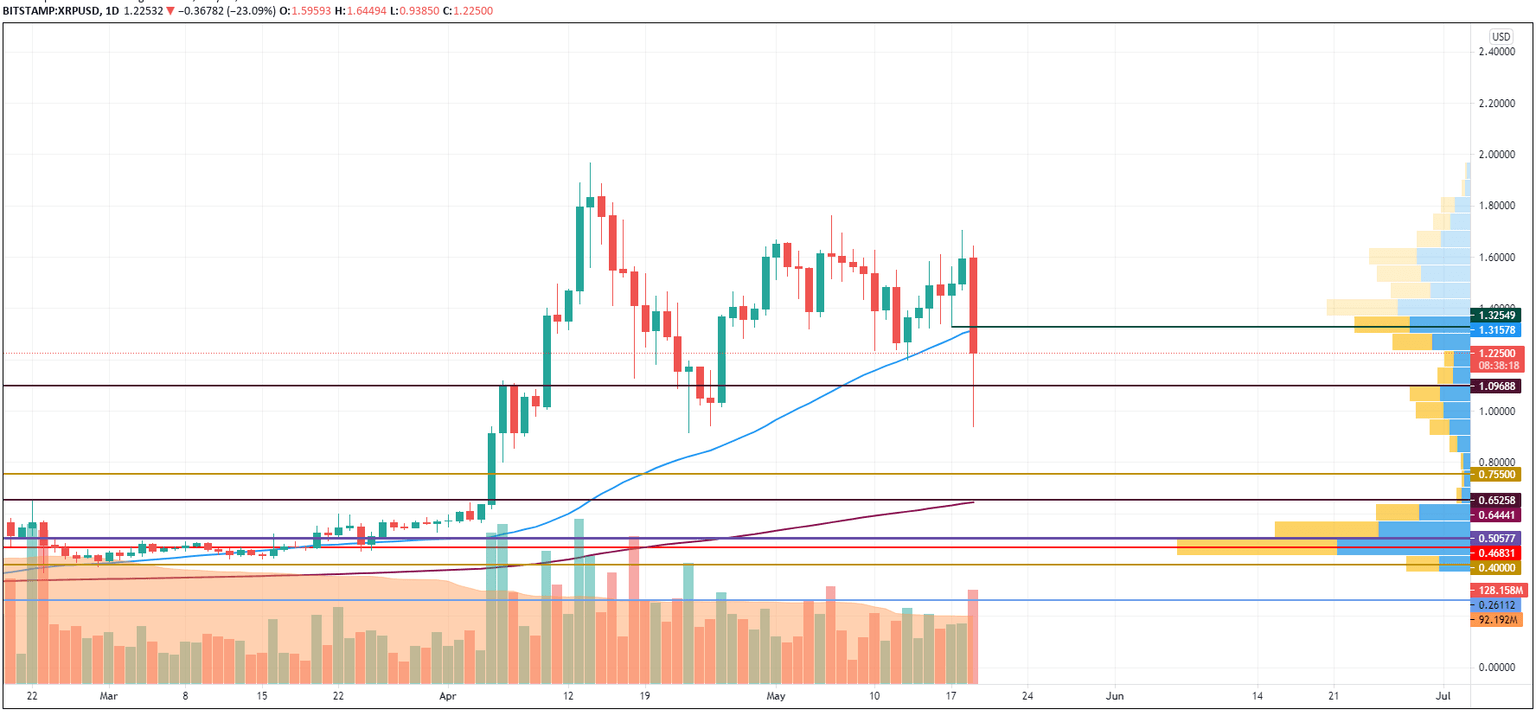

XRP/USD

The rate of XRP has fell down even deeper than that of Ethereum (ETH), with a drop of 24%.

XRP/USD chart by TradingView

The current dump might be viewed as gaining more liquidity for a future rise as the selling trading volume is even lower than the decline on April 17. In this case, the correction to the created level at $1.315 is the more likely scenario for the upcoming days.

XRP is trading at $1.248 at press time.

