Shiba Inu price marking fresh 2023 lows could lead to $107 million worth of tokens facing losses

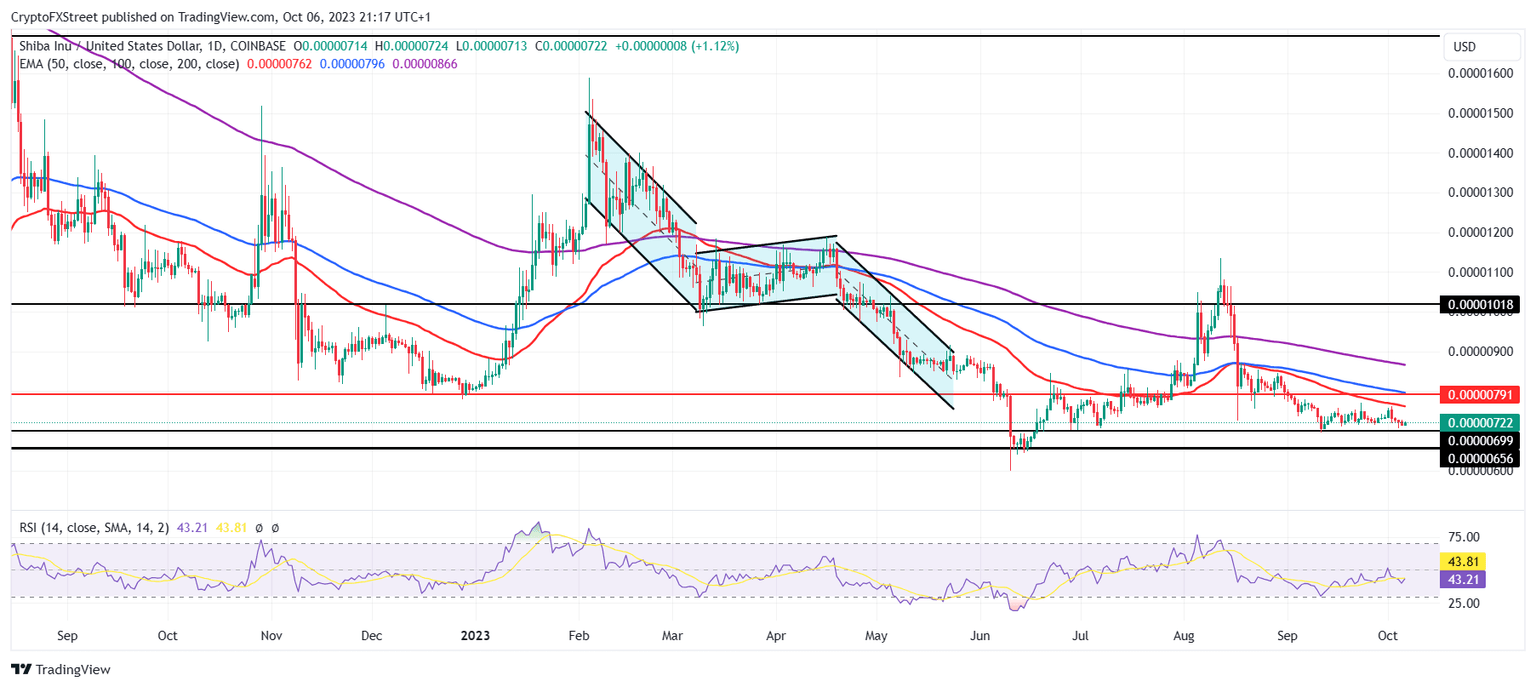

- Shiba Inu price is currently trading at $0.00000722 after failing to breach the 50-day EMA.

- Price indicators and movement suggest SHIB is not too far from charting a new year-to-date low, as it stands only 8% above $0.00000656.

- Whale addresses holding between 10 million to 1 billion SHIB have been shedding their tokens, hinting at a decline.

Shiba Inu price has failed to make any recovery since the August crash, and the meme coin has only reached closer to establishing a new year-to-date low. The possibility of the same is likely as even whales are switching their stance from bullish to bearish by selling their holdings.

