Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

- Trump Media will launch a utility token and digital wallet to power Trump-owned social media platform Truth Social.

- According to the shareholder letter, Premium services like subscriptions and longer video uploads will be tied to token utility.

- TMTG also plans Truth+ expansion into Canada and Mexico, and will invest $250M from cash reserves into digital assets.

- Trump token price is down 10% amid fears that the project could be abandoned for the newly launched token.

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Trump Media to roll out utility token and Truth wallet for platform monetization

Trump Media & Technology Group (TMTG) revealed plans to launch a native utility token and digital wallet as part of a broader monetization strategy for Truth Social and the Truth+ streaming platform.

The announcement, included in a shareholder letter released ahead of its 2025 annual meeting, outlines how the new token will serve as a payment method for Truth+ subscriptions, in-app services, and future cross-platform features.

The Truth wallet will integrate directly into Truth Social and Truth+ and will allow users to purchase premium services such as verification badges, scheduled posts, editing tools, expanded character counts, and longer video uploads.

The rollout marks a significant step in TMTG’s bid to decentralize its service offerings and create recurring digital revenue streams beyond traditional ad models.

TMTG to expand streaming service, eyes cross-border growth and fintech services

Alongside the token initiative, TMTG also announced the international expansion of Truth+, its subscription-based streaming service.

The company plans to launch Truth+ in Canada and Mexico and is actively exploring advertising, premium content bundles, and pay-per-view models.

These efforts will be paired with the debut of Truth.Fi, a financial services arm offering separately managed accounts and ETFs in collaboration with Index Technologies, Yorkville America Equities, and Crypto.com.

TMTG also addressed ongoing shareholder concerns, confirming continued legal efforts to investigate alleged naked short selling of DJT stock.

Meanwhile, the company is finalizing its corporate reincorporation in Florida, citing regulatory advantages and the state’s pro-business stance as key to long-term scalability.

Looking ahead

Earlier this year, TMTG announced it will allocate up to $250 million from its $777 million cash reserves to fund blockchain integrations, including investments in Bitcoin and other crypto assets.

Hence, as the company confirms the pivot toward crypto-based payments for the Truth+ streaming platform, it may trigger global adoption of cryptocurrencies in monetization and payments for larger digital media streaming platforms such as Netflix and Amazon Prime in 2025 and beyond.

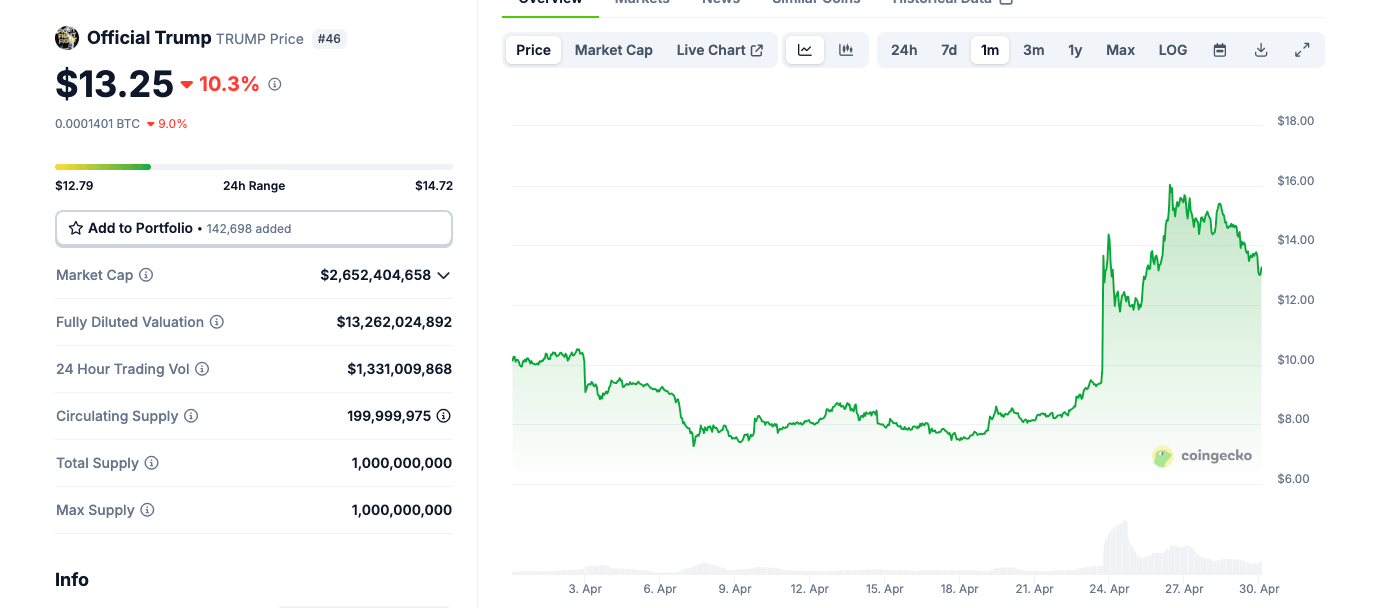

Notably, the official TRUMP meme-token price sharply fell 10% within hours of the TMTG shareholder letter, trading at $13.25 per coin.

Official TRUMP Memecoin token price performance, April 30 2025 | Coingecko

At press time, the memecoin market capitalization has declined to $2.6 billion, down 70% from its all-time highs of $8.8 billion all-time high recorded on the eve of Trump’s inauguration in January.

This sharp sell-off echoes concerns about potential sidelining of the Solana-hosted TRUMP memecoin project. While Trump has not officially dis-owned the TRUMP meme-token at press time, the rollout of an in-house utility token suggests an imminent shift toward revenue-generating blockchain applications.

Investors and Truth social users alike will be watching closely to see how the company navigates strategic alignment between both tokens in the coming weeks.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.