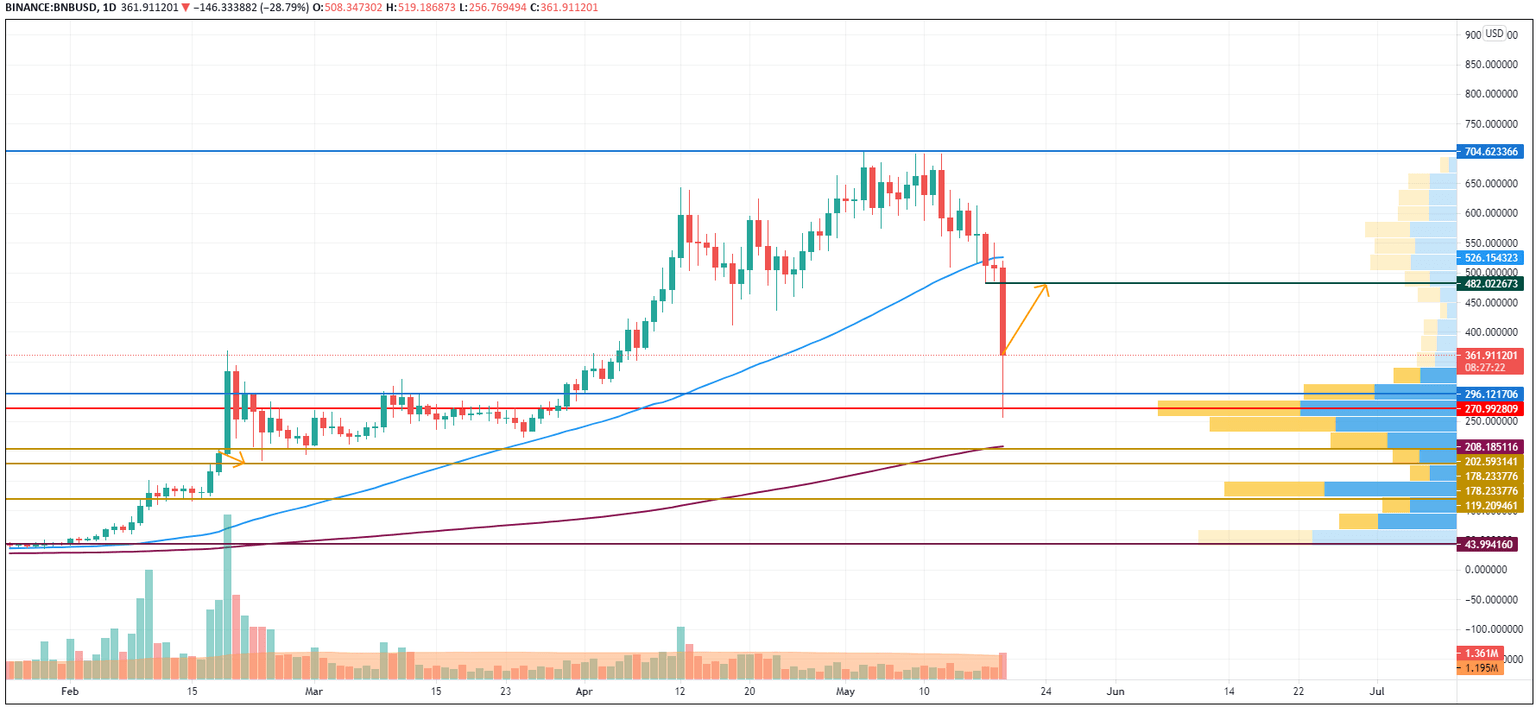

BNB/USD

Binance Coin (BNB) is the biggest loser today as the the native exchange coin has lost 30% of its price share since yesterday.

BNB/USD chart by TradingView

Binance Coin (BNB) is not an exception to the rule as it has also bounced off its support zone at $260. At the moment, BNB might keep growing as it is already oversold on the daily time frame. A rise to $480 may happen shortly.

Binance Coin is trading at $369 at press time.