Shiba Inu price to test the critical support line

Shiba Inu price, trading at $0.00000722 at the time of writing, is close to testing the support floor at $0.00000699. This level has been acting as a safety net for more than a month since SHIB failed to breach the 50-day Exponential Moving Average (EMA).

The Relative Strength Index (RSI) is presently below the neutral line marked at 50.0, which highlights the lack of bullish momentum in the market. This, as well as the 100 and 200-day EMA standing as resistance levels, only intensify the bearishness.

Thus, if Shiba Inu price slips below the $0.00000699 support line, it will have one chance to bounce back off the support level at $0.00000656. However, if this support is lost too, the meme coin will mark a new 2023 low, slipping to $0.00000600.

SHIB/USD 1-day chart

But if the meme coin bounces back off $0.00000699 and climbs upwards to breach the 50-day EMA, it would have a chance to reclaim $0.00000791 as support, which coincides with the 100-day EMA. This would invalidate the bearish thesis and set SHIB up for further recovery.

Whales hint at no recovery, though

Not only are the broader market conditions, but the investors are also not very bullish towards Shiba Inu right now. The addresses holding between 10 million to 1 billion SHIB tokens have recently begun shedding their holdings. Combined, their wallets have seen outflows of 270 billion SHIB worth over $1 million in just the past three days.

Historically, the accumulation of these whales has resulted in a rally in price, while their selling has led to a fall in SHIB’s value. Thus, their offloading of tokens suggests a decline is on the way.

Shiba Inu supply distribution

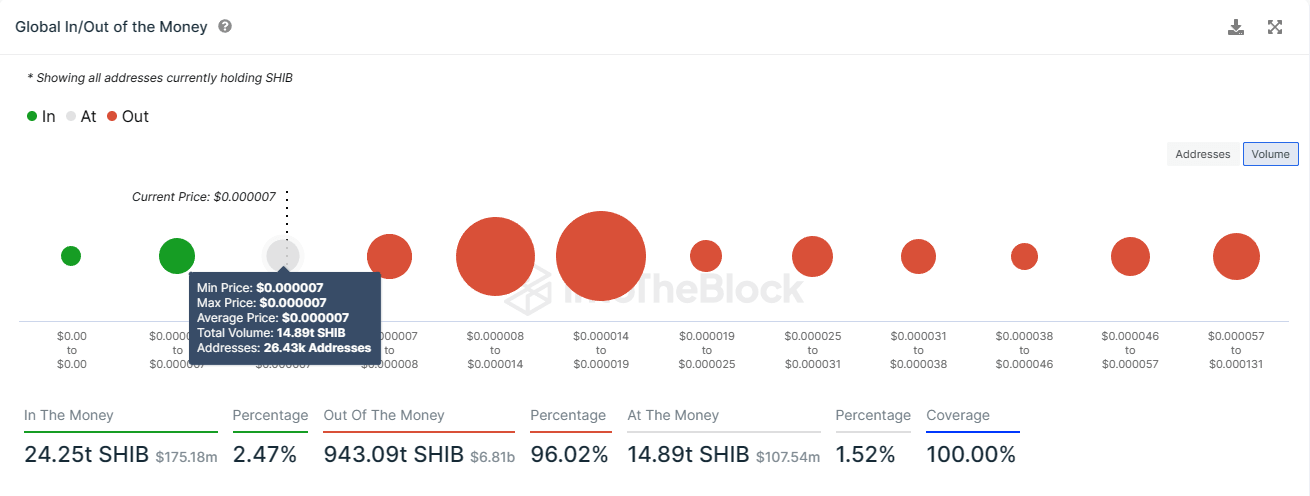

This would have a dire impact on about 14.89 trillion SHIB tokens worth over $107 million. As noted on the Global In/Out of Money (GIOM) indicator, these tokens have been hanging in uncertainty since Shiba Inu price slipped below $0.00000800 and could end up facing losses if the meme coin falls below $0.00000700.

Shiba Inu GIOM

Consequently, it could lead to investors offsetting their losses by selling before Shiba Inu price declines further. Thus, it is crucial for Shiba Inu to sustain above the $0.00000699 support line.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B01.20.33%2C%252007%2520Oct%2C%25202023%5D-638322213102445134.png&w=1536&q=95)