These two Polkadot-like cryptocurrencies show strong potential for massive gains

- Polkadot was one of the most successful cryptocurrencies in 2020.

- There are two cryptocurrencies related to Polkadot that could see similar gains in the future.

Polkadot was by far one of the most profitable cryptocurrency in 2020, achieving a $5 billion market capitalization almost instantly after getting listed on exchanges. Polkadot is a blockchain protocol capable of connecting multiple blockchains into one unified network. Its main feature is the scalability it can achieve and how easy it is to upgrade.

Polkastarter has immense potential in the long-term

Polkastarter is a cross-chain protocol for token pools built on Polkadot. It allows projects to raise capital in a decentralized manner through Polkadot. The project has already helped numerous projects raise money, including SpiderDAO, FIRE, MahaDAO among others.

POLS/USD 12-hour chart

POLS is only listed on Uniswap and Poloniex and seems to be in a long-term uptrend. On the 12-hour chart, the digital asset had a massive 50% pump in the past 48 hours, climbing above the 12-EMA and the 26-EMA which are on the verge of a bullish cross.

Polkastarter price faces very little resistance to the upside now with the next potential price target located at $0.655. The project has a lot of room for growth as more projects start utilizing the platform to raise funds.

Kusama price ready for a 50% breakout or breakdown

Kusama is a scalable multi-chain network and ‘cousin’ of Polkadot. The platform is also built using Substrate and has nearly the same codebase as Polkadot. It was founded by Gavin Wood, the founder of Polkadot and co-founder of Ethereum. The main idea behind the project is that anyone is able to launch a custom blockchain that is scalable and fast.

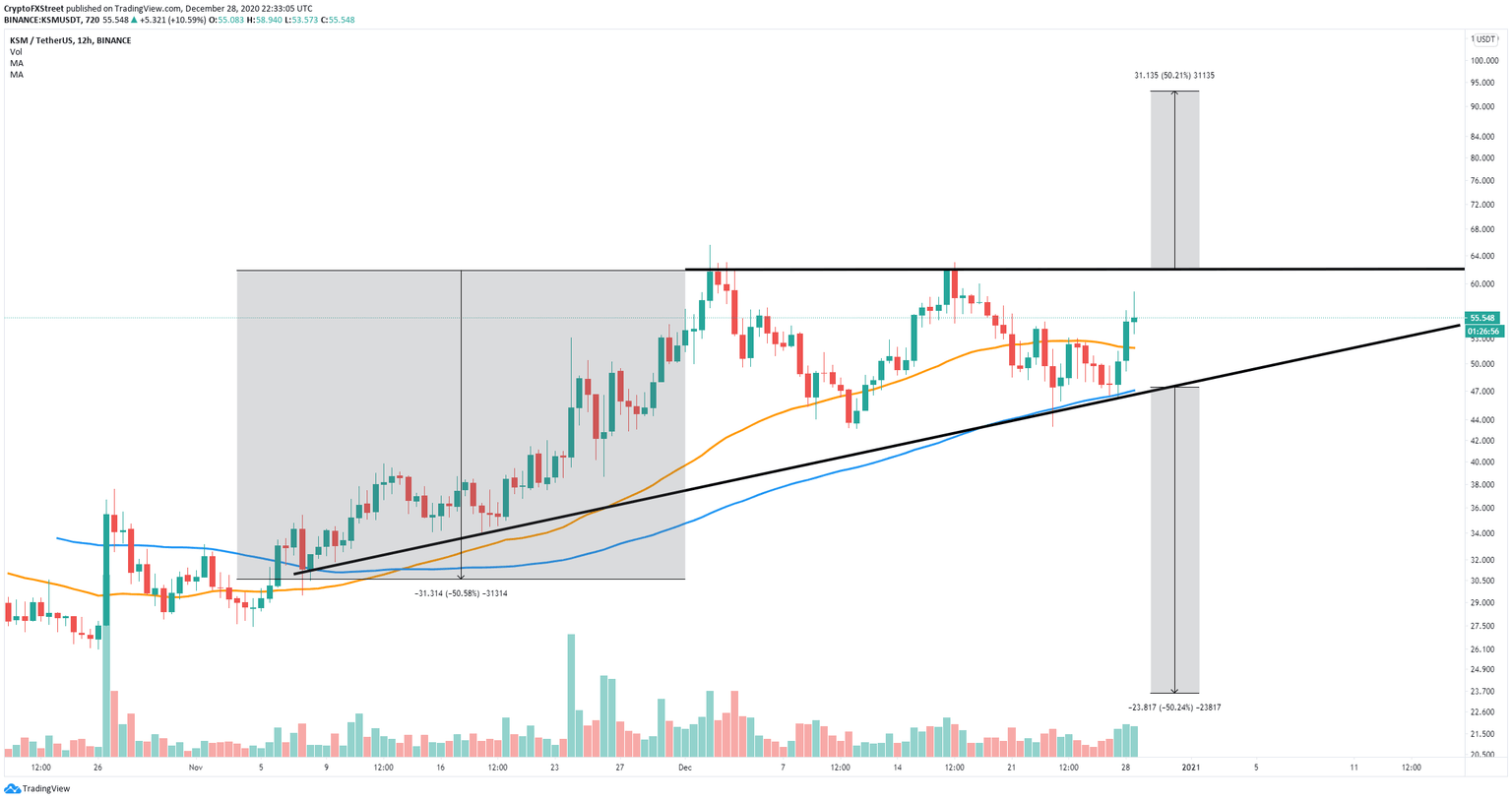

Kusama is an older project listed on prominent exchanges including Binance, Kraken, and Bitfinex, among others. Kusama price is currently $55 and bounded inside an ascending triangle pattern on the 12-hour chart.

KSM/USD 12-hour chart

Bulls have pushed Kusama above the 50-SMA and the 100-SMA and are ready for a breakout above the upper trendline resistance level at $62. A push above this point will move Kusama up to $93.

On the other hand, if the bulls slip up and lose both moving averages, the odds of a breakdown would increase. Losing the critical support level at $47 can quickly drive Kusama price towards $23.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.