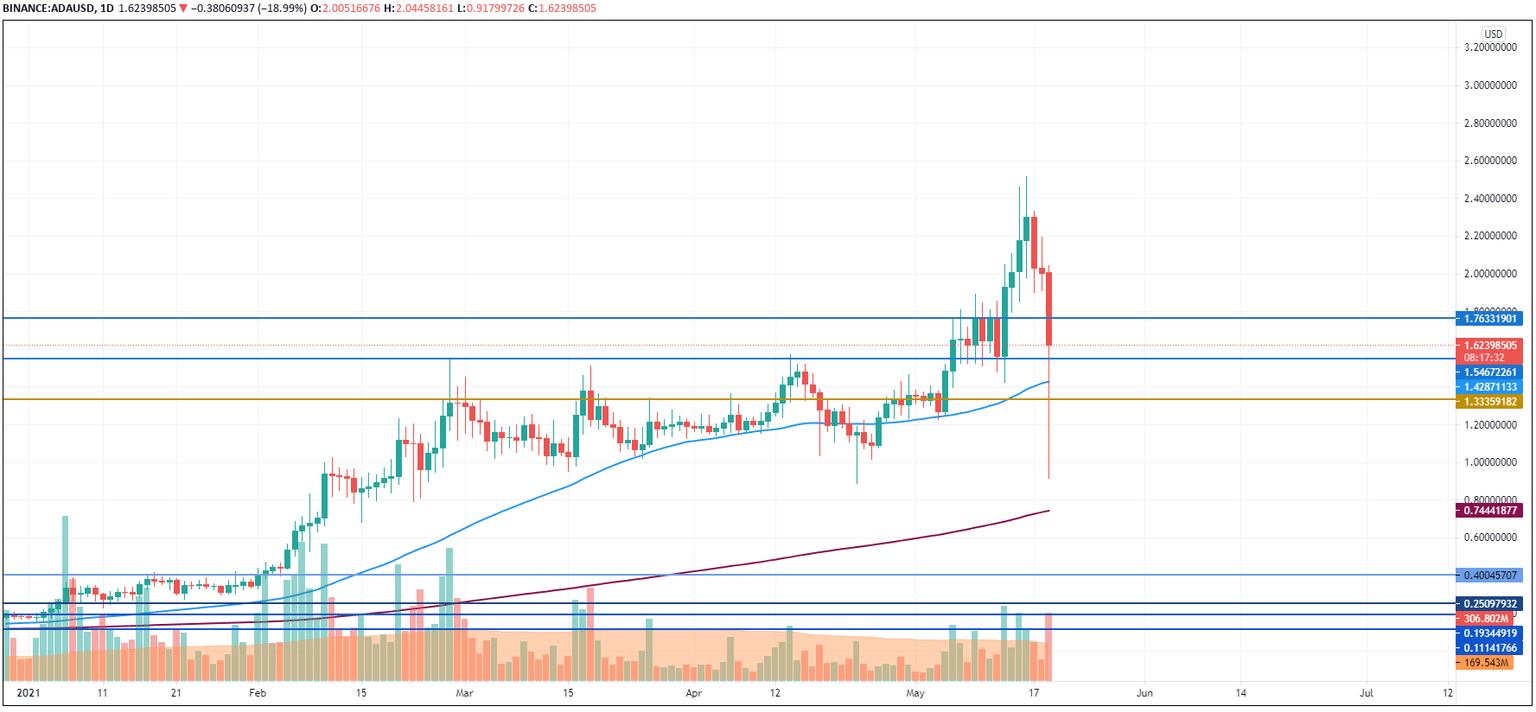

ADA/USD

Cardano (ADA) has also been under bearish influence recently, and the drop over the last day has constituted 18%.

ADA/USD chart by TradingView

Cardano (ADA) has tested the MA 50 and almost reached the MA 200 on the daily chart. While the altcoin keeps trading above $1.33, the bullish scenario remains relevant. Regarding the short-term prediction, the retest of the resistance at $1.763 may occur within the next few days.

Cardano is trading at $1.64 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.