Stellar Price Prediction: XLM is breaking out, primed for 40% rally towards 0.2300

- XLM bulls set for a big move northward.

- Descending triangle spotted on the 12H chart.

- XLM/USDT probes 21-SMA amid bullish RSI.

Stellar Lumens is primed for a massive upswing against Tether, as a key technical breakout looks imminent on the 12-hour time frame.

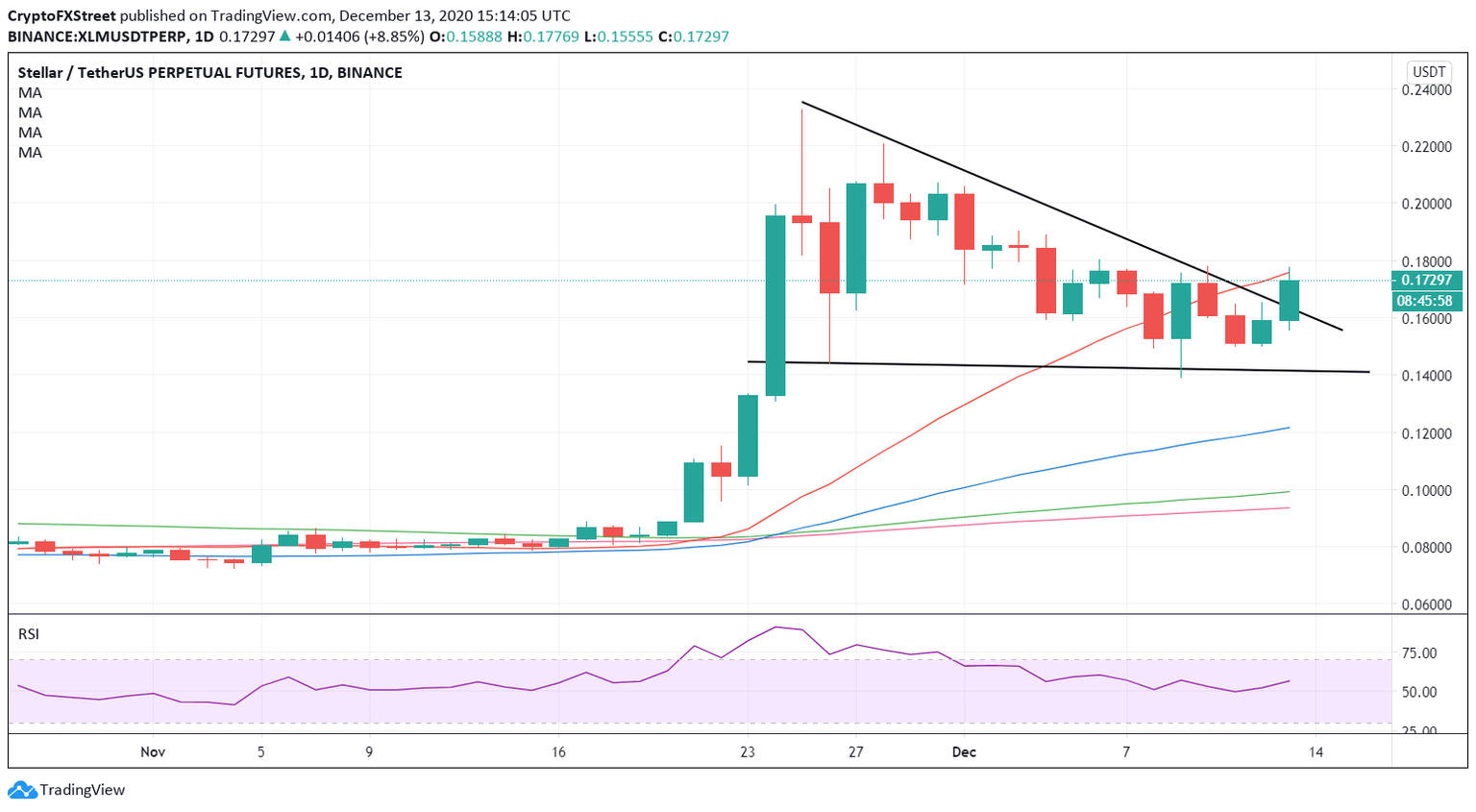

XLM/USDT: 12-hour chart

XLM/USDT is on the verge of confirming a descending triangle breakout on the given timeframe, having breached the falling trendline resistance at 0.1626.

At the time of writing, the token trades around 0.1732, challenging the 21-simple moving average (SMA).

Acceptance above the latter could trigger a fresh 40% rally towards the measured target of near the 0.2270 region.

The path of least resistance appears to the upside, as the Relative Strength Index (RSI) trades firmer at 55.54, allowing room for more gains.

Any pullbacks could meet initial demand at the pattern resistance now support around 0.1630. A failure to resist above the latter could fuel a fresh drop towards the horizontal trendline support around 0.1440.

Sellers could then aim for a 40% retracement from that level, with a test of the downside target of 0.0844 likely on the cards.

However, the upward-sloping 50-SMA at 0.1216 could challenge the bears' commitment before reaching the above-mentioned target.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.